Integra Essentia Ltd Share Price Target Tomorrow 2025 To 2030

Integra Essentia Limited is an Indian company headquartered in New Delhi, engaged in providing essential products and services across various sectors. Established in 2007 as Five Star Mercantile Private Limited, the company underwent several transformations, including a name change to Integra Garments & Textile Ltd. in 2012 and later to Integra Essentia Limited in 2022. Under the leadership of entrepreneur Vishesh Gupta, the company expanded its operations beyond textiles into sectors such as food, infrastructure, and energy. Its diverse portfolio includes trading certified organic and general agro products, manufacturing clothing and furnishing fabrics, supplying construction materials, and offering renewable energy solutions like solar and hydrogen power equipment. Integra Essentia Ltd Share Price on NSE as of 29 April 2025 is 2.33 INR.

Integra Essentia Ltd Share Market Overview

- Open: 2.40

- High: 2.40

- Low: 2.30

- Previous Close: 2.34

- Volume: 1,455,110

- Value (Lacs): 33.76

- 52 Week High: 7.70

- 52 Week Low: 2.01

- Mkt Cap (Rs. Cr.): 247

- Face Value: 1

Integra Essentia Ltd Share Price Chart

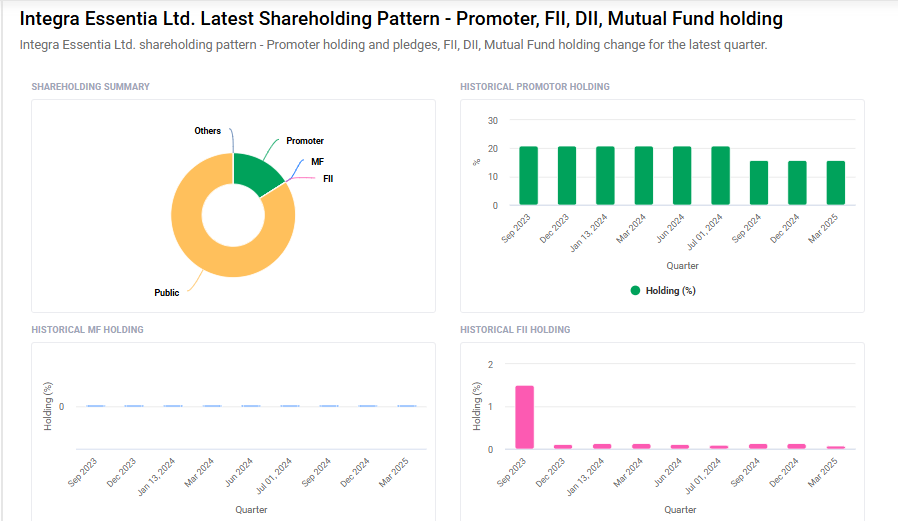

Integra Essentia Ltd Shareholding Pattern

- Promoters: 16%

- FII: 0.1%

- DII: 0%

- Public: 83.9%

Integra Essentia Ltd Share Price Target Tomorrow 2025 To 2030

| Integra Essentia Ltd Share Price Target Years | Integra Essentia Ltd Share Price |

| 2025 | ₹5.30 |

| 2026 | ₹6 |

| 2027 | ₹7 |

| 2028 | ₹8 |

| 2029 | ₹9 |

| 2030 | ₹10 |

Integra Essentia Ltd Share Price Target 2025

Here are four key factors that could influence the growth of Integra Essentia Ltd’s share price by 2025:

1. Diversified Business Portfolio

Integra Essentia operates across multiple sectors, including food, clothing, energy, and infrastructure. This diversification allows the company to tap into various revenue streams, reducing dependency on a single market and enhancing resilience against sector-specific downturns.

2. Strategic Partnerships and Acquisitions

The company has been actively engaging in strategic partnerships and acquisitions to accelerate growth. By collaborating with other businesses and acquiring new ventures, Integra Essentia aims to expand its market presence and enhance its product offerings.

3. Focus on Innovation and Sustainability

Integra Essentia is investing in innovative technologies, particularly in the renewable energy and healthcare sectors. The company’s commitment to sustainability and eco-friendly practices aligns with global trends, potentially attracting environmentally conscious investors and customers.

4. Improving Financial Performance

The company has demonstrated significant profit growth over the past three years and has effectively reduced its debt levels. A healthy interest coverage ratio and efficient cash conversion cycle indicate strong financial management, which could positively impact investor confidence and share price.

Integra Essentia Ltd Share Price Target 2030

Here are 4 Risks and Challenges for Integra Essentia Ltd Share Price Target 2030:

1. Dependence on Market Conditions

Integra Essentia operates in sectors like food, clothing, energy, and infrastructure, which are sensitive to changes in market demand and economic conditions. A slowdown in any major sector could affect the company’s overall performance and impact its share price growth by 2030.

2. Competition Pressure

The company faces tough competition from well-established players in each of its operating segments. If Integra Essentia cannot maintain a competitive edge through innovation and quality, it may lose market share, which could slow down its future growth.

3. Execution Risks in Expansion Plans

As the company expands through new projects and acquisitions, there is always a risk of delays, cost overruns, or poor integration. If the expansion strategies do not go as planned, it could negatively affect the company’s financial health and future share value.

4. Regulatory and Environmental Challenges

Being involved in sectors like energy and infrastructure, Integra Essentia must comply with various government policies and environmental regulations. Any changes or stricter laws in the future could create additional costs and operational difficulties for the company.

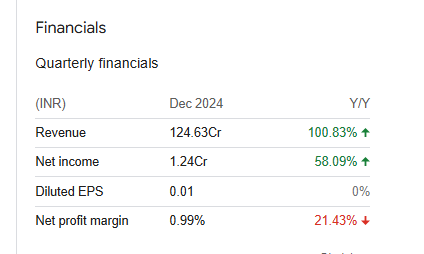

Integra Essentia Ltd Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 2.77B | 14.85% |

| Operating expense | 62.47M | 133.28% |

| Net income | 154.35M | 131.52% |

| Net profit margin | 5.57 | 101.81% |

| Earnings per share | — | — |

| EBITDA | 62.74M | 99.83% |

| Effective tax rate | 19.22% | — |

Read Also:- Aarti Drugs Share Price Target Tomorrow 2025 To 2030