Richa Industries Share Price Target Tomorrow 2025 To 2030

Richa Industries Limited, established in 1993 and headquartered in Faridabad, Haryana, is a diversified manufacturing company operating in the pre-engineered building (PEB), engineering, procurement and construction (EPC), and textile sectors. The company is ISO 9001:2015 certified and has been recognized for its commitment to quality and timely project delivery. Under the leadership of Chairman Emeritus Mr. Sushil Gupta and Managing Director Dr. Sandeep Gupta, Richa Industries has expanded its operations, catering to both government and private clients across India. Richa Industries Share Price on BOM as of 12 May 2025 is 1.66 INR.

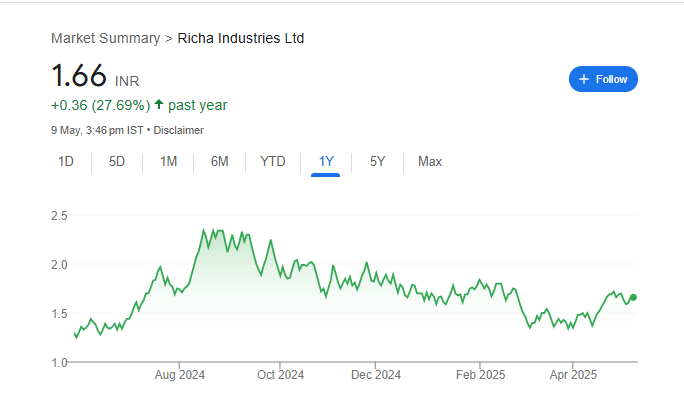

Richa Industries Share Market Overview

- Open: 1.60

- High: 1.68

- Low: 1.52

- Previous Close: 1.60

- Volume: 7,931

- Value (Lacs): 0.13

- VWAP: 1.57

- 52 Week High: 2.45

- 52 Week Low: 1.20

- Mkt Cap (Rs. Cr.): 3

- Face Value: 10

Richa Industries Share Price Chart

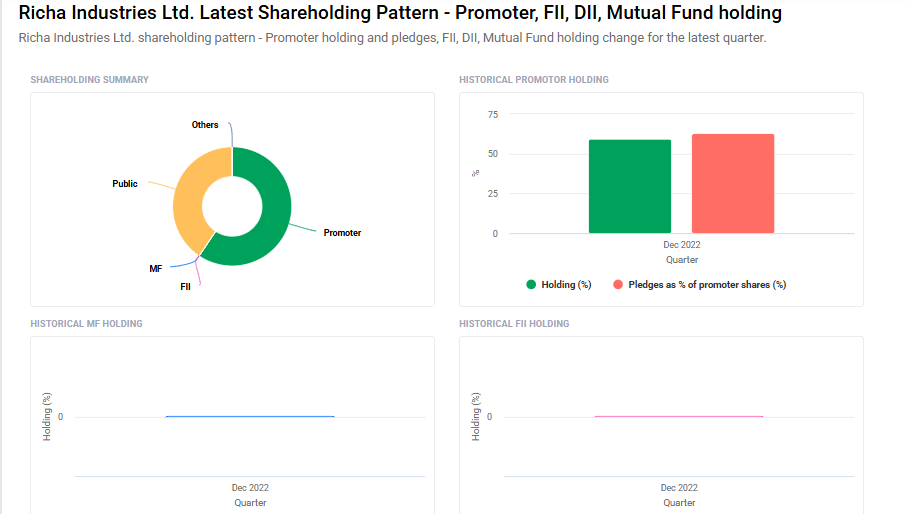

Richa Industries Shareholding Pattern

- Promoters: 59.4%

- FII: 0%

- DII: 0%

- Public: 40.6%

Richa Industries Share Price Target Tomorrow 2025 To 2030

| Richa Industries Share Price Target Years | Richa Industries Share Price |

| 2025 | ₹3 |

| 2026 | ₹6 |

| 2027 | ₹9 |

| 2028 | ₹12 |

| 2029 | ₹15 |

| 2030 | ₹18 |

Richa Industries Share Price Target 2025

Richa Industries share price target 2025 Expected target could ₹3. Here are four key factors that could influence Richa Industries Ltd.‘s share price target for 2025:

1. Strategic Diversification into Infrastructure

Richa Industries has expanded its operations beyond textiles into the infrastructure sector, notably in pre-engineered buildings (PEB) and engineering, procurement, and construction (EPC) projects. This diversification aims to tap into India’s growing infrastructure demands, potentially offering new revenue streams and reducing reliance on the textile segment.

2. Operational Challenges and Financial Performance

The company has faced financial headwinds, with a reported net loss of ₹17 crore for the fiscal year ending March 2024. Additionally, revenues have declined over recent years, indicating operational challenges that need to be addressed to restore profitability and investor confidence.

3. Asset Utilization and Debt Management

Richa Industries has a significant asset base, with total assets reported at ₹281.12 crore as of March 2024. However, the company’s total liabilities stood at ₹592.33 crore, highlighting the importance of effective asset utilization and debt management strategies to improve financial health and support growth initiatives.

4. Market Position and Competitive Landscape

Operating in both textile and infrastructure sectors, Richa Industries faces competition from established players. Enhancing its market position through innovation, quality service delivery, and strategic partnerships could be pivotal in capturing market share and driving growth.

Richa Industries Share Price Target 2030

Richa Industries share price target 2030 Expected target could ₹18. Here are four key risks and challenges that could impact Richa Industries Ltd.‘s share price target by 2030:

1. Consistent Financial Losses

Richa Industries has reported significant net losses over recent fiscal years, including a loss of ₹176.81 crore in FY2023 and ₹57.28 crore in FY2024. Such persistent financial underperformance raises concerns about the company’s ability to achieve profitability in the long term.

2. High Debt Levels and Interest Obligations

The company faces substantial interest expenses, with net interest outflows of ₹357.05 crore reported in FY2023. High debt levels and associated interest obligations can strain cash flows and limit the company’s capacity to invest in growth opportunities.

3. Promoter Share Pledging

As of the latest reports, 62.67% of promoter holdings are pledged. High levels of pledged shares can indicate financial stress and may lead to stock price volatility, especially if lenders invoke the pledges.

4. Low Market Capitalization and Liquidity Concerns

With a market capitalization of approximately ₹3.89 crore as of May 2025, Richa Industries is categorized as a micro-cap company. Such companies often face challenges related to low trading volumes and limited investor interest, which can result in higher stock price volatility.

Richa Industries Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 426.18M | -72.62% |

| Operating expense | 445.09M | -36.19% |

| Net income | -572.83M | 67.60% |

| Net profit margin | -134.41 | -18.34% |

| Earnings per share | — | — |

| EBITDA | –107.58M | 88.78% |

| Effective tax rate | -0.02% | — |

Read Also:- Saptak Chem Share Price Target Tomorrow 2025 To 2030