Shree Renuka Sugars Share Price Target Tomorrow 2025 To 2030

Shree Renuka Sugars Limited is one of India’s leading agribusiness and bio-energy companies, specializing in sugar production and ethanol manufacturing. Established in 1998 and headquartered in Belagavi, Karnataka, the company operates eight sugar mills across Maharashtra and Karnataka, with a total crushing capacity of 46,000 tonnes per day. It also runs two of India’s largest port-based sugar refineries located at Kandla and Haldia, enhancing its export capabilities. Renuka Sugars is a significant contributor to India’s ethanol blending program, with a daily production capacity of 1,250 kilolitres, supporting the nation’s move towards sustainable energy sources. Shree Renuka Sugars Share Price on NSE as of 2 May 2025 is 28.80 INR.

Shree Renuka Sugars Share Market Overview

- Open: 29.24

- High: 29.37

- Low: 28.59

- Previous Close: 29.38

- Volume: 5,017,528

- Value (Lacs): 1,444.55

- 52 Week High: 56.50

- 52 Week Low: 24.71

- Mkt Cap (Rs. Cr.): 6,127

- Face Value: 1

Shree Renuka Sugars Share Price Chart

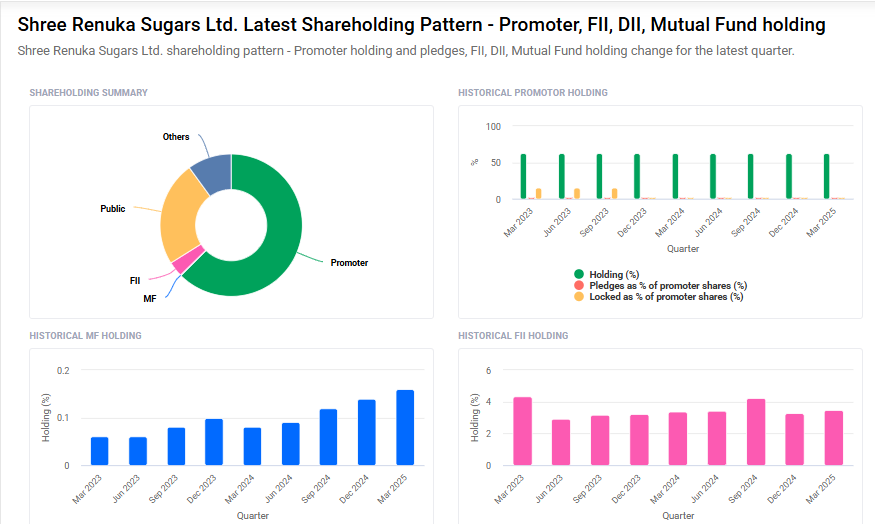

Shree Renuka Sugars Shareholding Pattern

- Promoters: 62.5%

- FII: 3.5%

- DII: 10.2%

- Public: 23.9%

Shree Renuka Sugars Share Price Target Tomorrow 2025 To 2030

| Shree Renuka Sugars Share Price Target Years | Shree Renuka Sugars Share Price |

| 2025 | ₹60 |

| 2026 | ₹80 |

| 2027 | ₹100 |

| 2028 | ₹120 |

| 2029 | ₹140 |

| 2030 | ₹160 |

Shree Renuka Sugars Share Price Target 2025

Shree Renuka Sugars share price target 2025 Expected target could ₹60. Here are four key factors influencing the growth of Shree Renuka Sugars and its share price target for 2025:

1. Expansion into Ethanol Production

Shree Renuka Sugars is significantly increasing its ethanol production capacity, aiming to meet the growing demand driven by government policies promoting biofuels. This expansion is expected to diversify revenue streams and enhance profitability.

2. Strategic Acquisition of Anamika Sugar Mills

The acquisition of Anamika Sugar Mills for ₹235.5 crore has expanded the company’s presence in Uttar Pradesh and North-East India, key sugar-producing regions. This move is anticipated to increase production capacity and market share.

3. Government Support and Favorable Policies

Supportive government initiatives, such as ethanol blending mandates and incentives for biofuel production, are creating a conducive environment for growth in the sugar and ethanol sectors.

4. Operational Efficiency and Cost Management

The company’s focus on improving operational efficiency and reducing costs is expected to enhance profit margins and overall financial performance, positively impacting the share price.

Shree Renuka Sugars Share Price Target 2030

Shree Renuka Sugars share price target 2030 Expected target could ₹160. Here are four key Risks and Challenges that could impact Shree Renuka Sugars:

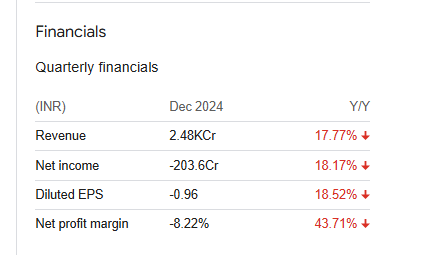

1. Sustained Financial Losses and Negative Profitability

Shree Renuka Sugars has been reporting consecutive quarterly losses, with a net loss of ₹203.6 crore in the quarter ending December 2024. The company’s Return on Equity (ROE) has been negative over the past five financial years, indicating challenges in generating profits from shareholders’ investments.

2. High Debt and Interest Expenses

The company faces significant interest expenses, accounting for 8.11% of its operating revenues as of March 31, 2024. This high debt burden, coupled with increased interest rates on external commercial borrowings and a weakening Indian Rupee, has contributed to a widening pre-tax loss of ₹3,935 million in the fiscal year 2023-24.

3. Vulnerability to Climatic Conditions

Adverse weather conditions have impacted sugarcane crushing volumes, leading to a 7% reduction in cane crushing in FY2023. Such climatic vulnerabilities can affect raw material availability and production efficiency.

4. Market Volatility and Share Price Fluctuations

The company’s share price has experienced significant volatility, with a 24% decline in a recent quarter. Despite a 675% increase over five years, such fluctuations can affect investor confidence and the company’s market valuation.

Shree Renuka Sugars Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 113.19B | 25.48% |

| Operating expense | 14.18B | 1.39% |

| Net income | -6.27B | -218.40% |

| Net profit margin | -5.54 | -154.13% |

| Earnings per share | — | — |

| EBITDA | 6.97B | 11.98% |

| Effective tax rate | -35.81% | — |

Read Also:- Chennai Petroleum Share Price Target Tomorrow 2025 To 2030