Saptak Chem Share Price Target Tomorrow 2025 To 2030

Saptak Chem and Business Limited, established in 1980 and headquartered in Ahmedabad, Gujarat, is engaged in trading agricultural produce and chemicals in India. The company deals in both organic and inorganic chemicals, including silicates, caustic soda, soda ash, phosphoric acid, hydrochloric acid, sulphuric acid, nitric acid, and various dyes and pigments. Over the years, Saptak Chem has diversified its operations to include trading in industrial salt, particularly targeting chemical industries in Gujarat. Saptak Chem Share Price on BOM as of 10 May 2025 is 3.20 INR.

Saptak Chem Share Market Overview

- Open: 3.45

- High: 3.45

- Low: 3.20

- Previous Close: 3.45

- Volume: 1,147

- Value (Lacs): 0.04

- VWAP: 3.23

- UC Limit: 3.84

- LC Limit: 2.56

- 52 Week High: 4.80

- 52 Week Low: 2.40

- Mkt Cap (Rs. Cr.): 3

- Face Value: 10

Saptak Chem Share Price Chart

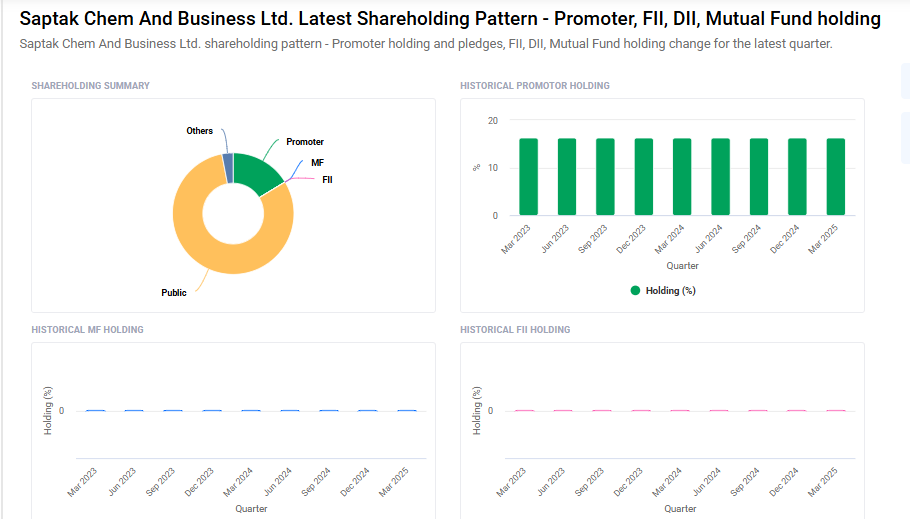

Saptak Chem Shareholding Pattern

- Promoters: 16.3%

- FII: 0%

- DII: 3%

- Public: 80.7%

Saptak Chem Share Price Target Tomorrow 2025 To 2030

| Saptak Chem Share Price Target Years | Saptak Chem Share Price |

| 2025 | ₹5 |

| 2026 | ₹7 |

| 2027 | ₹10 |

| 2028 | ₹13 |

| 2029 | ₹16 |

| 2030 | ₹20 |

Saptak Chem Share Price Target 2025

Saptak Chem share price target 2025 Expected target could ₹5. Here are four key factors that could influence Saptak Chem and Business Ltd.‘s share price target for 2025:

1. Diversification into Emerging Sectors

Saptak Chem and Business Ltd. has expressed intentions to expand beyond its core chemical and agricultural trading operations into sectors like textiles, marine, solar energy, and infrastructure, pending necessary approvals. This strategic diversification could open new revenue streams and enhance the company’s growth prospects.

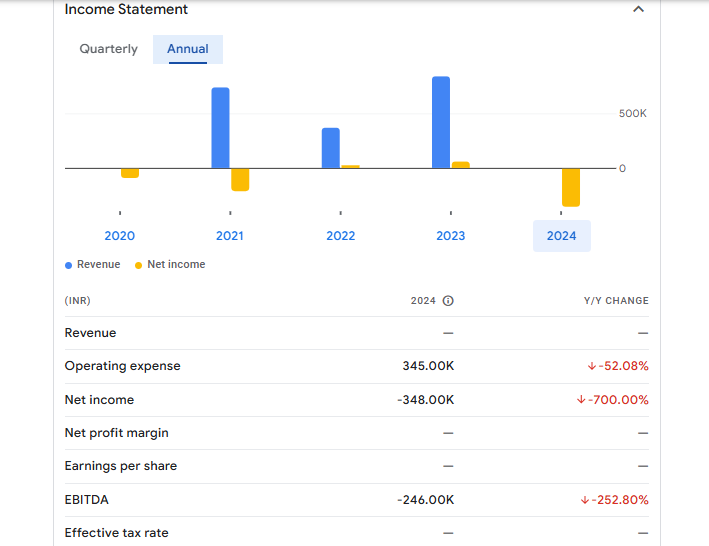

2. Recent Financial Performance

In the fiscal year ending March 2024, the company reported a net loss of ₹3.48 lakhs, compared to a net profit of ₹0.59 lakhs in the previous year. This shift highlights the importance of financial stability and effective cost management in influencing investor confidence and share price.

3. Stock Market Activity and Investor Sentiment

As of May 8, 2025, Saptak Chem and Business Ltd.’s stock was trading at ₹3.62, with a 52-week range between ₹2.40 and ₹4.80. The stock has experienced a 51.25% gain from its 52-week low, indicating positive investor sentiment and potential for growth.

4. Operational Challenges and Market Risks

The company faces operational challenges, including flat financial performance and negative EBITDA in recent quarters. These factors underscore the need for strategic planning and operational efficiency to mitigate risks and support sustainable growth.

Saptak Chem Share Price Target 2030

Saptak Chem share price target 2030 Expected target could ₹20. Here are four key risks and challenges that could impact Saptak Chem and Business Ltd.‘s share price target by 2030:

1. Persistent Financial Underperformance

Saptak Chem and Business Ltd. has reported consistent net losses in recent quarters, including a net loss of ₹0.08 crore in March 2025. Additionally, the company has experienced periods with no reported sales, indicating challenges in generating consistent revenue streams.

2. Limited Market Capitalization and Liquidity

With a market capitalization of approximately ₹3.43 crore as of May 2025, the company falls into the micro-cap category. Such companies often face challenges in attracting institutional investors and may experience higher stock price volatility due to limited trading volumes.

3. Ineffective Diversification Efforts

While the company has attempted to diversify its business, including ventures into industrial salt trading, these efforts have not yielded significant results. The lack of successful diversification may hinder the company’s ability to mitigate risks associated with its core operations.

4. Low Promoter Holding and Governance Concerns

The promoter holding in Saptak Chem and Business Ltd. stands at a relatively low 16.3%. Low promoter ownership can sometimes lead to concerns about management’s commitment to the company’s long-term success and may affect investor confidence.

Saptak Chem Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | — | — |

| Operating expense | 345.00K | -52.08% |

| Net income | -348.00K | -700.00% |

| Net profit margin | — | — |

| Earnings per share | — | — |

| EBITDA | -246.00K | -252.80% |

| Effective tax rate | — | — |

Read Also:- Shivansh Finserv Share Price Target Tomorrow 2025 To 2030