Surana Solar Share Price Target Tomorrow 2025 To 2030

Surana Solar Limited, based in Hyderabad, India, is a prominent player in the renewable energy sector, specializing in the manufacturing of solar photovoltaic (PV) modules and the execution of turnkey solar power projects. Established in 2006 as Surana Ventures Limited, the company underwent a rebranding in 2014 to become Surana Solar Limited, aligning its identity more closely with its core focus on solar energy solutions. As a part of the diversified Surana Group, which has interests spanning telecommunications, metal processing, and infrastructure, Surana Solar benefits from a robust industrial backing. Surana Solar Share Price on NSE as of 25 April 2025 is 35.90 INR.

Surana Solar Share Market Overview

- Open: 36.13

- High: 36.13

- Low: 35.25

- Previous Close: 35.45

- Volume: 116,738

- Value (Lacs): 41.54

- 52 Week High: 65.38

- 52 Week Low: 18.55

- Mkt Cap (Rs. Cr.): 175

- Face Value: 5

Surana Solar Share Price Chart

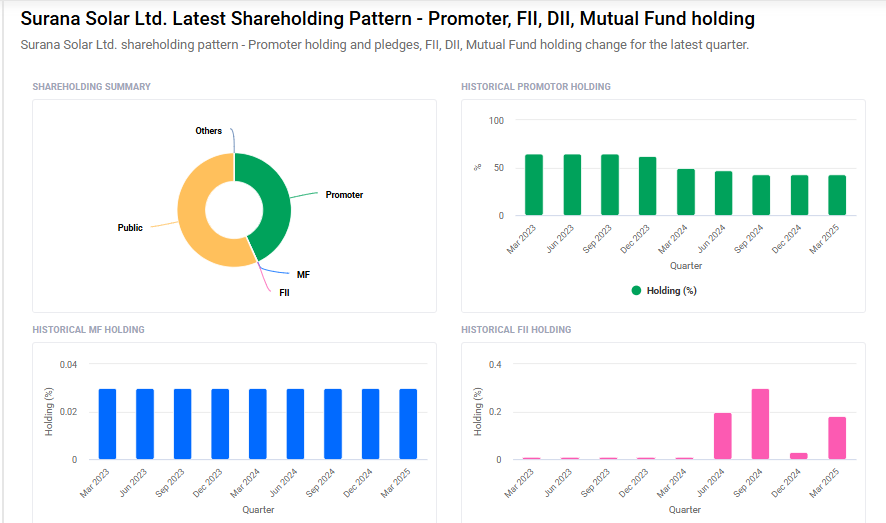

Surana Solar Shareholding Pattern

- Promoters: 43.2%

- FII: 0.2%

- DII: 0%

- Public: 56.6%

Surana Solar Share Price Target Tomorrow 2025 To 2030

| Surana Solar Share Price Target Years | Surana Solar Share Price |

| 2025 | ₹70 |

| 2026 | ₹90 |

| 2027 | ₹110 |

| 2028 | ₹130 |

| 2029 | ₹150 |

| 2030 | ₹170 |

Surana Solar Share Price Target 2025

Here are four key factors that could influence the growth of Surana Solar’s share price by 2025:

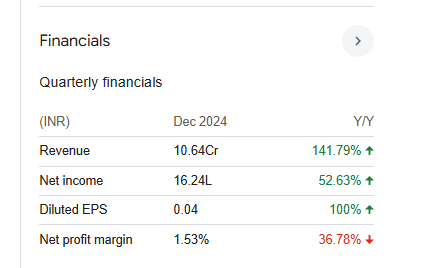

1. Strong Revenue Growth in Recent Quarters

Surana Solar has demonstrated impressive revenue growth in recent quarters. For instance, in September 2024, the company’s standalone net sales surged by 415.73% year-over-year to ₹14.28 crore. Similarly, in December 2024, net sales increased by 141.79% year-over-year to ₹10.64 crore. These significant upticks indicate a positive trend in the company’s financial performance, which could bolster investor confidence and positively impact the share price.

2. Positive Technical Indicators

Technical analysis suggests a favorable outlook for Surana Solar’s stock. The stock has shown a 7.04% increase over the past two weeks, with buy signals from both short and long-term moving averages. Additionally, increased trading volume alongside price gains is considered a positive sign, indicating strong market interest and potential for continued upward momentum.

3. Expansion of Solar Power Projects

Surana Solar is actively expanding its solar power projects, with plans to set up 30MW of new installations in Karnataka, Andhra Pradesh, and Tamil Nadu. This strategic expansion into regions with high solar potential could enhance the company’s revenue streams and market presence, contributing to share price growth.

4. Favorable Industry Outlook

The renewable energy sector in India is experiencing robust growth, supported by government initiatives and increasing demand for clean energy solutions. As a player in the solar energy market, Surana Solar stands to benefit from this favorable industry environment, which could positively influence its share price trajectory.

Surana Solar Share Price Target 2030

Here are 4 different risks and challenges that could affect the Surana Solar share price by 2030:

1. Dependence on Government Policies

Surana Solar’s business growth is closely linked to government support, like subsidies and renewable energy policies. If there are changes in these policies or if support is reduced in the future, it may slow down the company’s expansion and affect its share price.

2. High Competition in the Solar Industry

The solar power sector in India is becoming more competitive, with many local and international players entering the market. This strong competition could put pressure on Surana Solar’s profit margins and make it harder to maintain its market position.

3. Fluctuations in Raw Material Costs

The company relies on materials like silicon and solar cells, which can experience price changes due to global supply issues. If raw material costs rise sharply, it could increase production expenses and reduce profit, which may impact the share price.

4. Technology Advancements by Competitors

As solar technology keeps improving, there’s a risk that Surana Solar may fall behind if it doesn’t invest in innovation. Competitors with better or cheaper technology might attract more customers, posing a challenge to the company’s growth over the long term.

Surana Solar Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 177.06M | -58.03% |

| Operating expense | 48.09M | -32.10% |

| Net income | -12.59M | -155.10% |

| Net profit margin | -7.11 | -231.18% |

| Earnings per share | — | — |

| EBITDA | 21.87M | 54.22% |

| Effective tax rate | -39.40% | — |

Read Also:- Diffusion Engineers Share Price Target Tomorrow 2025 To 2030