Biocon Share Price Target Tomorrow 2025 To 2030

Biocon Limited is a leading Indian biopharmaceutical company based in Bengaluru. Founded in 1978, Biocon focuses on developing affordable and innovative medicines, especially in areas like diabetes, cancer, and autoimmune diseases. The company is known for its work in biosimilars, generic drugs, and research services, supplying products to over 120 countries. Biocon’s mission is to make healthcare more accessible and to improve global health through science and innovation. Biocon Share Price on NSE as of 16 May 2025 is 337.75 INR.

Biocon Share Market Overview

- Open: 339.00

- High: 341.75

- Low: 334.05

- Previous Close: 338.20

- Volume: 3,182,074

- Value (Lacs): 10,774.50

- 52 Week High: 404.70

- 52 Week Low: 269.55

- Mkt Cap (Rs. Cr.): 40,652

- Face Value: 5

Biocon Share Price Chart

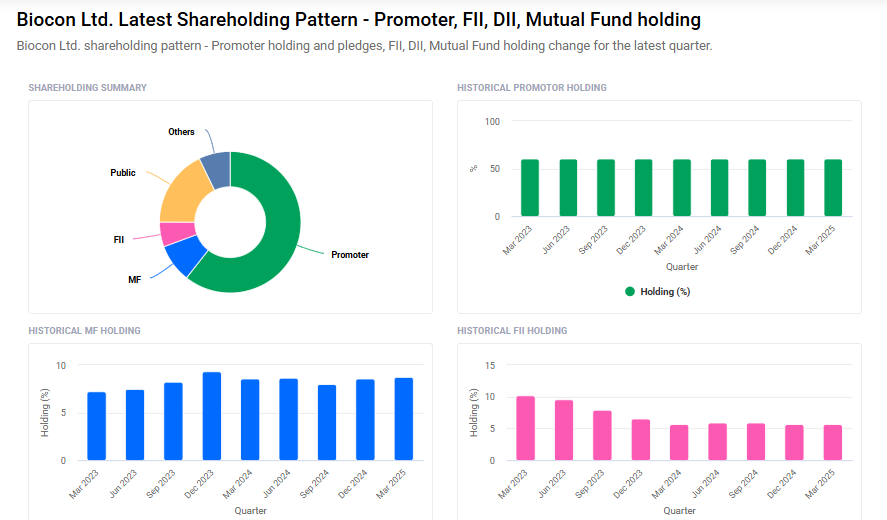

Biocon Shareholding Pattern

- Promoters: 60.6%

- FII: 5.7%

- DII: 15.7%

- Public: 17.8%

Biocon Share Price Target Tomorrow 2025 To 2030

| Biocon Share Price Target Years | Biocon Share Price |

| 2025 | ₹405 |

| 2026 | ₹450 |

| 2027 | ₹490 |

| 2028 | ₹530 |

| 2029 | ₹570 |

| 2030 | ₹610 |

Biocon Share Price Target 2025

Biocon share price target 2025 Expected target could ₹405. Here are five key factors that could influence the growth of Biocon Limited’s share price target for 2025:

-

Robust Growth in Biosimilars and Generics: Biocon reported a 15% year-on-year revenue increase in its biosimilars division, reaching ₹9,017 crore in FY25. This growth was driven by strong demand in the U.S. and European markets. Additionally, the generics segment saw a 46% year-on-year and 53% sequential growth in Q4 FY25, contributing to an 8% overall annual growth.

-

Strategic Capital Investment: Biocon has announced a $150 million capital expenditure plan over the next two years, with $100 million allocated to its biologics division and the remainder to support its generics business. This investment aims to enhance Biocon’s capabilities and growth in these key sectors.

-

Positive Analyst Outlook: Brokerages like Investec and HSBC have issued ‘Buy’ ratings for Biocon, with target prices of ₹400 and ₹430 respectively. These optimistic assessments are based on Biocon’s strategic positioning in the global biosimilars market and expected operational turnaround.

-

Expansion into Weight-Loss Therapeutics: Biocon is developing its own version of Novo Nordisk’s popular weight-loss drug, Wegovy (semaglutide), with plans to conduct clinical trials and target emerging markets like India, Brazil, and Mexico. The company anticipates that revenue from the weight-loss drugs market will significantly contribute to future earnings.

-

Enhanced Market Access for Biosimilars: Biocon’s biosimilar to Stelara, Yesintek, has secured strong market access coverage in the United States, covering 100 million lives. This development is expected to be a significant positive for the company’s growth in the biosimilars segment.

Biocon Share Price Target 2030

Biocon share price target 2030 Expected target could ₹610. Here are five key risks and challenges that could impact Biocon Limited’s share price target by 2030:

-

High Debt from Viatris Acquisition: Biocon’s acquisition of Viatris’ biosimilars business, primarily funded through debt, has raised concerns about the company’s financial stability. The increased debt burden may limit Biocon’s flexibility in making future investments and could affect its profitability.

-

Regulatory Scrutiny: Biocon has faced regulatory challenges, including observations from the US Food and Drug Administration (USFDA) during facility inspections. Such regulatory issues can lead to delays in product approvals and impact the company’s reputation and investor confidence.

-

Intense Market Competition: The biosimilars market is highly competitive, with established players and new entrants exerting pricing pressures. Biocon’s biosimilars have struggled to capture the expected market share in the U.S., indicating challenges in competing effectively in this space.

-

Integration Challenges Post-Acquisition: Integrating Viatris’ assets into Biocon’s operations presents complexities that may hinder operational efficiency in the short term. Successful integration is crucial to realizing the anticipated benefits of the acquisition.

-

Forecasted Share Price Decline: Analyst projections suggest a potential decline in Biocon’s share price, with forecasts indicating a drop from ₹336.55 to ₹321.61. Such a trend reflects market concerns about the company’s future performance.

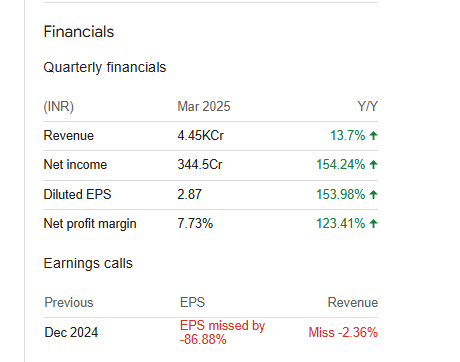

Biocon Financials Statement

| (INR) | Mar 2025 | Y/Y change |

| Revenue | 44.54B | 13.70% |

| Operating expense | 23.02B | 71.69% |

| Net income | 3.45B | 154.24% |

| Net profit margin | 7.73 | 123.41% |

| Earnings per share | 2.71 | 129.37% |

| EBITDA | 11.01B | 16.71% |

| Effective tax rate | 5.63% | — |

Read Also:- Kpit Share Price Target Tomorrow 2025 To 2030