Inoc Wind Share Price Target Tomorrow 2025 To 2030

Inox Wind is a company in India that focuses on making wind turbines to generate clean and renewable energy. Their main goal is to help reduce pollution and support a greener environment by providing sustainable power solutions. The company has been growing steadily by building new wind power projects and improving their technology to make turbines more efficient. Inox Wind works hard to meet the increasing demand for wind energy in India and aims to play a strong role in the country’s journey toward cleaner energy. Inoc Wind Share Price on NSE as of 19 May 2025 is 179.70 INR.

Inoc Wind Share Market Overview

- Open: 180.00

- High: 182.66

- Low: 179.00

- Previous Close: 178.16

- Volume: 7,052,231

- Value (Lacs): 12,681.32

- 52 Week High: 261.90

- 52 Week Low: 37.01

- Mkt Cap (Rs. Cr.): 23,444

- Face Value: 10

Inoc Wind Share Price Chart

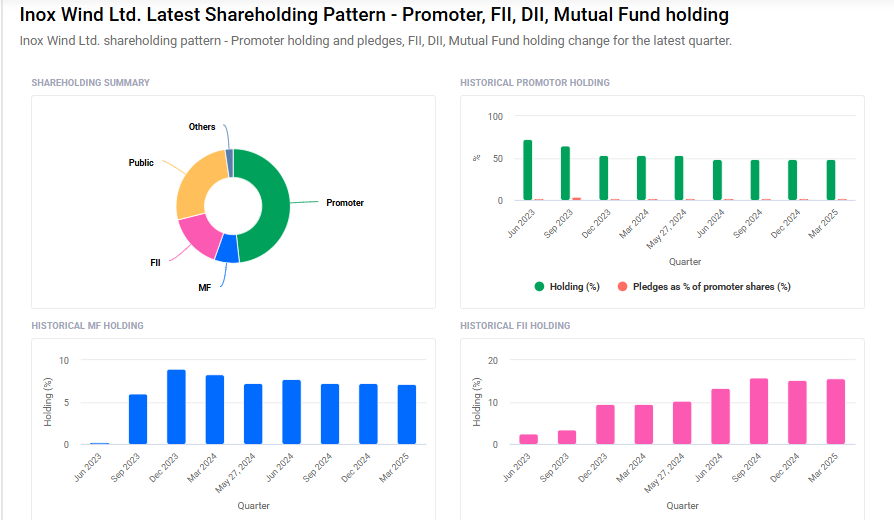

Inoc Wind Shareholding Pattern

- Promoters: 48.3%

- FII: 15.7%

- DII: 9.4%

- Public: 26.6%

Inoc Wind Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹265 |

| 2026 | ₹290 |

| 2027 | ₹320 |

| 2028 | ₹350 |

| 2029 | ₹380 |

| 2030 | ₹410 |

Inoc Wind Share Price Target 2025

Inoc Wind share price target 2025 Expected target could ₹265. Here are five key factors influencing Inox Wind’s share price target for 2025:

1. Robust Order Book and Execution Pipeline

Inox Wind boasts a substantial order book of 2.7 GW, reflecting strong demand for its wind turbine generators. The company has set ambitious execution targets: 800 MW for FY25, 1.2 GW for FY26, and 2 GW for FY27. Successful fulfillment of these orders is expected to drive revenue growth and enhance investor confidence.

2. Technological Advancements in Wind Turbines

Transitioning from 2 MW to 3–3.3 MW wind turbine generators, and developing “4.X” MW models, Inox Wind is aligning with global trends favoring higher-capacity turbines. These advancements position the company to meet evolving market demands and improve operational efficiency.

3. Strong Financial Performance and Analyst Endorsements

Analysts project significant growth for Inox Wind, with earnings and revenue expected to increase by approximately 54% annually, and EPS by over 51%. Brokerage firms like Systematix Institutional Equities and JM Financial have issued “Buy” ratings, setting price targets ranging from ₹212 to ₹275, indicating potential upside.

4. Favorable Government Policies and Renewable Energy Initiatives

India’s commitment to expanding its renewable energy capacity, including awarding 33 GW of hybrid project capacities since January 2023, creates a conducive environment for wind energy companies. This policy support is likely to benefit Inox Wind’s growth prospects.

5. Improved Financial Health and Operational Efficiency

Efforts to strengthen the balance sheet and streamline operations have enhanced Inox Wind’s financial stability. A leaner operations and maintenance arm contributes to better margins and positions the company for sustainable growth.

Inoc Wind Share Price Target 2030

Inoc Wind share price target 2030 Expected target could ₹410. Here are five key risks and challenges that could impact Inox Wind’s share price trajectory by 2030:

1. Debt Management and Financial Stability

As of September 2024, Inox Wind reported a total debt of ₹35.4 billion, up from ₹27.3 billion the previous year, with a net debt of approximately ₹27.4 billion after accounting for ₹8.05 billion in cash reserves. While efforts have been made to reduce debt, the company still faces challenges in managing its financial obligations, which could impact investor confidence and share price stability.

2. Intense Market Competition

The wind energy sector is highly competitive, with numerous players vying for market share. Inox Wind faces competition from both established companies and new entrants, which could pressure profit margins and market positioning. Additionally, global competition from Chinese manufacturers offering lower-priced turbines may affect Inox Wind’s competitiveness in international markets.

3. Technological Advancements and Innovation

The wind energy industry is rapidly evolving, with continuous advancements in turbine technology. Inox Wind’s ability to innovate and develop new, efficient turbine models is crucial to maintaining its market position. Failure to keep pace with technological developments could result in a loss of competitive edge and impact long-term growth prospects.

4. Regulatory and Policy Risks

Changes in government policies and regulations related to renewable energy can significantly impact Inox Wind’s operations. Unfavorable policy shifts, such as reductions in subsidies or changes in tax incentives, could affect the company’s profitability and growth prospects. Staying aligned with evolving regulatory frameworks is essential to mitigate such risks.

5. Execution Risks and Operational Challenges

Inox Wind’s ability to execute its large order book effectively is critical to its financial performance. Delays in project execution, supply chain disruptions, or cost overruns could negatively impact revenue generation and profit margins. Operational inefficiencies or challenges in scaling up production to meet increasing demand could also pose risks to achieving long-term growth targets.

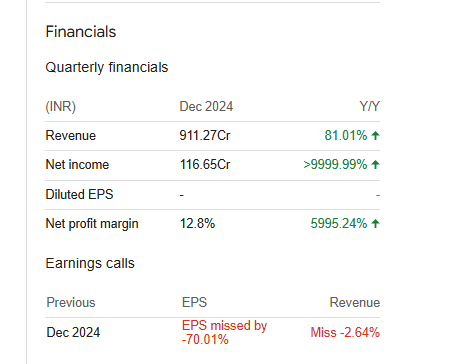

Inoc Wind Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 17.43B | 137.81% |

| Operating expense | 3.86B | -25.03% |

| Net income | -404.21M | 93.94% |

| Net profit margin | -2.32 | 97.45% |

| Earnings per share | -0.24 | — |

| EBITDA | 2.65B | 202.57% |

| Effective tax rate | -7.64% | — |

Read Also:- GTL Share Price Target Tomorrow 2025 To 2030