Lambodhara Textiles Share Price Target Tomorrow 2025 To 2030

Lambodhara Textiles Limited, established in 1994 and headquartered in Coimbatore, India, is a prominent manufacturer of synthetic fancy yarns. Over the years, the company has expanded its operations and now boasts a capacity of 37,856 spindles, with 33,224 dedicated to producing fancy yarns. Their product range includes slub yarns, multi-count and multi-twist yarns, siro yarns, and neppy yarns, crafted from materials like polyester, viscose, modal, excel, and flax. Beyond textiles, Lambodhara Textiles has diversified into power generation, operating windmills and solar power plants with a combined capacity of approximately 2.75 MW. Lambodhara Textiles Share Price on NSE as of 3 May 2025 is 132.10 INR.

Lambodhara Textiles Share Market Overview

- Open: 132.59

- High: 139.10

- Low: 131.00

- Previous Close: 130.29

- Volume: 35,910

- Value (Lacs): 47.63

- VWAP: 135.53

- UC Limit: 156.34

- LC Limit: 104.23

- 52 Week High: 248.00

- 52 Week Low: 99.65

- Mkt Cap (Rs. Cr.): 137

- Face Value: 5

Lambodhara Textiles Share Price Chart

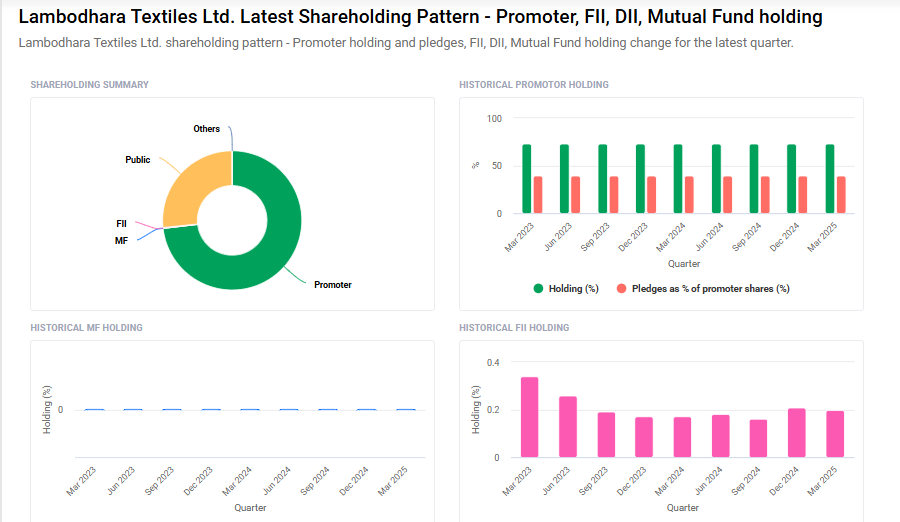

Lambodhara Textiles Shareholding Pattern

- Promoters: 73.2%

- FII: 0.2%

- DII: 0%

- Public: 26.6%

Lambodhara Textiles Share Price Target Tomorrow 2025 To 2030

| Lambodhara Textiles Share Price Target Years | Lambodhara Textiles Share Price |

| 2025 | ₹250 |

| 2026 | ₹270 |

| 2027 | ₹290 |

| 2028 | ₹310 |

| 2029 | ₹330 |

| 2030 | ₹350 |

Lambodhara Textiles Share Price Target 2025

Lambodhara Textiles share price target 2025 Expected target could ₹250. Here are four key factors that could influence the growth of Lambodhara Textiles Ltd:

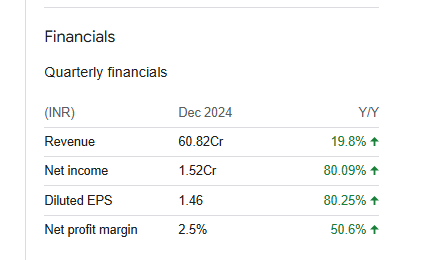

1. Strong Revenue Growth

Lambodhara Textiles has demonstrated consistent revenue growth, with net sales reaching ₹60.82 crore in December 2024, marking a 19.8% year-over-year increase. This upward trend in sales indicates robust demand for the company’s products and effective market strategies, which could positively impact its share price.

2. Improved Profit Margins

The company’s net profit margin improved to 2.50% in Q3 FY2024-2025, a 54.79% increase compared to the same period the previous year. Enhanced profitability suggests better cost management and operational efficiency, contributing to potential share price appreciation.

3. Positive Investor Sentiment

Investor sentiment has shown improvement, with the stock experiencing a 20% rise in March 2025. Such positive market perception can drive increased investment and support share price growth.

4. Strategic Financial Management

Lambodhara Textiles maintains a conservative capital structure, with a debt-to-equity ratio of 0.55. This prudent financial management provides stability and flexibility for future investments, potentially enhancing shareholder value.

Lambodhara Textiles Share Price Target 2030

Lambodhara Textiles share price target 2030 Expected target could ₹350. Here are four key Risks and Challenges that could impact Lambodhara Textiles Ltd:

1. High Promoter Share Pledging

Approximately 39.3% of the promoter’s shares are pledged, which can be a red flag for investors. High levels of pledged shares may indicate financial stress and can lead to stock price volatility, especially if lenders invoke the pledge due to market downturns.

2. Stagnant Revenue Growth

Over the past five years, Lambodhara Textiles has experienced only a 1.75% annual growth in net sales. Such sluggish growth suggests challenges in expanding market share or product offerings, potentially limiting future profitability and investor returns.

3. Declining Profitability

The company has reported negative financial results for four consecutive quarters, with a significant decrease in profits and a low Return on Capital Employed (ROCE) of 11.32%. This trend raises concerns about operational efficiency and the company’s ability to generate sustainable earnings.

4. Reduced Dividend Payout

Lambodhara Textiles has reduced its dividend to ₹0.50, resulting in a dividend yield of 0.3%, which is lower than the industry average. A lower dividend payout may reflect cash flow constraints and can be unattractive to income-focused investors.

Lambodhara Textiles Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 1.95B | -7.90% |

| Operating expense | 557.15M | 12.85% |

| Net income | 46.11M | -73.36% |

| Net profit margin | 2.37 | -71.03% |

| Earnings per share | — | — |

| EBITDA | 171.93M | -45.89% |

| Effective tax rate | 41.43% | — |

Read Also:- Menon Pistons Share Price Target Tomorrow 2025 To 2030