Sun Pharma Share Price Target Tomorrow 2025 To 2030

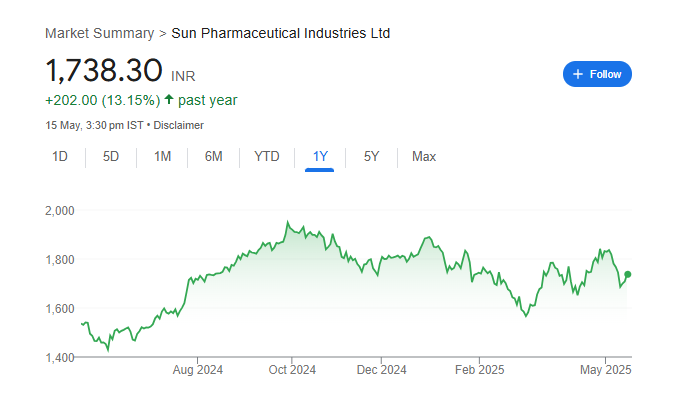

Sun Pharmaceutical Industries Ltd., commonly known as Sun Pharma, is one of the largest pharmaceutical companies in India and a major player globally. Founded in 1983, the company is known for making affordable and high-quality medicines for people around the world. It produces a wide range of products, including generic drugs, specialty medicines, and active pharmaceutical ingredients. Sun Pharma Share Price on NSE as of 16 May 2025 is 1,738.30 INR.

Sun Pharma Share Market Overview

- Open: 1,701.10

- High: 1,744.40

- Low: 1,684.10

- Previous Close: 1,708.20

- Volume: 3,880,385

- Value (Lacs): 67,522.58

- 52 Week High: 1,960.35

- 52 Week Low: 922.45

- Mkt Cap (Rs. Cr.): 417,508

- Face Value: 1

Sun Pharma Share Price Chart

Sun Pharma Shareholding Pattern

- Promoters: 54.5%

- FII: 18%

- DII: 18.7%

- Public: 8.9%

Sun Pharma Share Price Target Tomorrow 2025 To 2030

| Sun Pharma Share Price Target Years | Sun Pharma Share Price |

| 2025 | ₹1970 |

| 2026 | ₹2150 |

| 2027 | ₹2400 |

| 2028 | ₹2600 |

| 2029 | ₹2700 |

| 2030 | ₹2800 |

Sun Pharma Share Price Target 2025

Sun Pharma share price target 2025 Expected target could ₹1970. Here are five key factors that could influence the growth of Sun Pharmaceutical Industries Ltd. share price target for 2025:

-

Expansion of Specialty Pharmaceuticals Segment: Sun Pharma’s specialty pharmaceuticals segment has shown significant growth, particularly in the U.S. market. The company’s acquisition of Checkpoint Therapeutics for $355 million aims to bolster its oncology and immunotherapy portfolio, potentially enhancing revenue streams in high-margin areas.

-

Robust Domestic Market Performance: The Indian pharmaceutical market experienced a 9.3% year-on-year growth in March 2025, with Sun Pharma contributing significantly. The company’s strong presence in India, its largest revenue-generating region, supports its overall financial performance.

-

Strategic R&D Investments: Sun Pharma is intensifying efforts to recruit top research and development talent, focusing on innovation and expanding capabilities in emerging therapeutic areas. This strategic emphasis on R&D is expected to drive long-term growth through the development of high-quality, commercially viable biosimilars.

-

Development of Novel Therapies: The company is advancing its pipeline with the development of Utreglutide (GL0034), an experimental drug targeting obesity and type 2 diabetes. With plans for a global launch within five years, this initiative positions Sun Pharma to tap into the growing market for weight-loss and metabolic disorder treatments.

-

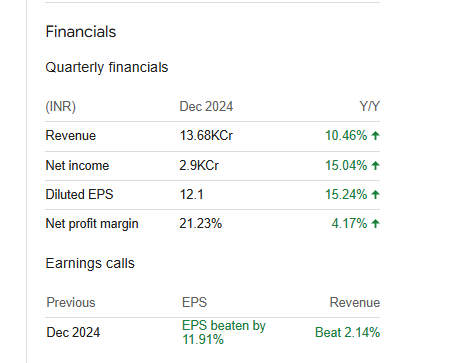

Financial Performance and Profitability: Sun Pharma reported a 28% rise in net profit in the second quarter, driven by higher demand for its specialty drugs. The company’s EBIT margins have improved from 22% to 24%, indicating enhanced operational efficiency and profitability, which are positive indicators for investor confidence.

