REC Share Price Target Tomorrow 2025 To 2030

REC Limited (formerly Rural Electrification Corporation Limited) is a public sector company in India that provides financial support to the power sector. It mainly helps fund projects related to electricity generation, transmission, and distribution, especially in rural areas. REC plays an important role in improving access to electricity across the country by offering loans to state governments, power utilities, and private companies. REC Share Price on NSE as of 30 April 2025 is 429.45 INR.

REC Share Market Overview

- Open: 433.80

- High: 441.30

- Low: 428.10

- Previous Close: 433.05

- Volume: 4,863,017

- Value (Lacs): 20,930.43

- 52 Week High: 654.00

- 52 Week Low: 357.35

- Mkt Cap (Rs. Cr.): 113,333

- Face Value: 10

REC Share Price Chart

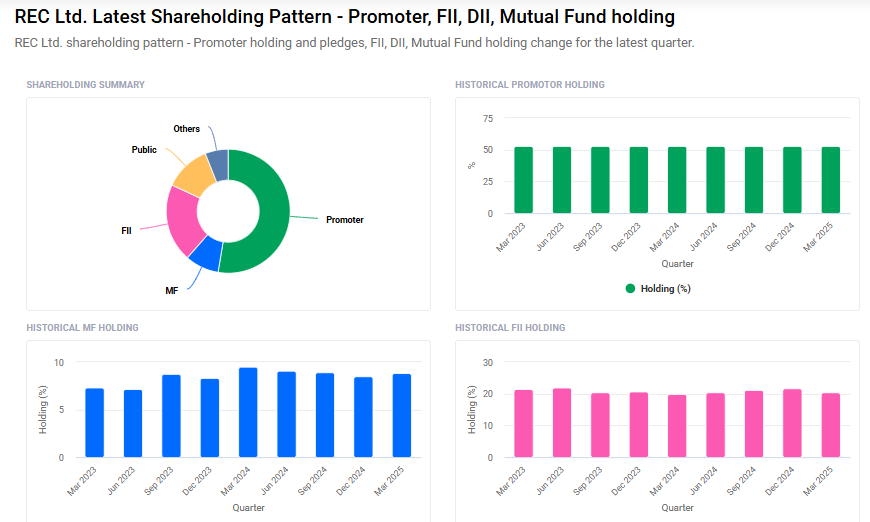

REC Shareholding Pattern

- Promoters: 52.6%

- FII: 20.5%

- DII: 14.8%

- Public: 12.1%

REC Share Price Target Tomorrow 2025 To 2030

| REC Share Price Target Years | REC Share Price |

| 2025 | ₹660 |

| 2026 | ₹700 |

| 2027 | ₹740 |

| 2028 | ₹780 |

| 2029 | ₹820 |

| 2030 | ₹860 |

REC Share Price Target 2025

Here are four key factors that could influence the growth of REC Limited’s (RECLTD) share price by 2025:

1. Strong Loan Growth and Asset Expansion

REC Limited has demonstrated robust loan growth, with the management aiming for a 15–20% increase in the loan book over the next 3–4 years. The company plans to double its assets under management (AUM) by 2030, supported by a healthy sanction pipeline and a focus on the reform-driven power distribution sector.

2. Government Support and Infrastructure Initiatives

As a Navratna public sector enterprise under the Ministry of Power, REC benefits from strong government backing. Its involvement in key national programs like the Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and the Saubhagya scheme positions the company to capitalize on India’s ongoing infrastructure development and electrification efforts.

3. Attractive Valuation and Dividend Yield

REC’s stock is considered undervalued, with a price-to-earnings (P/E) ratio of 7.3x compared to an estimated fair P/E ratio of 23.4x. Additionally, the company offers a dividend yield of approximately 4.65%, making it appealing to value-focused investors seeking stable returns.

4. Positive Analyst Outlook

Analysts have expressed optimism about REC’s prospects. For instance, CLSA has upgraded REC’s rating to ‘High Perform’, citing robust loan growth, strong return on equity (ROE), and attractive dividend yields. The brokerage firm has set a target price of ₹525 for the stock.

REC Share Price Target 2030

Here are four potential Risks and Challenges for the REC (Rural Electrification Corporation) share price target by 2030:

-

Regulatory and Policy Changes: REC operates in a highly regulated sector. Any changes in government policies related to power sector financing, renewable energy norms, or lending regulations could adversely impact its business and profitability.

-

Credit Risk and Rising NPAs: REC’s loan book primarily consists of power sector entities, some of which may face financial stress. Any increase in non-performing assets (NPAs) could affect investor confidence and impact share price performance.

-

Interest Rate Volatility: As a financial institution, REC is sensitive to interest rate movements. A sharp rise in borrowing costs or a narrowing interest spread could reduce margins and earnings, putting downward pressure on its valuation.

-

Energy Transition and Demand Shift: A faster-than-expected shift toward renewable energy and decentralization of power generation could reduce demand for REC’s traditional financing services, especially in thermal and transmission sectors.

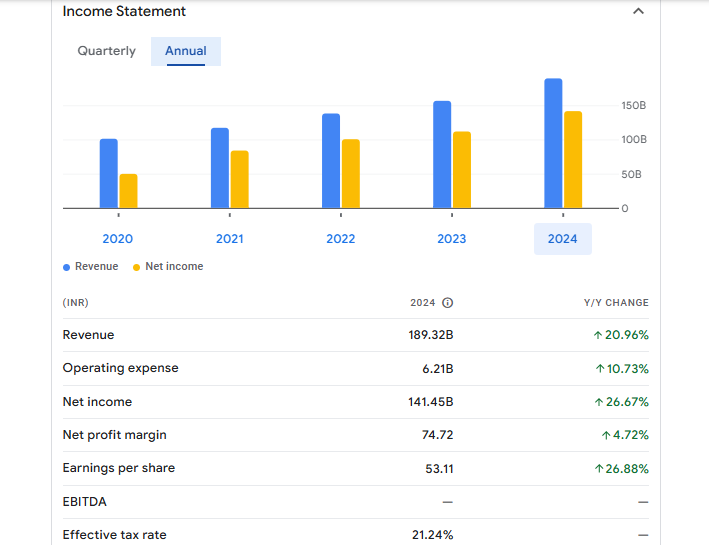

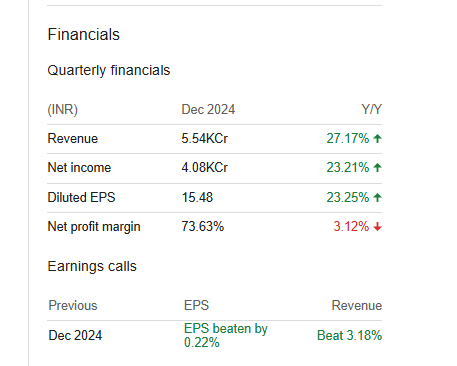

REC Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 189.32B | 20.96% |

| Operating expense | 6.21B | 10.73% |

| Net income | 141.45B | 26.67% |

| Net profit margin | 74.72 | 4.72% |

| Earnings per share | 53.11 | 26.88% |

| EBITDA | — | — |

| Effective tax rate | 21.24% | — |

Read Also:- Adani Port Share Price Target Tomorrow 2025 To 2030