Indus Towers Share Price Target Tomorrow 2025 To 2030

Indus Towers is one of the largest telecom tower companies in India. It helps mobile network companies by providing the infrastructure they need to set up their antennas and equipment. This allows people across cities, towns, and even villages to get better mobile signals and internet connections. Indus Towers has thousands of towers all over the country and works with major telecom operators like Airtel and Vodafone Idea. The company plays an important role in supporting the digital growth of India. Indus Towers Share Price on NSE as of 17 May 2025 is 399.20 INR.

Indus Towers Share Market Overview

- Open: 397.70

- High: 407.35

- Low: 396.10

- Previous Close: 396.95

- Volume: 5,908,953

- Value (Lacs): 23,662.40

- VWAP: 402.57

- UC Limit: 436.60

- LC Limit: 357.25

- 52 Week High: 460.35

- 52 Week Low: 292.00

- Mkt Cap (Rs. Cr.): 105,645

- Face Value: 10

Indus Towers Share Price Chart

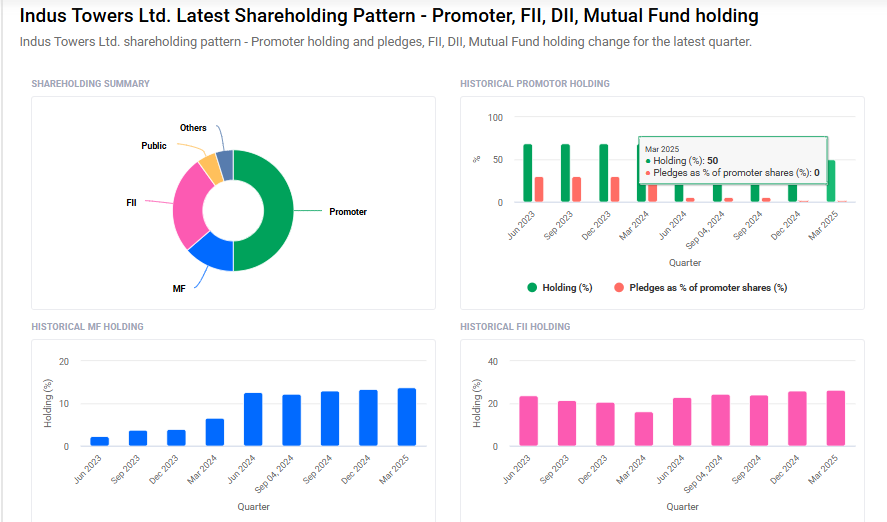

Indus Towers Shareholding Pattern

- Promoters: 50%

- FII: 26.4%

- DII: 18.4%

- Public: 5.2%

Indus Towers Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹465 |

| 2026 | ₹515 |

| 2027 | ₹570 |

| 2028 | ₹620 |

| 2029 | ₹670 |

| 2030 | ₹720 |

Indus Towers Share Price Target 2025

Indus Towers share price target 2025 Expected target could ₹465. Here are five key factors that could influence the growth of Indus Towers’ share price target for 2025:

-

Robust Financial Performance: In Q2 FY25, Indus Towers reported a significant 71.7% year-on-year increase in net profit, reaching ₹2,224 crore. This growth was driven by strong tower additions and improved collections from Vodafone Idea. Additionally, the company’s EBITDA margin expanded to 65.7%, indicating enhanced operational efficiency.

-

Expansion of Tower Infrastructure: Indus Towers completed the acquisition of 12,700 sites from Bharti Airtel, contributing to its extensive portfolio of over 249,000 towers across India. This expansion positions the company to meet the increasing demand for network infrastructure, especially with the rollout of 5G services.

-

Growth in Tenancies from Telecom Operators: Major telecom operators like Bharti Airtel and Vodafone Idea have announced plans to expand their network coverage, particularly in rural areas. Bharti Airtel aims to enhance its rural broadband coverage with 25,000 new sites, while Vodafone Idea plans to deploy over 60,000 new tenancies. These expansions are expected to increase demand for Indus Towers’ infrastructure services.

-

Diversification into EV Charging Infrastructure: Indus Towers has initiated pilot projects for electric vehicle (EV) charging stations in Gurugram and Bengaluru. This diversification into the EV charging sector aligns with India’s push towards sustainable transportation and opens new revenue streams for the company.

-

Positive Analyst Outlook: Financial analysts have expressed optimism about Indus Towers’ growth prospects. For instance, Citi has projected a 46% upside for the company’s shares, citing positive growth outlook driven by network rollouts from major telecom operators.

Indus Towers Share Price Target 2030

Indus Towers share price target 2030 Expected target could ₹720. Here are 5 key risks and challenges that could impact Indus Towers’ share price target for 2030:

-

Dependence on Key Clients (like Vodafone Idea): Indus Towers relies heavily on a few major telecom operators for revenue. If financially stressed clients like Vodafone Idea reduce tenancy or fail to meet obligations, it could significantly impact revenue and investor confidence.

-

Regulatory and Policy Risks: Changes in telecom regulations, spectrum pricing, or tower infrastructure norms can affect the cost structure and profitability of tower companies. Delays or policy uncertainty could hinder expansion plans.

-

Technological Disruption and 5G Transition: While 5G rollout could bring growth, it also requires significant capital investment. Indus Towers must keep up with technology to avoid obsolescence, and failure to do so could lead to loss of competitiveness.

-

Competitive Pressure and Pricing: Increasing competition from other tower companies or infrastructure-sharing arrangements could drive down pricing and margins, affecting long-term profitability.

-

Environmental and Legal Hurdles: Tower installations often face opposition due to environmental, health, or zoning concerns. Legal challenges or delays in getting local approvals can slow growth and impact projected targets.

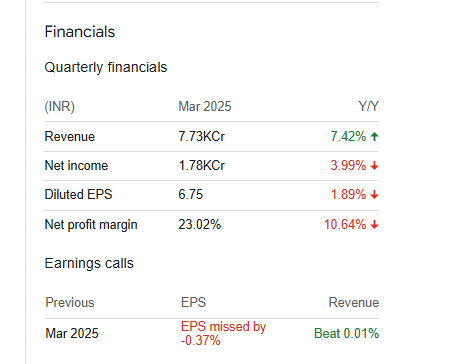

Indus Towers Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 301.23B | 5.32% |

| Operating expense | 19.49B | -70.63% |

| Net income | 99.32B | 64.54% |

| Net profit margin | 32.97 | 56.18% |

| Earnings per share | 37.31 | 66.56% |

| EBITDA | 183.60B | 47.40% |

| Effective tax rate | 24.50% | — |

Read Also:- Trident Share Price Target Tomorrow 2025 To 2030