Maruti Suzuki Share Price Target Tomorrow 2025 To 2030

Maruti Suzuki is one of the most popular car companies in India, known for making reliable, fuel-efficient, and affordable vehicles. It started in 1981 and quickly became a household name with models like the Maruti 800, Alto, and Swift. Today, it offers a wide range of cars, from small hatchbacks to stylish SUVs. Maruti Suzuki is also working on cleaner and smarter vehicles, including electric and hybrid cars, to meet the future needs of customers. Maruti Suzuki Share Price on NSE as of 17 May 2025 is 13,000.00 INR.

Maruti Suzuki Share Market Overview

- Open: 12,950.00

- High: 13,086.00

- Low: 12,912.00

- Previous Close: 12,952.00

- Volume: 425,275

- Value (Lacs): 55,264.49

- VWAP: 12,992.64

- UC Limit: 14,247.00

- LC Limit: 11,657.00

- 52 Week High: 13,680.00

- 52 Week Low: 10,725.00

- Mkt Cap (Rs. Cr.): 408,566

- Face Value: 5

Maruti Suzuki Share Price Chart

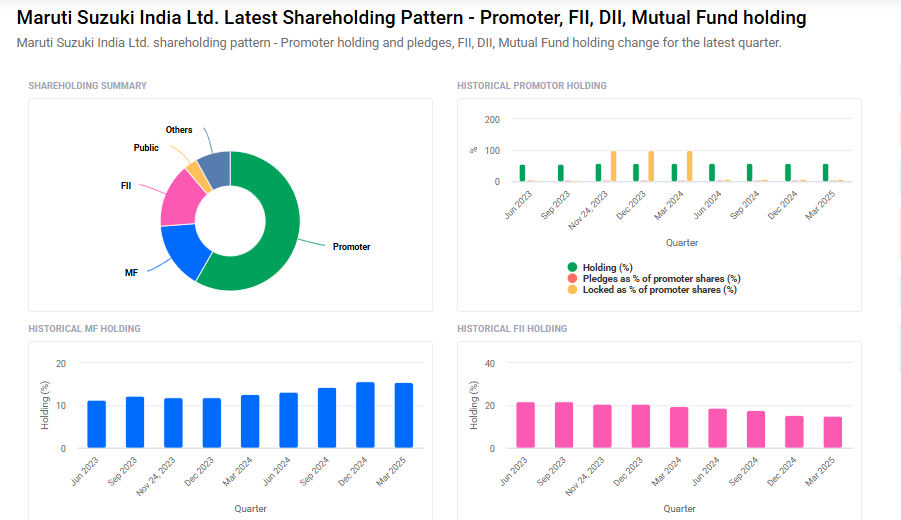

Maruti Suzuki Shareholding Pattern

- Promoters: 58.3%

- FII: 15%

- DII: 23.6%

- Public: 3.1%

Maruti Suzuki Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹13,700 |

| 2026 | ₹14,200 |

| 2027 | ₹14,700 |

| 2028 | ₹15,300 |

| 2029 | ₹15,800 |

| 2030 | ₹16,300 |

Maruti Suzuki Share Price Target 2025

Maruti Suzuki share price target 2025 Expected target could ₹13,700. Here are 5 key factors influencing the growth outlook and share price target of Maruti Suzuki for 2025:

1. Strong Sales Performance and Market Leadership

Maruti Suzuki achieved its highest-ever total sales in FY2024-25, with over 2.23 million units sold, including record domestic sales of 1.79 million units and exports of 332,585 units. The company’s utility vehicle segment, comprising models like the Brezza and Grand Vitara, experienced significant growth, contributing to a 12.1% year-on-year increase in UV sales.

2. Strategic Investments and Capacity Expansion

To meet growing demand, Maruti Suzuki is investing approximately $864 million to establish a third plant at its Kharkhoda facility in Haryana. This expansion will increase the site’s total production capacity to 750,000 vehicles annually by 2029, supporting both domestic and international markets.

3. Diversification into Electric and Hybrid Vehicles

Maruti Suzuki is entering the electric vehicle (EV) market with the launch of its first EV, the e-Vitara SUV, in 2025. Additionally, the company plans to install fast-charging stations across India’s top 100 cities and is considering a battery rental service to attract EV buyers. These initiatives aim to address infrastructure and cost challenges associated with EV adoption.

4. Export Growth and Global Collaboration

Exports have become a significant growth driver for Maruti Suzuki, with a 27.3% year-on-year increase in export numbers as of March 2025. The company is also collaborating with Toyota to supply its first-ever EV, produced in India, to global markets, positioning India as a central hub for Suzuki’s EV production.

5. Challenges from Rising Costs and Margin Pressures

Despite strong sales, Maruti Suzuki faces challenges from increased input costs and operational expenses. In April 2025, the company announced a price hike of up to ₹62,000 across various models to offset these rising costs. Analysts anticipate that such cost pressures may impact profit margins in the near term.

Maruti Suzuki Share Price Target 2030

Maruti Suzuki share price target 2030 Expected target could ₹16,300. Here are 5 key risks and challenges that could affect Maruti Suzuki’s share price target for 2030:

1. Transition to Electric Vehicles (EVs)

While Maruti is entering the EV space, it is behind global and domestic competitors in EV adoption. If the transition is slow or poorly executed, the company may lose market share in a rapidly shifting automotive landscape.

2. Rising Raw Material and Input Costs

Volatility in the prices of steel, aluminum, lithium (for batteries), and other raw materials can impact profit margins. If Maruti cannot manage these costs or pass them to consumers, it could affect earnings.

3. Global and Domestic Competition

By 2030, competition from global automakers like Tesla, BYD, and domestic players like Tata Motors and Mahindra is expected to intensify, especially in the EV and hybrid segments. This could pressure Maruti’s dominance in the Indian market.

4. Regulatory and Policy Risks

Future government policies related to emissions, safety standards, fuel efficiency, and EV incentives may require continuous investment and adaptation. Any failure to comply or adapt in time could disrupt operations or affect investor sentiment.

5. Changing Consumer Preferences and Mobility Trends

The rise of shared mobility, increased urbanization, and changing preferences toward sustainable and tech-enabled vehicles may challenge Maruti’s traditional product line. Adapting to these trends while maintaining affordability will be crucial.

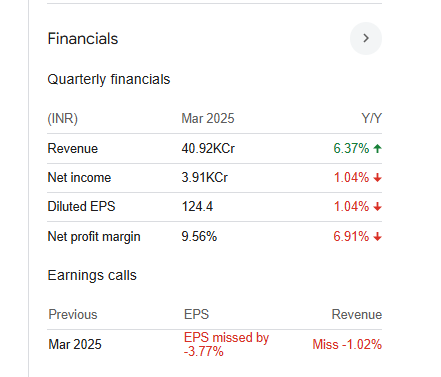

Maruti Suzuki Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 1.53T | 7.79% |

| Operating expense | 312.49B | 13.87% |

| Net income | 145.00B | 7.50% |

| Net profit margin | 9.48 | -0.32% |

| Earnings per share | 461.20 | 6.99% |

| EBITDA | 201.56B | 8.45% |

| Effective tax rate | 26.09% | — |

Read Also:- Asian Paints Share Price Target Tomorrow 2025 To 2030