Hindustan Motors Share Price Target Tomorrow 2025 To 2030

Hindustan Motors is one of the oldest automobile companies in India, best known for producing the iconic Ambassador car, which was once a common sight on Indian roads. Founded in 1942, the company played a major role in shaping the country’s auto industry. In recent years, Hindustan Motors has faced financial difficulties and halted car production, but it is now planning a comeback. The company is exploring new opportunities, including a shift towards electric vehicles (EVs), which could bring it back into the spotlight. Hindustan Motors Share Price on NSE as of 16 May 2025 is 26.15 INR.

Hindustan Motors Share Market Overview

- Open: 26.65

- High: 26.80

- Low: 26.08

- Previous Close: 26.60

- Volume: 1,082,019

- Value (Lacs): 283.92

- 52 Week High: 40.55

- 52 Week Low: 20.55

- Mkt Cap (Rs. Cr.): 547

- Face Value: 5

Hindustan Motors Share Price Chart

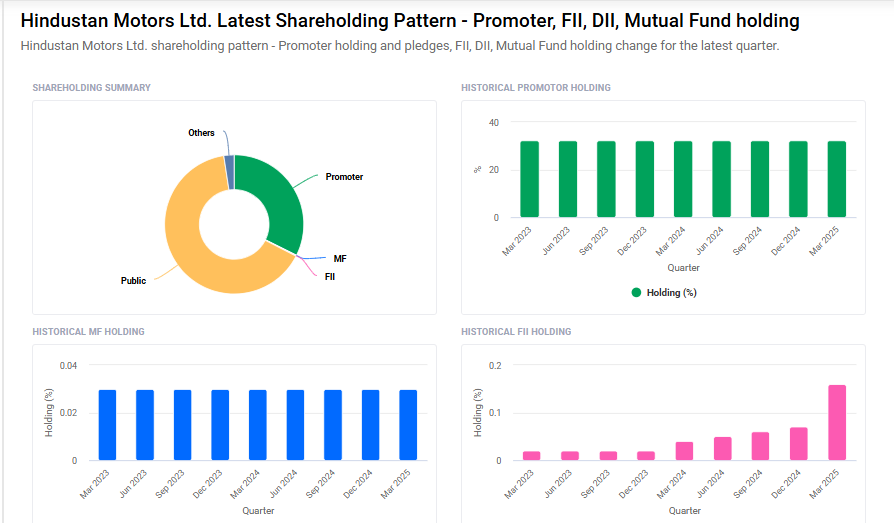

Hindustan Motors Shareholding Pattern

- Promoters: 32.3%

- FII: 0.2%

- DII: 2.5%

- Public: 65%

Hindustan Motors Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹45 |

| 2026 | ₹60 |

| 2027 | ₹75 |

| 2028 | ₹90 |

| 2029 | ₹105 |

| 2030 | ₹120 |

Hindustan Motors Share Price Target 2025

Hindustan Motors share price target 2025 Expected target could ₹45. Here are five key factors that could influence the growth of Hindustan Motors Ltd.’s share price target for 2025:

-

Revival of the Iconic Ambassador Model: Hindustan Motors is planning to reintroduce the Ambassador, one of India’s most iconic car models. This move aims to capitalize on nostalgia and brand recognition, potentially attracting both old and new customers.

-

Entry into the Electric Vehicle (EV) Market: The company has announced plans to develop electric vehicles, aligning with India’s push towards sustainable transportation. This strategic shift could open new revenue streams and position Hindustan Motors as a player in the growing EV segment.

-

Debt-Free Status and Strong Balance Sheet: Hindustan Motors maintains a debt-free status, providing financial stability and flexibility to invest in new projects without the burden of interest payments. This financial health can be advantageous in funding innovation and expansion.

-

Potential for Market Revaluation: Despite a low intrinsic value estimate of ₹7.31, the company’s current market price suggests investor optimism about its future prospects. If the company’s strategic initiatives succeed, there could be a revaluation of its market position.

-

Favorable Government Policies for EVs: The Indian government’s incentives for electric vehicle adoption, including tax benefits and infrastructure development, could support Hindustan Motors’ transition into the EV market, enhancing its growth potential.

Hindustan Motors Share Price Target 2030

Hindustan Motors share price target 2030 Expected target could ₹120. Here are five key risks and challenges that could impact Hindustan Motors Ltd.’s share price target by 2030:

-

Financial Instability and Declining Profitability: Hindustan Motors has experienced financial challenges, including a significant decline in profit after tax and a high debt-to-EBITDA ratio. These factors indicate potential difficulties in sustaining profitability and may affect investor confidence.

-

Intense Market Competition: The Indian automotive sector is highly competitive, with established players like Tata Motors, Mahindra & Mahindra, and Hyundai introducing new models and technologies. Hindustan Motors may face challenges in capturing market share amidst this competition.

-

Challenges in Electric Vehicle (EV) Transition: While Hindustan Motors plans to enter the EV market, it faces obstacles such as limited charging infrastructure and consumer concerns about EV range. Successfully transitioning to EVs requires substantial investment and strategic planning.

-

Dependence on Joint Ventures for EV Development: The company’s strategy to develop EVs through joint ventures with foreign partners introduces risks related to collaboration, technology sharing, and execution. Any delays or disagreements in these partnerships could hinder progress.

-

Historical Financial Distress: Hindustan Motors has a history of financial distress, including negative operating results and factory layoffs. These past challenges may continue to influence investor perceptions and the company’s ability to secure funding for future projects.

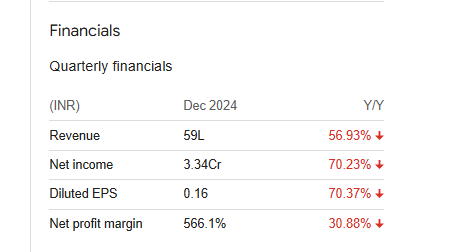

Hindustan Motors Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 32.48M | — |

| Operating expense | 43.55M | -11.25% |

| Net income | 254.25M | 56,400.44% |

| Net profit margin | 782.92 | — |

| Earnings per share | — | — |

| EBITDA | -7.54M | 83.68% |

| Effective tax rate | -0.51% | — |

Read Also:- Sun Pharma Share Price Target Tomorrow 2025 To 2030