Sterlite Power Share Price Target Tomorrow 2025 To 2030

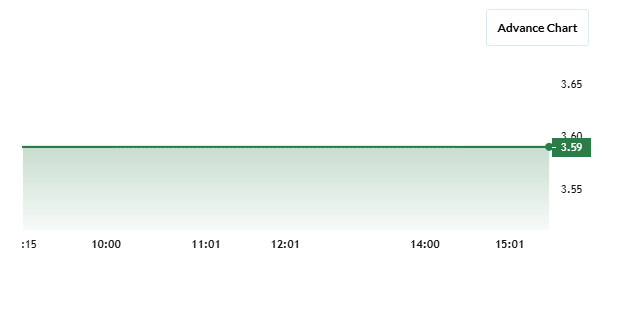

Sterlite Power Transmission Limited is a leading Indian company specializing in power transmission infrastructure and solutions. Established in 2016 following its demerger from Sterlite Technologies, the company has rapidly expanded its operations both domestically and internationally, notably in Brazil. Sterlite Power focuses on designing, constructing, owning, and operating power transmission assets, aiming to address the challenges of energy delivery by overcoming constraints related to time, space, and capital. Sterlite Power Share Price on NSE as of 3 May 2025 is 3.59 INR.

Sterlite Power Share Market Overview

- Open: 3.59

- High: 3.59

- Low: 3.59

- Previous Close: 3.42

- Volume: 33,996

- Value (Lacs): 1.22

- VWAP: 3.59

- UC Limit: 3.59

- LC Limit: 3.25

- 52 Week High: 6.79

- 52 Week Low: 2.05

- Mkt Cap (Rs. Cr.): 3

- Face Value: 10

Sterlite Power Share Price Chart

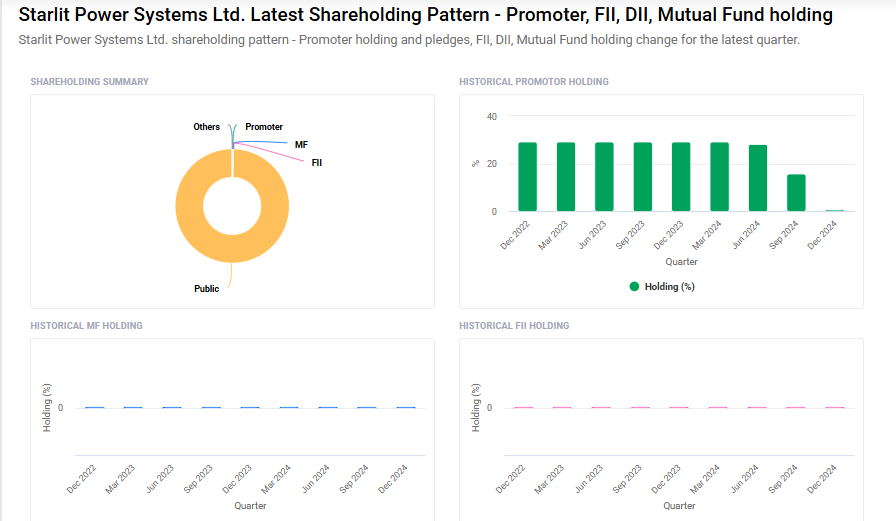

Sterlite Power Shareholding Pattern

- Promoters: 0.4%

- FII: 0%

- DII: 0%

- Public: 99.6%

Sterlite Power Share Price Target Tomorrow 2025 To 2030

| Sterlite Power Share Price Target Years | Sterlite Power Share Price |

| 2025 | ₹7 |

| 2026 | ₹10 |

| 2027 | ₹13 |

| 2028 | ₹16 |

| 2029 | ₹19 |

| 2030 | ₹21 |

Sterlite Power Share Price Target 2025

Sterlite Power share price target 2025 Expected target could ₹7. Here are four key factors that could influence the growth of Sterlite Power Transmission Ltd:

1. Robust Order Book and Revenue Growth

Sterlite Power has secured new orders worth ₹2,250 crore, marking its highest order book win for the current financial year. This substantial order intake reflects the company’s strong market position and is expected to drive significant revenue growth.

2. Strategic Demerger Enhancing Focus

The company has undergone a strategic demerger, resulting in the creation of two distinct entities: Resonia Ltd., focusing on transmission infrastructure, and Sterlite Power Transmission Ltd., specializing in power conductors, cables, and EPC services. This restructuring aims to enhance agility, drive innovation, and accelerate growth in their respective domains.

3. Strong Financial Backing and Credit Ratings

Sterlite Power has raised ₹725 crore from GEF Capital and ENAM Holdings, reinforcing its financial stability. Additionally, CRISIL upgraded the company’s long-term rating to AA-/Stable and short-term rating to A1+, reflecting improved creditworthiness and financial health.

4. Alignment with Renewable Energy Initiatives

The company’s focus on advancing India’s green energy transmission infrastructure aligns with national renewable energy goals. By enabling the seamless transfer of over 1000 MW of electricity in projects like the Nangalbibra-Bongaigaon transmission line, Sterlite Power is contributing to improved power reliability and accessibility, positioning itself as a key player in the renewable energy sector.

Sterlite Power Share Price Target 2030

Sterlite Power share price target 2030 Expected target could ₹21. Here are 4 key risks and challenges that could affect the long-term growth and share price target of Sterlite Power Transmission Ltd. by 2030:

1. Regulatory and Policy Uncertainty

Sterlite Power operates in a heavily regulated sector, and changes in government policies, power tariffs, or transmission regulations could impact project approvals and profitability. Uncertainty in regulations may delay projects or affect returns on investment.

2. High Capital Intensity and Debt Risks

Power transmission projects require significant capital investment and long gestation periods. If not managed carefully, high levels of debt or delays in project execution could lead to increased financial burden and reduced investor confidence.

3. Execution and Operational Challenges

Large-scale infrastructure projects often face risks related to land acquisition, local opposition, supply chain delays, and weather disruptions. Any such issues could lead to cost overruns, missed deadlines, and lower project efficiency.

4. Dependence on Power Sector Demand and Renewable Integration

While the shift toward renewable energy presents opportunities, it also brings challenges such as grid integration complexity and the need for flexible transmission infrastructure. Inconsistent demand growth or delays in renewable energy adoption could affect long-term planning and profitability.

Read Also:- Aakash Exploration Share Price Target Tomorrow 2025 To 2030