Hondapower Share Price Target Tomorrow 2025 To 2030

Honda India Power Products Limited (HIPP), established in 1985, is a leading manufacturer of power products in India. As a subsidiary of Honda Motor Co., Japan, HIPP specializes in producing and marketing a wide range of equipment, including portable generators, water pumps, general-purpose engines, lawn mowers, brush cutters, tillers, and marine engines. Hondapower Share Price on NSE as of 1 May 2025 is 2,044.60 INR.

Hondapower Share Market Overview

- Open: 2,063.00

- High: 2,068.40

- Low: 2,017.60

- Previous Close: 2,053.40

- Volume: 3,810

- Value (Lacs): 77.23

- VWAP: 2,035.19

- UC Limit: 2,464.00

- LC Limit: 1,642.80

- 52 Week High: 4,500.00

- 52 Week Low: 1,815.00

- Mkt Cap (Rs. Cr.): 2,056

- Face Value: 10

Hondapower Share Price Chart

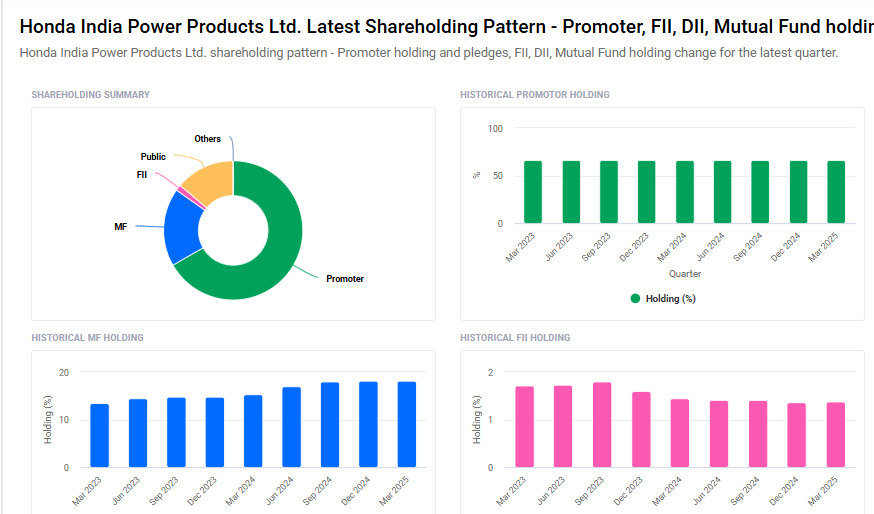

Hondapower Shareholding Pattern

- Promoters: 66.7%

- FII: 1.4%

- DII: 18.2%

- Public: 13.8%

Hondapower Share Price Target Tomorrow 2025 To 2030

| Hondapower Share Price Target Years | Hondapower Share Price |

| 2025 | ₹4500 |

| 2026 | ₹4800 |

| 2027 | ₹5100 |

| 2028 | ₹5400 |

| 2029 | ₹5800 |

| 2030 | ₹6200 |

Hondapower Share Price Target 2025

Hondapower share price target 2025 Expected target could ₹4500. Here are four key factors influencing the growth of Honda India Power Products Ltd (HONDAPOWER):

1. Product Diversification and Market Expansion

Honda India Power Products Ltd (HIPP) is actively diversifying its product portfolio by introducing new offerings such as concrete vibrators for the construction industry and dual-fuel (Petrol & CNG) engines for marine applications. These initiatives aim to tap into emerging markets and align with government projects like the Clean Ganga initiative, potentially boosting revenue streams.

2. Strong Financial Position and Asset-Light Model

HIPP operates with a debt-free balance sheet and maintains a high asset turnover ratio of 10.20, indicating efficient use of assets to generate revenue. This asset-light approach allows the company to fund growth initiatives and dividends without significant capital expenditure, enhancing shareholder value.

3. Strategic Focus on Agricultural and Infrastructure Sectors

The company’s emphasis on providing portable and cost-effective solutions for agriculture—such as equipment for land preparation, deweeding, and irrigation—positions it to benefit from the government’s increased investment in irrigation projects and the overall growth in the agricultural sector.

4. Positive Shareholding Trends and Market Confidence

An increase in mutual fund holdings by 1.62% over the last three months reflects growing institutional confidence in HIPP’s long-term prospects. Stable promoter holdings further indicate management’s commitment to the company’s growth trajectory

Hondapower Share Price Target 2030

Hondapower share price target 2030 Expected target could ₹6200.

Here are four key Risks and Challenges that could impact Honda India Power Products Ltd (HONDAPOWER) and its share price target by 2030:

-

Dependence on Rural and Agriculture Markets

A large portion of HONDAPOWER’s revenue comes from rural and agricultural sectors, which are vulnerable to monsoon variability, government policy shifts, and fluctuations in rural demand—any of which can directly affect sales. -

High Competition in the Power Equipment Sector

The market for generators, pumps, and small engines is highly competitive, with both domestic and international players. Aggressive pricing and innovation by competitors could pressure HONDAPOWER’s margins and market share. -

Technological Disruption and Changing Energy Trends

Growing interest in renewable energy and battery-powered alternatives may reduce long-term demand for traditional fuel-based power products. Failure to adapt could result in obsolescence of key products. -

Import Dependency for Key Components

Despite domestic manufacturing, HONDAPOWER depends on imports for several high-tech components. Any disruption in global supply chains or increase in import duties may raise costs and impact profitability.

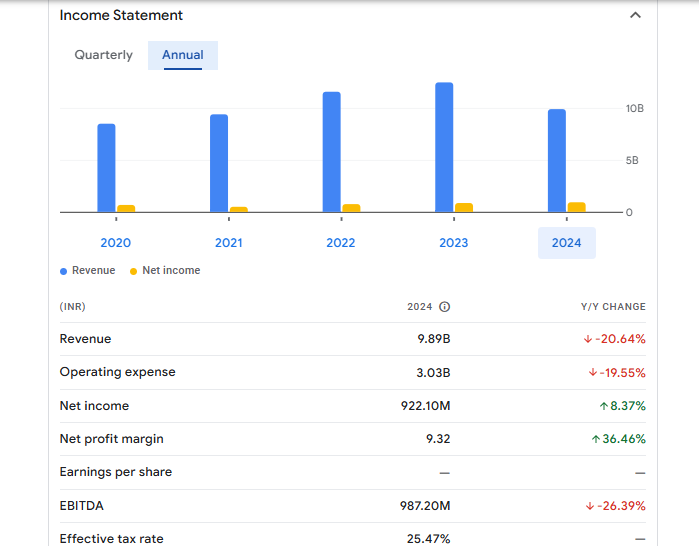

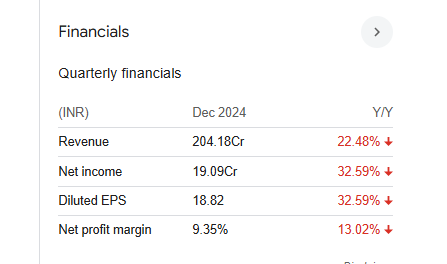

Hondapower Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 9.89B | -20.64% |

| Operating expense | 3.03B | -19.55% |

| Net income | 922.10M | 8.37% |

| Net profit margin | 9.32 | 36.46% |

| Earnings per share | — | — |

| EBITDA | 987.20M | -26.39% |

| Effective tax rate | 25.47% | — |

Read Also:- Udaipur Cement Share Price Target Tomorrow 2025 To 2030