Oscar Global Share Price Target Tomorrow 2025 To 2030

Oscar Global Limited, established in 1990 and headquartered in New Delhi, is a manufacturer and exporter of high-fashion leather garments and accessories. With an annual production capacity of 45,000 pieces, the company has served international markets, including the US, Europe, and Asia. However, due to declining demand for leather garments, Oscar Global ceased its production activities and sold its plant, machinery, land, and buildings, as disclosed to stock exchanges. Currently, the company operates from rented premises in Darya Ganj, New Delhi, focusing on its leather garment business. Oscar Global Share Price on BOM as of 14 May 2025 is 10.80 INR.

Oscar Global Share Market Overview

- Open: 10.80

- High: 10.80

- Low: 10.80

- Previous Close: 11.05

- Volume: 109

- Value (Lacs): 0.01

- VWAP: 10.80

- 52 Week High: 25.05

- 52 Week Low: 7.20

- Mkt Cap (Rs. Cr.): 3

- Face Value: 10

Oscar Global Share Price Chart

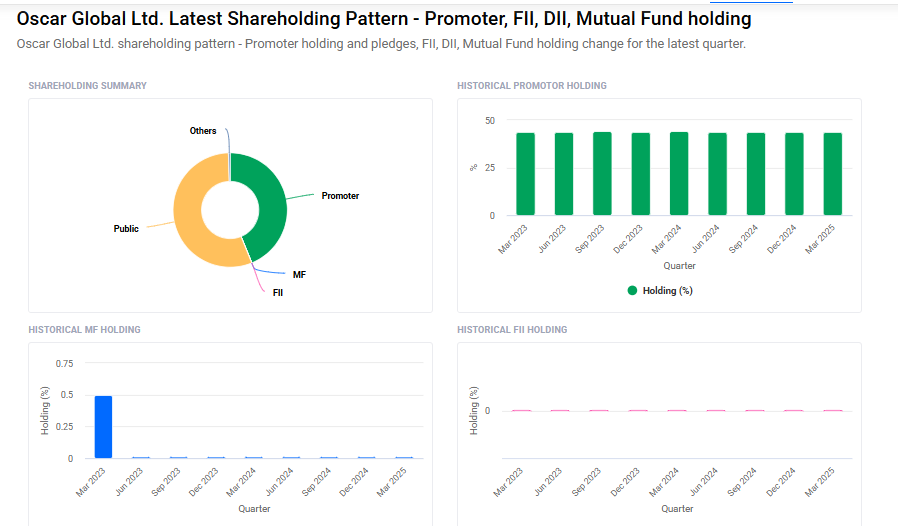

Oscar Global Shareholding Pattern

- Promoters: 43.8%

- FII: 0%

- DII: 0.5%

- Public: 55.7%

Oscar Global Share Price Target Tomorrow 2025 To 2030

| Oscar Global Share Price Target Years | Oscar Global Share Price |

| 2025 | ₹26 |

| 2026 | ₹30 |

| 2027 | ₹34 |

| 2028 | ₹38 |

| 2029 | ₹42 |

| 2030 | ₹46 |

Oscar Global Share Price Target 2025

Oscar Global share price target 2025 Expected target could ₹26. Here are 4 key factors influencing the growth of Oscar Global Ltd.’s share price target for 2025:

-

Expansion in Export Markets: Oscar Global Ltd., a Noida-based company, specializes in manufacturing and exporting leather garments and accessories. Its focus on international markets, particularly in Europe and North America, positions it to benefit from increasing global demand for quality leather products.

-

Adoption of E-commerce Channels: The company has embraced an internet-first approach, enhancing its online presence to reach a broader customer base. This digital strategy can lead to increased sales and brand recognition, contributing positively to revenue growth.

-

Product Diversification: Oscar Global offers a wide range of leather products, including jackets, bags, belts, and pants. Diversifying its product line allows the company to cater to various customer preferences and reduces dependence on a single product category.

-

Positive Share Price Forecasts: Analysts predict a favorable outlook for Oscar Global’s stock, with expectations of steady growth in the coming years. Such forecasts can boost investor confidence and attract more investment into the company.

Oscar Global Share Price Target 2030

Oscar Global share price target 2030 Expected target could ₹46. Here are 4 key risks and challenges that could affect Oscar Global Ltd.’s share price target for 2030:

-

Limited Revenue Diversification: Oscar Global Ltd. primarily operates in the manufacturing and export of high-fashion leather garments. This narrow focus can make the company vulnerable to sector-specific downturns or shifts in consumer preferences.

-

Intense Market Competition: The leather garment industry is highly competitive, with several players vying for market share. Oscar Global faces competition from companies like Euro Leder Fashion, Welterman International, and Super Tannery, which could impact its pricing power and profitability.

-

Volatility in Raw Material Prices: Fluctuations in the prices of raw materials, such as leather and related inputs, can affect production costs. Such volatility may impact the company’s margins if not managed effectively.

-

Regulatory and Environmental Challenges: The leather industry is subject to stringent environmental regulations due to its impact on pollution and waste management. Compliance with these regulations can lead to increased operational costs and may require significant investments in sustainable practices.

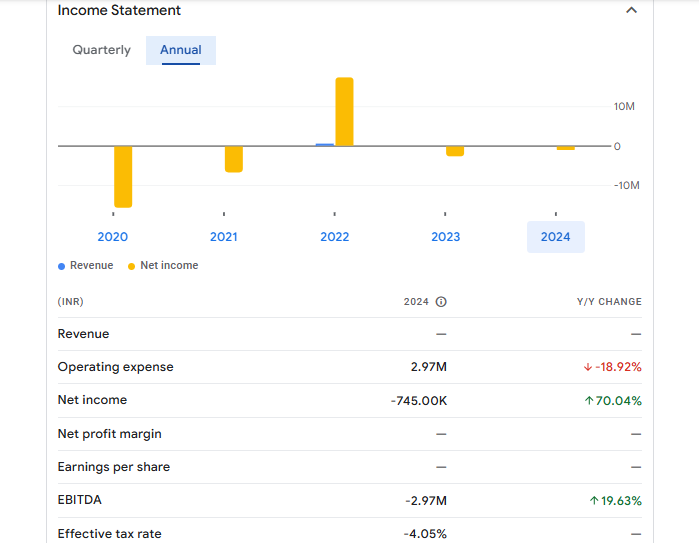

Oscar Global Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | — | — |

| Operating expense | 2.97M | -18.92% |

| Net income | -745.00K | 70.04% |

| Net profit margin | — | — |

| Earnings per share | — | — |

| EBITDA | -2.97M | 19.63% |

| Effective tax rate | -4.05% | — |

Read Also:- Premium Capital Share Price Target Tomorrow 2025 To 2030