Astra Microwave Products Share Price Target Tomorrow 2025 To 2030

Astra Microwave Products Limited (AMPL), established in 1991 in Hyderabad, India, is a leading company specializing in the design and manufacture of high-quality radio frequency (RF) and microwave components and sub-systems. Founded by a team of experienced scientists, AMPL has been instrumental in advancing India’s capabilities in defense, space, and meteorology sectors. Astra Microwave Products Share Price on NSE as of 15 May 2025 is 923.00 INR.

Astra Microwave Products Share Market Overview

- Open: 905.00

- High: 925.15

- Low: 892.45

- Previous Close: 897.55

- Volume: 802,574

- Value (Lacs): 7,371.64

- 52 Week High: 1,059.00

- 52 Week Low: 341.55

- Mkt Cap (Rs. Cr.): 8,720

- Face Value: 2

Astra Microwave Products Share Price Chart

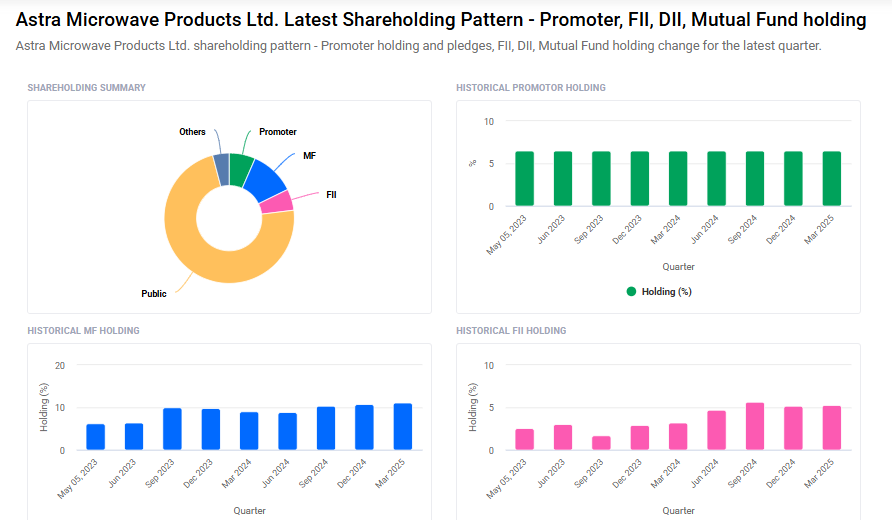

Astra Microwave Products Shareholding Pattern

- Promoters: 6.5%

- FII: 5.3%

- DII: 15.3%

- Public: 72.9%

Astra Microwave Products Share Price Target Tomorrow 2025 To 2030

| Astra Microwave Products Share Price Target Years | Astra Microwave Products Share Price |

| 2025 | ₹1060 |

| 2026 | ₹1250 |

| 2027 | ₹1450 |

| 2028 | ₹1650 |

| 2029 | ₹1850 |

| 2030 | ₹2050 |

Astra Microwave Products Share Price Target 2025

Astra Microwave Products share price target 2025 Expected target could ₹1060. Here are five key factors that could influence the growth of Astra Microwave Products Ltd. share price target for 2025:

-

Strong Revenue and Profit Growth: Analysts project Astra Microwave’s revenue to reach ₹11.2 billion in 2025, marking a 22% increase from the previous year. Earnings per share are also expected to rise by 21% to ₹15.45, reflecting robust financial performance.

-

Expanding Export Sales: In Q3 2025, the company reported a 25% year-over-year growth in export sales, highlighting its increasing presence in international markets and the effectiveness of its global expansion strategies.

-

Favorable Industry Outlook: The Indian government’s emphasis on defense indigenization and increased domestic production is leading to higher indigenous orders for defense PSUs. Private players like Astra Microwave are poised to benefit from this trend.

-

Positive Analyst Ratings: Brokerages such as ICICI Securities have maintained a ‘Buy’ rating on Astra Microwave, with a target price of ₹935, suggesting a potential upside of approximately 32% from its current levels.

-

Healthy Order Book and Profitability: As of June 2024, Astra Microwave reported a consolidated order book of ₹2,365 crore. Additionally, the company achieved an EBITDA margin of 15% in Q4 FY24, up from 3.5% in the previous year, indicating improved operational efficiency.

Astra Microwave Products Share Price Target 2030

Astra Microwave Products share price target 2030 Expected target could ₹2050. Here are five key risks and challenges that could impact Astra Microwave Products Ltd.’s share price target by 2030:

-

Heavy Dependence on Domestic Defense Sector: Approximately 85% of Astra Microwave’s revenue is derived from domestic defense contracts. This significant reliance exposes the company to risks associated with changes in government defense budgets or policies, which could affect future revenue stability.

-

High Valuation Metrics: As of May 2025, Astra Microwave’s stock is trading at a Price-to-Earnings (P/E) ratio of 63.39 and a Price-to-Book (P/B) ratio of 8.82, indicating a premium valuation compared to industry peers. Such high valuations may limit future upside potential and make the stock more susceptible to market corrections.

-

Limited Promoter Holding: The promoter holding in Astra Microwave stands at 6.54% as of March 2025. A lower promoter stake can sometimes be perceived as a lack of strong insider confidence, potentially impacting investor sentiment.

-

Exposure to Interest Rate Fluctuations: Increased interest costs have impacted the company’s profitability, as evidenced by a 15% year-over-year decline in Profit After Tax (PAT) in Q2 FY25. Rising interest rates could further strain financial performance.

-

Intense Industry Competition: Astra Microwave operates in a competitive landscape with peers like Bharat Electronics Ltd., Hindustan Aeronautics Ltd., and Mazagon Dock Shipbuilders Ltd. This competition can lead to pricing pressures and affect market share.

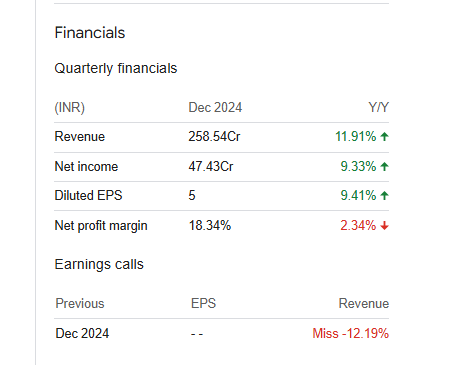

Astra Microwave Products Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 9.09B | 11.44% |

| Operating expense | 1.79B | 13.54% |

| Net income | 1.21B | 73.37% |

| Net profit margin | 13.32 | 55.61% |

| Earnings per share | 12.86 | 45.31% |

| EBITDA | 1.90B | 29.48% |

| Effective tax rate | 23.86% | — |

Read Also:- NCC Share Price Target Tomorrow 2025 To 2030