Adani Port Share Price Target Tomorrow 2025 To 2030

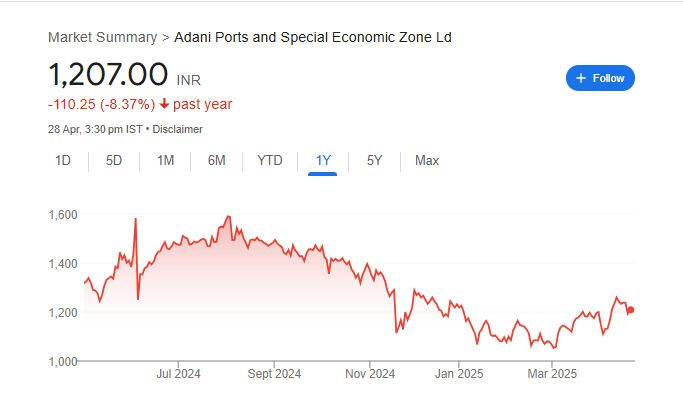

Adani Ports and Special Economic Zone Limited (APSEZ) is India’s largest private port operator and a key player in the nation’s logistics sector. Established in 1998 by Gautam Adani, the company has expanded its operations to include 13 domestic ports across seven maritime states, including Gujarat, Maharashtra, Goa, Kerala, Andhra Pradesh, Tamil Nadu, and Odisha. APSEZ handles a diverse range of cargo types, such as dry bulk, liquid, crude, and containers, accounting for nearly one-fourth of the country’s cargo movement. Adani Port Share Price on NSE as of 29 April 2025 is 1,207.00 INR.

Adani Port Share Market Overview

- Open: 1,188.10

- High: 1,214.70

- Low: 1,184.10

- Previous Close: 1,193.00

- Volume: 2,646,406

- Value (Lacs): 32,018.87

- 52 Week High: 1,621.40

- 52 Week Low: 703.00

- Mkt Cap (Rs. Cr.): 261,355

- Face Value: 2

Adani Port Share Price Chart

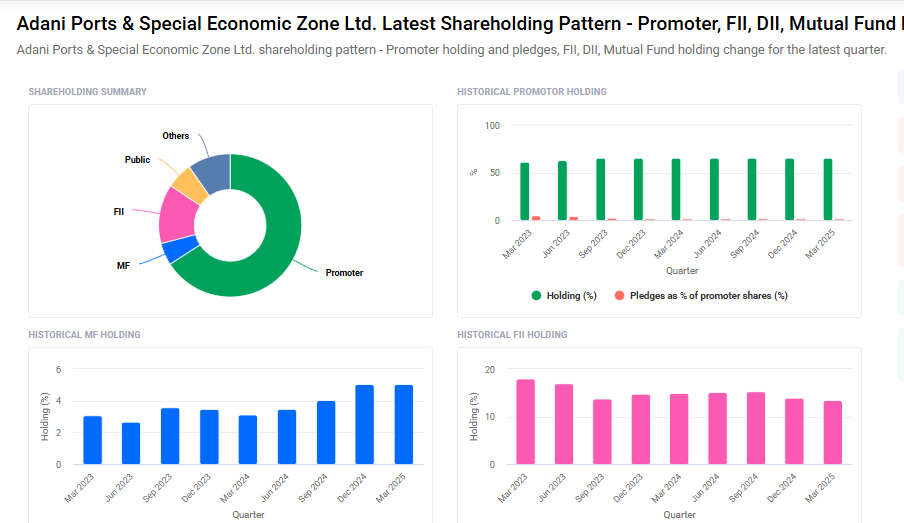

Adani Port Shareholding Pattern

- Promoters: 65.9%

- FII: 13.4%

- DII: 14.7%

- Public: 5.9%

Adani Port Share Price Target Tomorrow 2025 To 2030

| Adani Port Share Price Target Years | Adani Port Share Price |

| 2025 | ₹1625 |

| 2026 | ₹1700 |

| 2027 | ₹1800 |

| 2028 | ₹1900 |

| 2029 | ₹2000 |

| 2030 | ₹2100 |

Adani Port Share Price Target 2025

Here are four key factors that could influence the growth of Adani Ports & Special Economic Zone Ltd’s share price by 2025:

