Arcee Industries Share Price Target Tomorrow 2025 To 2030

Arcee Industries Ltd. is a public company based in Hisar, Haryana, India, specializing in the manufacture of rigid polyvinyl chloride (PVC) pipes and fittings. Established in 1992, it serves various industries, including construction and agriculture. Arcee Industries Share Price on BOM as of 14 May 2025 is 6.83 INR.

Arcee Industries Share Market Overview

- Open: 6.84

- High: 6.84

- Low: 6.80

- Previous Close: 6.84

- Volume: 256

- Value (Lacs): 0.02

- VWAP: 6.80

- 52 Week High: 7.26

- 52 Week Low: 4.43

- Mkt Cap (Rs. Cr.): 3

- Face Value: 10

Arcee Industries Share Price Chart

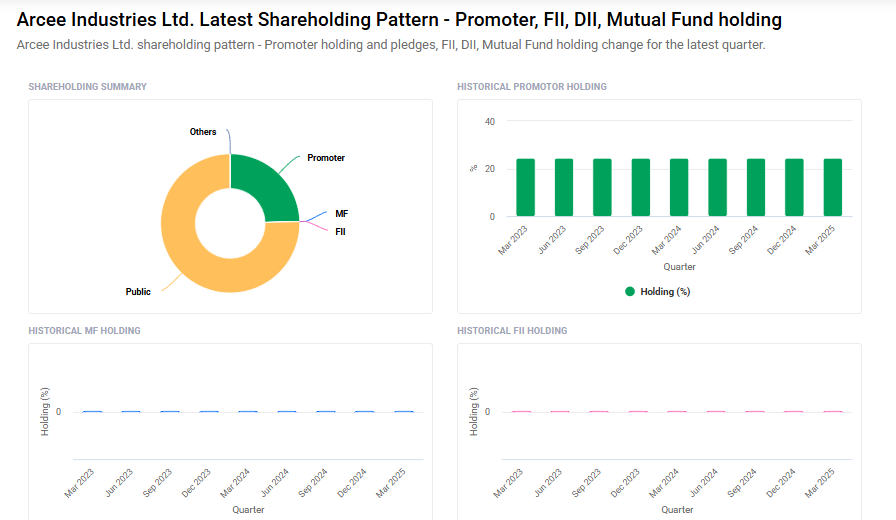

Arcee Industries Shareholding Pattern

- Promoters: 24.6%

- FII: 0%

- DII: 0%

- Public: 75.4%

Arcee Industries Share Price Target Tomorrow 2025 To 2030

| Arcee Industries Share Price Target Years | Arcee Industries Share Price |

| 2025 | ₹8 |

| 2026 | ₹10 |

| 2027 | ₹12 |

| 2028 | ₹14 |

| 2029 | ₹16 |

| 2030 | ₹18 |

Arcee Industries Share Price Target 2025

Arcee Industries share price target 2025 Expected target could ₹8. Here are four key factors that could influence the growth of Arcee Industries Ltd.’s share price target for 2025:

-

Improving Profit Margins: In the third quarter of FY 2024–25, Arcee Industries reported a net profit of ₹0.05 crore, marking a 50% increase compared to the same period in the previous year. Additionally, the company’s net profit margin improved by 90.91% year-over-year, reaching -45.45%. These figures indicate a positive trend in the company’s profitability, which could bolster investor confidence.

-

Low Price-to-Book Ratio: As of May 2025, Arcee Industries has a price-to-book (P/B) ratio of 0.70, suggesting that the stock is trading below its book value. This valuation may appeal to value investors seeking undervalued opportunities in the market.

-

Stable Promoter Holding: The promoter holding in Arcee Industries remained steady at 24.58% as of March 2025. Consistent promoter ownership can be perceived as a sign of confidence in the company’s future prospects, potentially attracting long-term investors.

-

Market Capitalization and Share Price Trends: With a market capitalization of approximately ₹3.22 crore and a 52-week share price range between ₹4.43 and ₹7.26, Arcee Industries is positioned as a micro-cap stock. Such stocks often exhibit higher volatility but can offer significant growth potential if the company executes its business strategies effectively.

Arcee Industries Share Price Target 2030

Arcee Industries share price target 2030 Expected target could ₹18. Here are four key risks and challenges that could impact Arcee Industries Ltd.’s share price target for 2030:

-

Declining Revenue Trends: Arcee Industries has experienced a significant decline in revenue, with net sales dropping by over 98% year-over-year in March 2024 . Such a steep decline raises concerns about the company’s ability to generate consistent income and sustain operations in the long term.

-

Negative Profit Margins: Despite a recent improvement in profit margins, the company reported a net profit margin of -45.45% in Q3 FY2024–25 . Persistent negative margins could hinder the company’s ability to reinvest in growth initiatives and may deter potential investors.

-

Limited Institutional Interest: As of March 2025, there is no foreign institutional investor (FII) or domestic institutional investor (DII) participation in the company’s shareholding . The absence of institutional backing can result in lower liquidity and increased volatility in the stock price.

-

Volatility in Stock Performance: The company’s stock has shown considerable volatility, with fluctuations in share price over short periods . Such volatility can be unsettling for investors and may affect the company’s ability to attract long-term capital.

Arcee Industries Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 10.72M | -94.98% |

| Operating expense | 8.99M | -69.59% |

| Net income | -7.25M | 40.18% |

| Net profit margin | -67.66 | -1,091.20% |

| Earnings per share | — | — |

| EBITDA | -5.27M | 63.73% |

| Effective tax rate | — | — |

Read Also:- Gujarat Winding Share Price Target Tomorrow 2025 To 2030