SEL Manufacturing Share Price Target Tomorrow 2025 To 2030

SEL Manufacturing Company Ltd., established in 2000 and headquartered in Ludhiana, Punjab, India, is a textile company engaged in the production of yarn, fabric, and garments. The company operates manufacturing facilities in Punjab and Himachal Pradesh. Despite facing financial challenges in recent years, including consistent net losses and declining revenues, SEL Manufacturing has experienced significant share price appreciation over the past three years, indicating strong investor interest. SEL Manufacturing Share Price on NSE as of 15 May 2025 is 39.51 INR.

SEL Manufacturing Share Market Overview

- Open: 39.51

- High: 39.51

- Low: 39.51

- Previous Close: 37.63

- Volume: 6,776

- Value (Lacs): 2.68

- 52 Week High: 164.10

- 52 Week Low: 25.50

- Mkt Cap (Rs. Cr.): 130

- Face Value: 10

SEL Manufacturing Share Price Chart

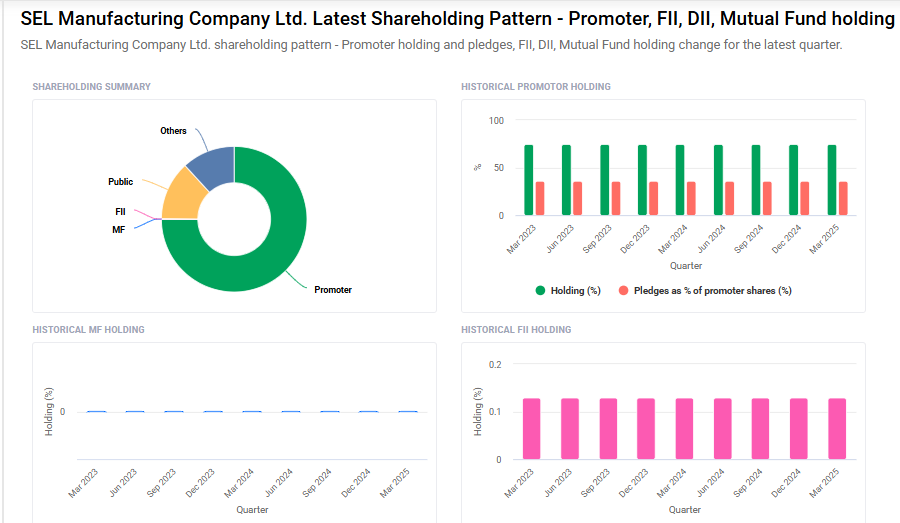

SEL Manufacturing Shareholding Pattern

- Promoters: 75%

- FII: 0.1%

- DII: 11.8%

- Public: 13.1%

SEL Manufacturing Share Price Target Tomorrow 2025 To 2030

| SEL Manufacturing Share Price Target Years | SEL Manufacturing Share Price |

| 2025 | ₹90 |

| 2026 | ₹130 |

| 2027 | ₹170 |

| 2028 | ₹210 |

| 2029 | ₹250 |

| 2030 | ₹290 |

SEL Manufacturing Share Price Target 2025

SEL Manufacturing share price target 2025 Expected target could ₹90. Here are five key factors that could influence the growth of SEL Manufacturing Company Ltd.’s share price target for 2025:

-

Significant Share Price Appreciation: Over the past three years, SEL Manufacturing’s share price has surged by over 4,300%, indicating strong investor interest and market momentum. This substantial growth reflects positive market sentiment and could continue to influence the stock’s performance.

-

High Promoter Holding: As of March 2025, the company’s promoters hold a substantial 75% stake in SEL Manufacturing. This high level of promoter ownership can be interpreted as a sign of confidence in the company’s future prospects, potentially attracting more investors.

-

Operational Challenges: Despite the impressive share price growth, the company faces operational challenges. For instance, in the quarter ending December 2024, SEL Manufacturing reported a net loss of ₹15.99 crore, highlighting ongoing profitability issues. Addressing these challenges is crucial for sustainable growth.

-

Market Capitalization and Valuation: As of January 2024, SEL Manufacturing’s market capitalization stood at over ₹300 crore. This valuation places the company in the small-cap category, which often attracts investors seeking high-growth opportunities, albeit with higher risks.

-

Technical Indicators and Stock Forecasts: Technical analyses and stock forecasts suggest potential price targets for SEL Manufacturing in 2025. For instance, some forecasts indicate an upside target of ₹44.12 and a downside target of ₹32.99, providing a range of expectations for investors to consider.

SEL Manufacturing Share Price Target 2030

SEL Manufacturing share price target 2030 Expected target could ₹290. Here are five key risks and challenges that could impact SEL Manufacturing Company Ltd.’s share price target by 2030:

-

Persistent Financial Losses: SEL Manufacturing has been reporting consistent net losses. For instance, in the quarter ending December 2024, the company reported a net loss of ₹15.99 crore, following a loss of ₹43.08 crore in the previous quarter . Such ongoing losses raise concerns about the company’s ability to achieve profitability in the long term.

-

Significant Decline in Revenue: The company has experienced a sharp decline in revenue. In September 2024, net sales stood at ₹4.89 crore, down 94.92% year-over-year . This substantial drop in revenue indicates challenges in maintaining market share and operational efficiency.

-

Negative Profit Margins: SEL Manufacturing has been operating with negative profit margins. As of December 2024, the net profit margin was reported at -89.9% . Negative margins can hinder the company’s ability to reinvest in growth initiatives and may deter potential investors.

-

Low Financial Stability Indicators: The company’s Altman Z-score, a measure of financial stability, is -0.49, placing it at the bottom among its peers . A low Z-score suggests a higher risk of financial distress, which could impact investor confidence and share price stability.

-

Challenging Industry Outlook: The textile industry faces challenges such as fluctuating raw material prices and changing consumer preferences. Additionally, global efforts towards decarbonization may require significant investments in sustainable practices, potentially increasing operational costs for companies like SEL Manufacturing .

SEL Manufacturing Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 3.75B | -32.52% |

| Operating expense | 1.91B | -31.50% |

| Net income | -1.93B | -3.79% |

| Net profit margin | -51.51 | -53.81% |

| Earnings per share | — | — |

| EBITDA | -549.24M | 21.98% |

| Effective tax rate | — | — |

Read Also:- T Spiritual Share Price Target Tomorrow 2025 To 2030