Sun Pharma Share Price Target 2030

Sun Pharma share price target 2030 Expected target could ₹2800. Here are five key risks and challenges that could impact Sun Pharmaceutical Industries Ltd.’s share price target by 2030:

-

Regulatory Scrutiny and Compliance Issues: Sun Pharma has faced significant regulatory challenges, notably receiving a warning letter from the U.S. Food and Drug Administration (FDA) in June 2024 for violations at its Dadra facility. The FDA cited failures in cleaning and maintaining equipment used for drug manufacturing. Additionally, three of Sun Pharma’s facilities—Toansa, Dewas, and Poanta Sahib—remain under import alerts and are subject to certain clauses of a consent decree with the FDA. These ongoing compliance issues can lead to operational disruptions and affect the company’s reputation.

-

Intense Market Competition: The pharmaceutical industry is highly competitive, with Sun Pharma facing competition from companies like Hospira, Alnylam Pharmaceuticals, Amneal Pharmaceuticals, and Cytokinetics. This intense competition can pressure profit margins and market share, especially in the specialty pharmaceuticals segment.

-

Patent Litigation Risks: Sun Pharma is involved in ongoing patent litigation, such as the lawsuit filed by Australia’s Mayne Pharma over alleged patent infringements related to the drug IMVEXXY. Such legal disputes can lead to delays in product launches and additional legal expenses, potentially impacting financial performance.

-

Exposure to Tariff and Trade Policy Changes: Changes in international trade policies, such as the announcement of potential tariffs on pharmaceutical imports by the U.S. government, can adversely affect Sun Pharma. In February 2025, Indian pharmaceutical stocks, including Sun Pharma, declined following the U.S. President’s announcement of potential tariffs of 25% or higher on pharma imports. Such tariffs can increase costs and reduce competitiveness in key markets.

-

Quality Control and Counterfeit Drug Concerns: Sun Pharma has reported issues related to counterfeit drugs, including a counterfeit batch of its antacid Pantocid. The presence of counterfeit products in the market can harm the company’s brand reputation and lead to regulatory scrutiny, affecting consumer trust and sales.

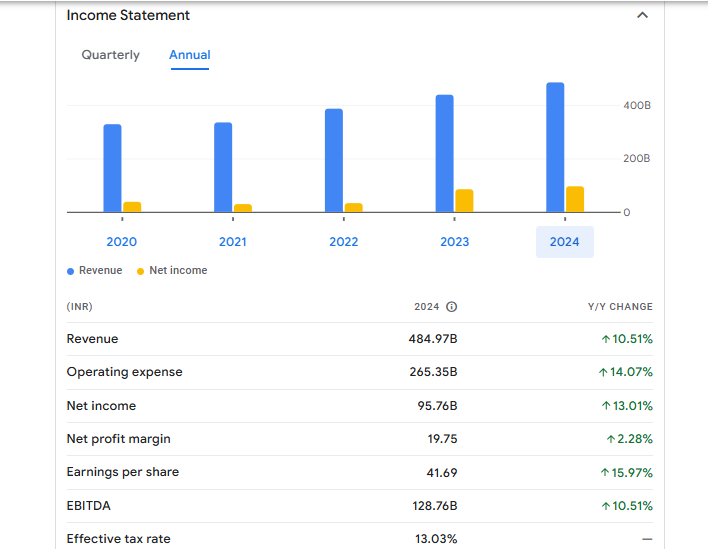

Sun Pharma Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 484.97B | 10.51% |

| Operating expense | 265.35B | 14.07% |

| Net income | 95.76B | 13.01% |

| Net profit margin | 19.75 | 2.28% |

| Earnings per share | 41.69 | 15.97% |

| EBITDA | 128.76B | 10.51% |

| Effective tax rate | 13.03% | — |

Read Also:- Biocon Share Price Target Tomorrow 2025 To 2030