Jio Finance Share Price Target Tomorrow 2025 To 2030

Jio Financial Services Limited (JFSL) is a prominent Indian financial services company, established in 1999 and headquartered in Mumbai. Originally a part of Reliance Industries, JFSL was demerged and listed independently on Indian stock exchanges in August 2023. The company operates through various subsidiaries, including Jio Finance Limited, Jio Insurance Broking Limited, Jio Payment Solutions Limited, and Jio Payments Bank, offering a comprehensive range of financial products and services. Jio Finance Share Price on NSE as of 26 April 2025 is 252.39 INR.

Jio Finance Share Market Overview

- Open: 258.78

- High: 261.62

- Low: 249.10

- Previous Close: 258.78

- Volume: 33,348,716

- Value (Lacs): 84,388.93

- VWAP: 254.05

- UC Limit: 284.65

- LC Limit: 232.90

- 52 Week High: 385.85

- 52 Week Low: 198.65

- Mkt Cap (Rs. Cr.): 160,766

- Face Value: 10

Jio Finance Share Price Chart

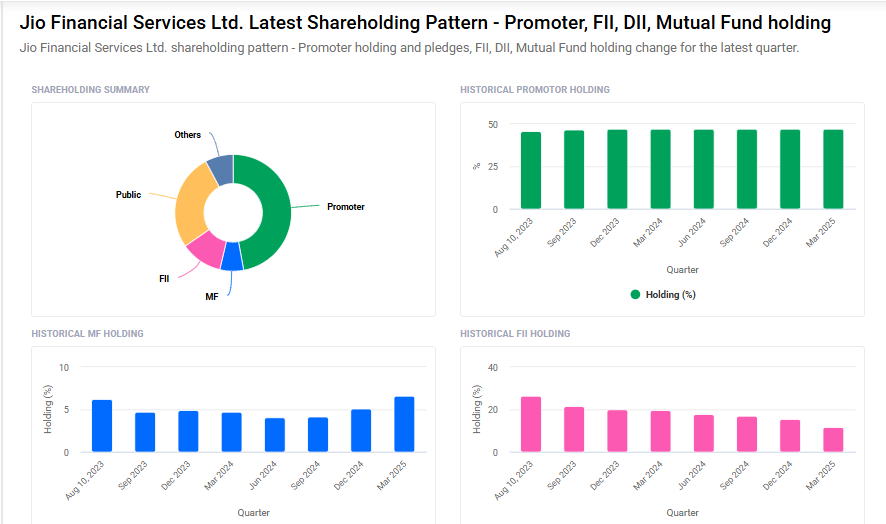

Jio Finance Shareholding Pattern

- Promoters: 47.1%

- FII: 11.7%

- DII: 14.4%

- Public: 26.8%

Jio Finance Share Price Target Tomorrow 2025 To 2030

| Jio Finance Share Price Target Years | Jio Finance Share Price |

| 2025 | ₹390 |

| 2026 | ₹420 |

| 2027 | ₹450 |

| 2028 | ₹480 |

| 2029 | ₹510 |

| 2030 | ₹540 |

Jio Finance Share Price Target 2025

Here are four key factors that could influence the growth of Jio Financial Services’ share price by 2025:

1. Rapid Expansion of Assets Under Management (AUM)

Jio Financial Services has experienced significant growth in its Assets Under Management. As of the end of FY2025, AUM surged to ₹10,053 crore, a substantial increase from ₹173 crore the previous year. This impressive growth indicates the company’s successful efforts in scaling its operations and attracting a larger customer base, which could positively impact its share price.

2. Strategic Partnerships and Diversification

The company has formed strategic alliances to diversify its financial services portfolio. Notably, Jio Financial Services has partnered with BlackRock to launch a wealth management and brokerage business in India. Additionally, it has reached a preliminary agreement with Allianz SE to establish an insurance business in the country. These collaborations aim to tap into India’s growing financial services market, potentially driving future growth.

3. Strong Backing from Reliance Industries

Being a part of the Reliance Group provides Jio Financial Services with robust support in terms of capital, infrastructure, and brand recognition. This backing facilitates the company’s expansion plans and enhances investor confidence, which can contribute to share price appreciation.

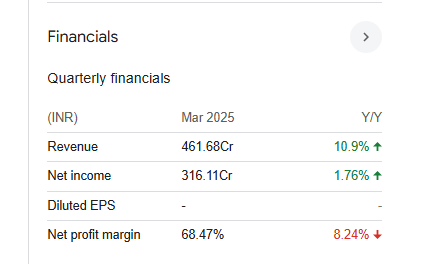

4. Positive Financial Performance

In FY2025, Jio Financial Services reported a 24% year-on-year increase in revenue, reaching ₹518 crore, driven by its payments and wealth management divisions. The company’s consolidated net profit also saw a modest rise of 1.8% year-on-year to ₹316.11 crore. Such financial performance reflects operational efficiency and growth potential, factors that are favorable for share price growth.

Jio Finance Share Price Target 2030

Here are four risks and challenges that could influence Jio Financial Services’ share price by 2030:

1. Intense Competition in the Financial Sector

Jio Financial Services operates in a highly competitive environment, facing established players like Bajaj Finance, Shriram Finance, and SBI Cards. This intense competition can make it challenging for Jio Financial to capture and maintain market share, potentially affecting its profitability and share price.

2. Regulatory and Compliance Challenges

The financial services industry is subject to stringent regulatory oversight. Any changes in regulations or compliance requirements can increase operational costs and limit the company’s flexibility, potentially impacting its growth and stock performance.

3. Dependence on Parent Company Support

While being part of the Reliance Group provides Jio Financial with certain advantages, over-reliance on the parent company for financial and operational support could pose risks. Any strategic shifts or financial challenges within the parent company might adversely affect Jio Financial’s operations and investor confidence.

4. Market Volatility and Economic Fluctuations

The financial sector is sensitive to macroeconomic factors such as interest rate changes, inflation, and economic downturns. Such fluctuations can impact consumer spending and borrowing behaviors, potentially affecting Jio Financial’s revenue streams and share price stability.

Jio Finance Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 19.95B | 8.33% |

| Operating expense | 4.77B | 51.38% |

| Net income | 16.13B | 0.50% |

| Net profit margin | 80.84 | -7.22% |

| Earnings per share | 2.54 | — |

| EBITDA | — | — |

| Effective tax rate | 17.17% | — |

Read Also:- Adani Power Share Price Target Tomorrow 2025 To 2030