Trident Share Price Target Tomorrow 2025 To 2030

Trident Limited is a well-known Indian company that works in the textile, paper, and chemicals industries. It is especially famous for its soft and high-quality towels and bedsheets, which are loved by customers in India and many other countries. The company is based in Punjab and has been growing steadily by focusing on innovation, sustainability, and customer satisfaction. Trident also exports its products to global markets and is working on becoming more eco-friendly by using renewable energy and sustainable materials. Trident Share Price on NSE as of 16 May 2025 is 28.92 INR.

Trident Share Market Overview

- Open: 28.55

- High: 29.00

- Low: 28.55

- Previous Close: 28.52

- Volume: 6,334,767

- Value (Lacs): 1,832.01

- 52 Week High: 52.90

- 52 Week Low: 23.11

- Mkt Cap (Rs. Cr.): 14,737

- Face Value: 1

Trident Share Price Chart

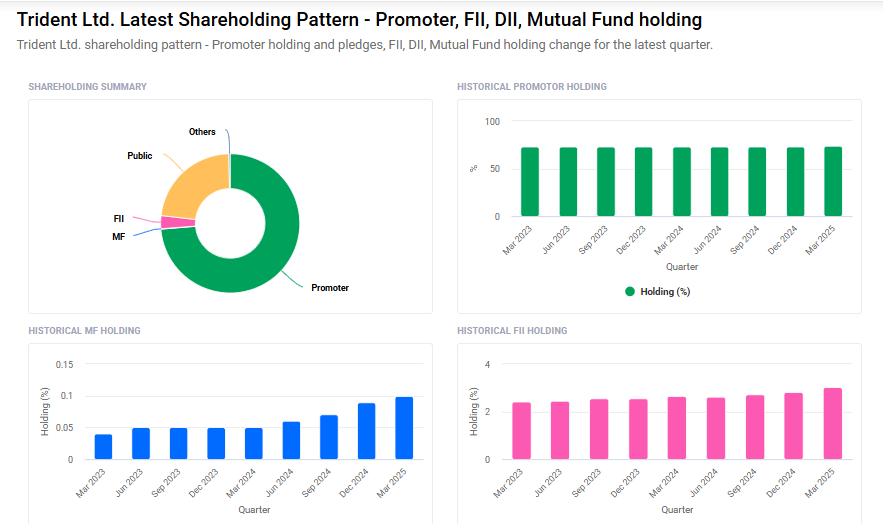

Trident Shareholding Pattern

- Promoters: 73.7%

- FII: 3%

- DII: 0.1%

- Public: 22.9%

Trident Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹45 |

| 2026 | ₹55 |

| 2027 | ₹70 |

| 2028 | ₹80 |

| 2029 | ₹90 |

| 2030 | ₹100 |

Trident Share Price Target 2025

Trident share price target 2025 Expected target could ₹45. Here are five key factors that could influence the growth of Trident Limited’s share price target for 2025:

-

Ambitious Expansion Plans: Trident has announced a significant capital expenditure of ₹1,000 crore for FY25–26, focusing on sustainability, modernization, and asset enhancement across its home textiles, yarn, and energy businesses. This investment aims to triple the company’s growth by 2027.

-

Strategic Retail Expansion: The company plans to add 500 premium retail points under its ‘myTrident’ brand by 2025, particularly targeting growth in East and South India. This move is expected to enhance market penetration and brand visibility.

-

International Market Penetration: Trident is actively expanding its presence in the over €13 billion EU home textile market, focusing on sustainable bed and bath linens. Participation in international trade fairs like Heimtextil 2025 underscores its commitment to global growth.

-

Financial Performance and Growth Projections: Analyst estimates project a compound annual growth rate (CAGR) of 13% for revenue, 22% for operating income, and 27% for net income over the next three years, indicating strong financial prospects.

-

Digital Transformation Initiatives: Under its ‘VISION 2025’ strategy, Trident is embracing Industry 4.0 by digitizing operations and enhancing technological capabilities, aiming to improve efficiency and shareholder value.

Trident Share Price Target 2030

Trident share price target 2030 Expected target could ₹100. Here are five key risks and challenges that could impact Trident Limited’s share price target by 2030:

-

Debt Levels and Financial Strain: Trident has been utilizing debt to finance its operations. While this can support growth, excessive debt may pose financial risks, especially if earnings do not keep pace with interest obligations.

-

Intense Industry Competition: The textile, paper, and chemical sectors are highly competitive. Trident faces pressure from both domestic and international players, which could affect its market share and profitability.

-

Exposure to Global Market Fluctuations: Trident’s operations are influenced by global economic conditions. Factors such as changes in international trade policies, currency exchange rates, and global demand can impact the company’s performance.

-

Environmental and Regulatory Compliance: As environmental regulations become more stringent, Trident must invest in sustainable practices. Failure to comply with environmental standards could lead to legal penalties and damage the company’s reputation.

-

Management and Governance Challenges: Recent changes in Trident’s leadership and a high number of new directors may lead to strategic uncertainties. Effective governance is crucial to navigate the company through industry challenges and ensure long-term stability.

Trident Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 68.09B | 7.53% |

| Operating expense | 27.35B | 19.81% |

| Net income | 3.50B | -20.70% |

| Net profit margin | 5.13 | -26.29% |

| Earnings per share | 0.73 | -13.63% |

| EBITDA | 9.09B | -2.09% |

| Effective tax rate | 26.60% | — |

Read Also:- Apollo Tyres Share Price Target Tomorrow 2025 To 2030