Time Technoplast Share Price Target Tomorrow 2025 To 2030

Time Technoplast Ltd., founded in 1992 and headquartered in Mumbai, is a leading Indian multinational company specializing in innovative polymer and composite products. With over 40 production facilities across India and countries like the UAE, USA, Thailand, and Egypt, the company serves diverse sectors including industrial packaging, infrastructure, automotive components, lifestyle products, and healthcare. Time Technoplast is known for its commitment to research and development, pioneering products such as composite LPG and CNG cylinders, HDPE pipes, and advanced industrial packaging solutions. Time Technoplast Share Price on NSE as of 10 May 2025 is 312.20 INR.

Time Technoplast Share Market Overview

- Open: 313.00

- High: 317.90

- Low: 306.60

- Previous Close: 314.60

- Volume: 1,176,996

- Value (Lacs): 3,629.27

- VWAP: 309.85

- UC Limit: 377.50

- LC Limit: 251.70

- 52 Week High: 513.55

- 52 Week Low: 244.30

- Mkt Cap (Rs. Cr.): 6,997

- Face Value: 1

Time Technoplast Share Price Chart

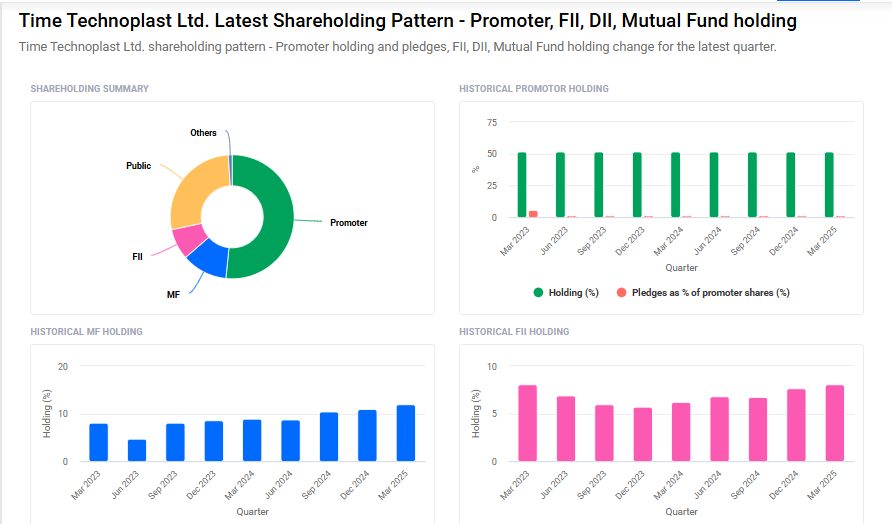

Time Technoplast Shareholding Pattern

- Promoters: 51.6%

- FII: 8.1%

- DII: 13%

- Public: 27.3%

Time Technoplast Share Price Target Tomorrow 2025 To 2030

| Time Technoplast Share Price Target Years | Time Technoplast Share Price |

| 2025 | ₹520 |

| 2026 | ₹570 |

| 2027 | ₹620 |

| 2028 | ₹670 |

| 2029 | ₹720 |

| 2030 | ₹770 |

Time Technoplast Share Price Target 2025

Time Technoplast share price target 2025 Expected target could ₹520. Here are four key factors that could influence Time Technoplast Ltd.‘s share price target for 2025:

1. Robust Financial Performance

Time Technoplast has demonstrated strong financial growth, with its consolidated revenue increasing from ₹42,932 million in FY23 to ₹50,066 million in FY24. The company’s EBITDA also rose from ₹5,809 million to ₹7,050 million during the same period, and PAT grew from ₹2,191 million to ₹3,105 million. These figures indicate enhanced operational efficiency and profitability, which can positively impact investor confidence.

2. Expansion in Value-Added Product Segments

The company has been focusing on value-added products, such as Intermediate Bulk Containers (IBCs), composite cylinders for LPG, CNG, and medical oxygen, and MOX films. In FY24, revenue from value-added products increased by 32% year-over-year, contributing to 26% of the total revenue. This strategic shift towards high-margin products can drive future growth.

3. Strategic Capacity Expansion

Time Technoplast has been investing in expanding its manufacturing capacities. For instance, its subsidiary, TPL Plastech Ltd., is setting up a greenfield manufacturing project in the Konkan region of Maharashtra to produce industrial packaging products like IBCs, plastic drums, and jerry cans. This expansion aims to cater to the growing demand in the agrochemical and allied sectors.

4. Favorable Industry Outlook

The global plastics market is projected to reach $738 billion by 2030, with a CAGR of 3.8% from 2024 to 2030. In India, over 40% of packaging needs are met by plastics, and consumption is expected to grow. Time Technoplast, with its diverse product portfolio and strong market presence, is well-positioned to benefit from this industry growth.

Time Technoplast Share Price Target 2030

Time Technoplast share price target 2030 Expected target could ₹770. Here are four key risks and challenges that could impact Time Technoplast Ltd.‘s share price target by 2030:

1. Intense Industry Competition

Time Technoplast operates in a highly competitive environment, facing pressure from both large established players and numerous smaller firms. This intense competition can exert pressure on the company’s profitability and market share, potentially affecting its long-term growth prospects.

2. Stock Volatility and Market Sentiment

The company’s stock has experienced significant volatility, with notable declines observed over consecutive days in early 2025. Such fluctuations can impact investor confidence and may lead to challenges in maintaining a stable share price.

3. ESG Risk and Regulatory Compliance

Time Technoplast has an ESG Risk Rating of 22.8, placing it in the medium-risk category. This indicates potential exposure to environmental, social, and governance-related risks, which could lead to increased regulatory scrutiny and compliance costs, potentially affecting the company’s operations and profitability.

4. Macroeconomic Factors and Raw Material Costs

The company is susceptible to macroeconomic factors such as fluctuating raw material prices and global economic conditions. These factors can impact production costs and demand for the company’s products, thereby influencing its financial performance and share price.

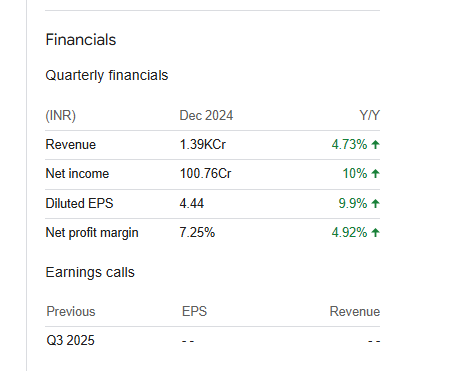

Time Technoplast Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 49.96B | 16.40% |

| Operating expense | 8.55B | 12.01% |

| Net income | 3.10B | 41.73% |

| Net profit margin | 6.21 | 21.76% |

| Earnings per share | — | — |

| EBITDA | 6.81B | 20.44% |

| Effective tax rate | 26.70% | — |

Read Also:- Keltech Energies Share Price Target Tomorrow 2025 To 2030