Karnimata Cold Share Price Target Tomorrow 2025 To 2030

Karnimata Cold is a company that specializes in providing reliable cold storage solutions for industries like food, pharmaceuticals, and agriculture. They focus on offering safe, efficient, and temperature-controlled storage to preserve products for longer periods. With the growing need for better storage and transportation of perishable goods, Karnimata Cold plays an important role in ensuring quality and reducing waste. Karnimata Cold Share Price on BOM as of 13 May 2025 is 8.89 INR.

Karnimata Cold Share Market Overview

- Open: 6.25

- High: 8.89

- Low: 6.25

- Previous Close: 7.41

- Volume: 12,000

- Value (Lacs): 1.07

- VWAP: 7.57

- 52 Week High: 19.60

- 52 Week Low: 6.25

- Mkt Cap (Rs. Cr.): 4

- Face Value: 10

Karnimata Cold Share Price Chart

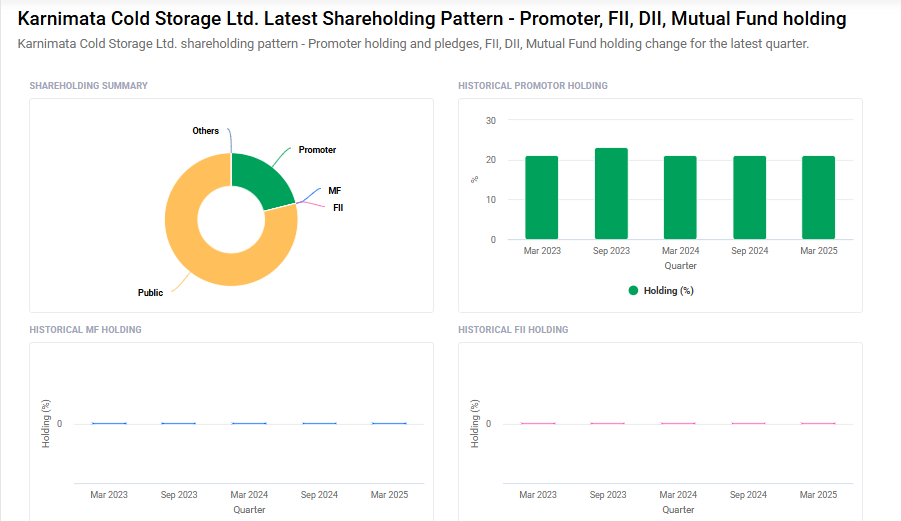

Karnimata Cold Shareholding Pattern

- Promoters: 21.1%

- FII: 0%

- DII: 0%

- Public: 78.9%

Karnimata Cold Share Price Target Tomorrow 2025 To 2030

| Karnimata Cold Share Price Target Years | Karnimata Cold Share Price |

| 2025 | ₹20 |

| 2026 | ₹28 |

| 2027 | ₹36 |

| 2028 | ₹44 |

| 2029 | ₹52 |

| 2030 | ₹60 |

Karnimata Cold Share Price Target 2025

Karnimata Cold share price target 2025 Expected target could ₹20. Here are 4 key factors affecting growth for Karnimata Cold share price target in 2025:

-

Rising Demand for Cold Storage Solutions: As the food and pharmaceutical industries expand, the need for reliable cold storage increases. This growing demand can boost Karnimata Cold’s revenue and market presence.

-

Government Support for Agri-Infrastructure: Policies and subsidies promoting better food preservation and reducing post-harvest losses can benefit cold storage companies like Karnimata Cold, supporting growth in the short and long term.

-

Geographical Expansion and Capacity Addition: Expanding storage capacity and entering new regions with high demand can help the company serve more clients and increase profits.

-

Technological Advancements in Storage Systems: Adopting energy-efficient and automated cold chain technologies can improve service quality, reduce costs, and enhance the company’s competitive advantage.

Karnimata Cold Share Price Target 2030

Karnimata Cold share price target 2030 Expected target could ₹60. Here are 4 key risks and challenges that could affect Karnimata Cold’s share price target for 2030:

-

Rising Energy Costs: Cold storage facilities are energy-intensive, and an increase in energy prices could significantly raise operating costs, reducing profitability for Karnimata Cold.

-

Regulatory and Environmental Pressures: Stricter environmental regulations or government policies targeting energy use and emissions could require costly upgrades to facilities, affecting financial performance.

-

Competition from New Entrants: As demand for cold storage grows, more companies may enter the market, increasing competition and potentially squeezing margins if Karnimata Cold cannot maintain a unique value proposition.

-

Supply Chain Disruptions: Geopolitical instability, natural disasters, or supply chain challenges can disrupt operations, leading to delays or cost increases in maintaining cold storage systems.

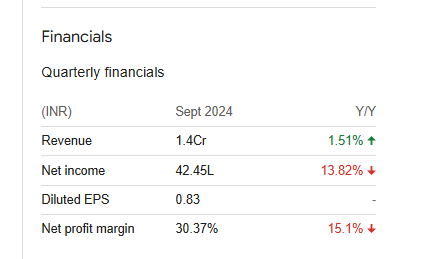

Karnimata Cold Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 41.87M | -2.24% |

| Operating expense | 30.16M | -4.46% |

| Net income | 6.06M | 30.33% |

| Net profit margin | 14.46 | 33.27% |

| Earnings per share | — | — |

| EBITDA | 13.41M | -2.21% |

| Effective tax rate | 17.20% | — |

Read Also:- Encode Packaging Share Price Target Tomorrow 2025 To 2030