Take Solutions Share Price Target Tomorrow 2025 To 2030

Take Solutions Limited is an Indian company that provides specialized services in the life sciences sector. Established in 2000 and headquartered in Chennai, the company offers a range of services including clinical research, generics development, data sciences, regulatory affairs, and pharmacovigilance, all supported by technological expertise. Through its subsidiary, Navitas, Take Solutions focuses on delivering comprehensive solutions to pharmaceutical, biotech, and medical device companies worldwide. Take Solutions Share Price on NSE as of 9 May 2025 is 7.45 INR.

Take Solutions Share Market Overview

- Open: 7.35

- High: 7.65

- Low: 7.35

- Previous Close: 7.50

- Volume: 5,019

- Value (Lacs): 0.38

- VWAP: 7.53

- UC Limit: 7.70

- LC Limit: 7.40

- 52 Week High: 24.25

- 52 Week Low: 6.70

- Mkt Cap (Rs. Cr.): 111

- Face Value: 1

Take Solutions Share Price Chart

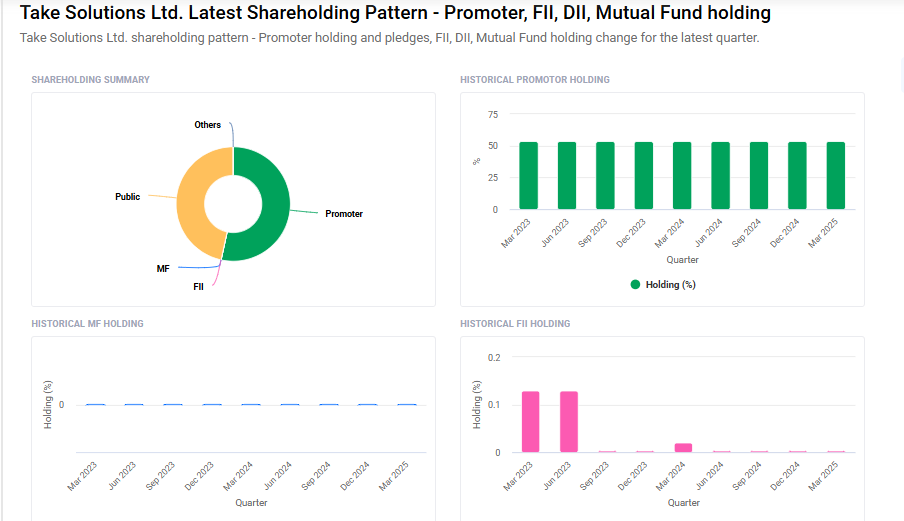

Take Solutions Shareholding Pattern

- Promoters: 53.4%

- FII: 0%

- DII: 0%

- Public: 46.6%

Take Solutions Share Price Target Tomorrow 2025 To 2030

| Take Solutions Share Price Target Years | Take Solutions Share Price |

| 2025 | ₹25 |

| 2026 | ₹40 |

| 2027 | ₹60 |

| 2028 | ₹80 |

| 2029 | ₹100 |

| 2030 | ₹120 |

Take Solutions Share Price Target 2025

Take Solutions share price target 2025 Expected target could ₹25. Here are four key factors that could influence Take Solutions Ltd.’s share price target for 2025:

-

Significant Financial Turnaround

In the third quarter ending December 2024, Take Solutions reported a consolidated net profit of ₹47.68 crore, a notable recovery from a net loss of ₹21.36 crore in the same period the previous year. This turnaround indicates improved operational efficiency and could positively impact investor confidence. -

Strategic Focus on Life Sciences

Take Solutions has been focusing on its core competencies in the life sciences sector, offering services in clinical research, regulatory affairs, and pharmacovigilance. This strategic alignment positions the company to capitalize on the growing demand in the healthcare and pharmaceutical industries. -

Positive Industry Outlook

The global life sciences and healthcare sectors are experiencing robust growth, driven by increased R&D investments and a focus on healthcare innovation. Take Solutions, with its domain expertise, is well-positioned to benefit from these industry trends. -

Improved Earnings Per Share (EPS)

The company’s basic earnings per share from continuing operations improved to ₹0.33 in Q3 FY2024-25, compared to a loss per share of ₹0.37 in the same quarter the previous year. This improvement reflects better financial health and could make the stock more attractive to investors.

Take Solutions Share Price Target 2030

Take Solutions share price target 2030 Expected target could ₹120. Here are four key risks and challenges that could impact Take Solutions Ltd.’s share price target by 2030:

-

Financial Volatility and Profitability Concerns

While Take Solutions reported a profit of ₹47.68 crore in the quarter ending December 2024, this followed three consecutive quarters of losses. Such fluctuations raise concerns about the company’s ability to maintain consistent profitability, which is crucial for long-term investor confidence. -

Market Perception and Stock Classification

According to Stockopedia, Take Solutions is currently classified as a “Sucker Stock,” indicating a negative outlook based on its quality, value, and momentum scores. This classification suggests that the stock may underperform compared to its peers, potentially deterring investors. -

Exposure to Financial Risks

The company is exposed to various financial risks, including fluctuations in foreign currency exchange rates, credit, liquidity, and interest rates. These factors can adversely impact the fair value of its financial instruments, affecting overall financial stability. -

Intense Industry Competition

Operating in the life sciences and healthcare IT sectors, Take Solutions faces stiff competition from both domestic and international players. The rapidly evolving technological landscape and the need for continuous innovation pose challenges in maintaining market share and profitability.

Take Solutions Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 656.08M | -65.30% |

| Operating expense | 425.94M | -49.57% |

| Net income | -1.20B | -19.30% |

| Net profit margin | -182.33 | -243.82% |

| Earnings per share | — | — |

| EBITDA | -168.21M | 32.60% |

| Effective tax rate | -1.04% | — |

Read Also:- Steel Exchange Share Price Target Tomorrow 2025 To 2030