1. Record-High Cargo Volumes

Adani Ports achieved its highest-ever monthly cargo volume in March 2025, handling 41.5 million metric tonnes (MMT), marking a 9% year-on-year increase. This growth was driven by a 19% rise in container volumes and a 5% increase in liquid and gas cargo. Notably, Mundra Port became the first Indian port to surpass 200 MMT of cargo in a single fiscal year, underscoring the company’s strong operational performance.

2. Strategic Global Expansion

In April 2025, Adani Ports announced the acquisition of the North Queensland Export Terminal in Australia for $2.54 billion. This deep-water coal export facility, with a capacity of 50 MMT annually, enhances Adani Ports’ international footprint and diversifies its revenue streams. The company aims to increase the terminal’s EBITDA to A$400 million within four years, reflecting its commitment to global growth.

3. Robust Financial Performance

For the first nine months of FY25, Adani Ports reported a 14% year-on-year increase in revenue and a 19% rise in EBITDA. This strong financial performance is attributed to organic growth at key ports like Mundra and a diversified cargo mix, positioning the company for continued profitability.

4. Positive Analyst Outlook

Financial analysts have expressed optimism about Adani Ports’ growth prospects. For instance, Macquarie Equity Research anticipates a 34% upside for the company’s stock, citing ambitious expansion plans, strong cash flows, and a diversified cargo portfolio as key drivers.

Adani Port Share Price Target 2030

Here are four key risks and challenges that could influence Adani Ports & Special Economic Zone Ltd’s (APSEZ) share price by 2030:

1. Regulatory and Legal Challenges

Adani Group has faced significant legal scrutiny, including U.S. indictments alleging bribery and fraud involving its chairman, Gautam Adani. These allegations have led to credit rating downgrades and raised concerns about the group’s governance practices. Such legal issues can affect investor confidence and the company’s ability to secure funding, potentially impacting its share price.

2. Environmental and Climate Risks

Ports are increasingly under pressure to comply with stringent environmental regulations due to their impact on air and water quality. Additionally, climate change poses risks such as rising sea levels and extreme weather events, which can disrupt operations and require substantial investments in resilient infrastructure.

3. High Debt Levels and Expansion Risks

APSEZ has ambitious plans to expand its cargo-handling capacity to 2,000 million metric tonnes by 2030, backed by significant capital investments. While this growth strategy can drive revenue, it also increases the company’s debt burden. If the expected returns do not materialize, the company may face financial strain, affecting its profitability and share value.

4. Intense Competition

The port industry is highly competitive, with both domestic and international players vying for market share. Competitors like Jawaharlal Nehru Port Trust (JNPT) and global operators such as DP World are continually enhancing their capabilities. This competition can pressure APSEZ to maintain its market position, potentially impacting its margins and growth prospects.

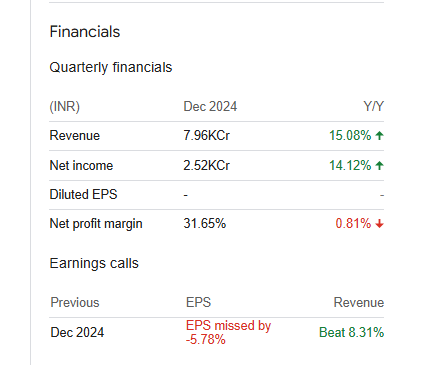

Adani Port Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 267.11B | 28.10% |

| Operating expense | 54.97B | 24.49% |

| Net income | 81.11B | 52.78% |

| Net profit margin | 30.36 | 19.25% |

| Earnings per share | 38.94 | 28.21% |

| EBITDA | 156.64B | 23.81% |

| Effective tax rate | 15.20% | — |

Read Also:- Adani Power Share Price Target Tomorrow 2025 To 2030