CG Power Share Price Target Tomorrow 2025 To 2030

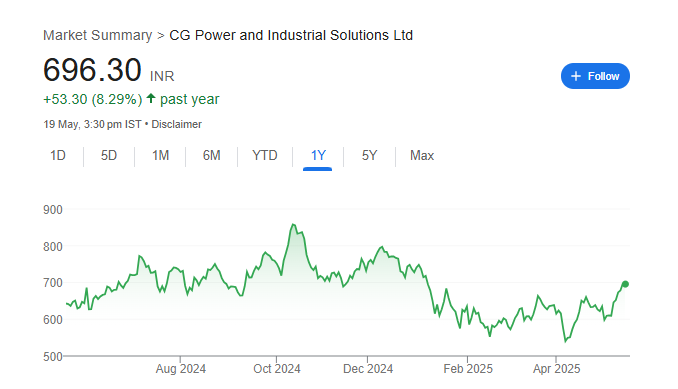

CG Power and Industrial Solutions Limited is a well-known Indian company that provides electrical products and solutions. It mainly focuses on power systems, industrial equipment, and automation services. The company has a long history and plays an important role in supporting India’s power and manufacturing sectors. CG Power is known for making products like transformers, motors, and switchgear that help manage electricity safely and efficiently. CG Power Share Price on NSE as of 20 May 2025 is 696.30 INR.

CG Power Share Market Overview

- Open: 702.00

- High: 704.35

- Low: 692.45

- Previous Close: 696.45

- Volume: 1,989,685

- Value (Lacs): 13,861.14

- 52 Week High: 874.70

- 52 Week Low: 359.20

- Mkt Cap (Rs. Cr.): 106,518

- Face Value: 2

CG Power Share Price Chart

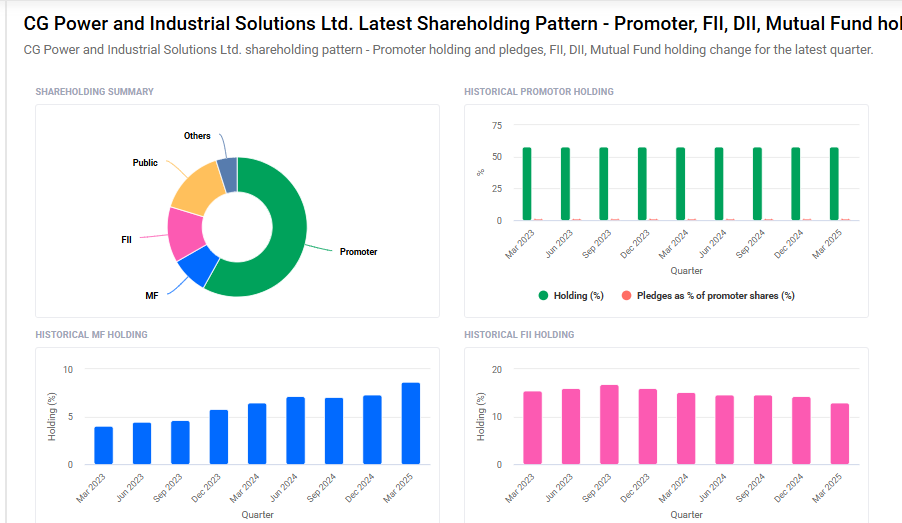

CG Power Shareholding Pattern

- Promoters: 58.1%

- FII: 13%

- DII: 13.6%

- Public: 15.4%

CG Power Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹880 |

| 2026 | ₹930 |

| 2027 | ₹980 |

| 2028 | ₹1030 |

| 2029 | ₹1080 |

| 2030 | ₹1130 |

CG Power Share Price Target 2025

CG Power share price target 2025 Expected target could ₹880. Here are five key factors influencing CG Power and Industrial Solutions Ltd.’s share price target for 2025:

1. Robust Revenue and Earnings Growth

CG Power has demonstrated strong financial performance, with a 23.6% year-over-year revenue growth in FY2025, reaching ₹10,075.83 crore. The company’s earnings per share (EPS) are projected to grow at an average annual rate of 20% over the next three years, indicating a positive outlook for profitability.

2. Expanding Order Book and Market Demand

The company has secured significant orders, with a 61% year-over-year increase in order intake, totaling ₹3,636 crore in Q3 FY2025. This surge reflects strong demand in both the industrial and power systems segments, contributing to a growing order backlog and future revenue streams.

3. Strategic Focus on Renewable Energy and Innovation

CG Power is investing in renewable energy solutions and product innovation to meet evolving market needs. These initiatives are expected to open new revenue channels and enhance the company’s competitive edge in the energy sector.

4. Strong Financial Metrics and Operational Efficiency

The company boasts a healthy return on capital employed (ROCE) of 34% and maintains a free cash flow to profit after tax (PAT) ratio of 96%. Such financial strength enables CG Power to invest in growth opportunities and navigate market challenges effectively.

5. Positive Analyst Outlook and Shareholder Confidence

Analysts have projected CG Power’s share price to range between ₹700 and ₹800 by the end of 2025, reflecting confidence in the company’s growth trajectory. The promoter holding stands at a robust 58.90%, indicating strong insider confidence in the company’s future prospects.

CG Power Share Price Target 2030

CG Power share price target 2030 Expected target could ₹1130. Here are five key risks and challenges that could impact CG Power and Industrial Solutions Ltd.’s share price trajectory by 2030:

1. Talent Acquisition and Retention Challenges

As CG Power expands into advanced sectors like semiconductor manufacturing, attracting and retaining skilled professionals becomes crucial. The company acknowledges that failing to secure top talent could hinder its competitiveness and innovation capabilities. To address this, CG Power is developing comprehensive recruitment strategies emphasizing organizational culture, career advancement opportunities, and competitive compensation packages.

2. Execution Risks in New Ventures

CG Power’s diversification into areas such as semiconductor packaging (OSAT) introduces execution risks. The company has secured a significant government subsidy of up to INR 35.01 billion for an OSAT facility in Sanand, Gujarat. However, the success of such large-scale projects depends on timely execution, effective project management, and navigating complex regulatory environments.

3. Market Volatility and Stock Performance

Despite strong fundamentals, CG Power’s stock has experienced short-term declines, underperforming the broader market. For instance, on April 30, 2025, the stock declined by 3.1%, indicating sensitivity to market fluctuations. Such volatility can impact investor confidence and affect long-term share price targets.

4. Macroeconomic and Regulatory Risks

CG Power’s operations are influenced by broader economic factors, including inflation, interest rate fluctuations, and changes in taxation or regulatory frameworks. Adverse changes in environmental regulations or labor laws could pose compliance challenges and affect project timelines and costs.

5. Dependence on Government Policies and Subsidies

A significant portion of CG Power’s growth strategy relies on government initiatives and subsidies, such as the fiscal support for the OSAT facility. Any changes in government policies, reduction in subsidies, or delays in policy implementation could adversely affect the company’s expansion plans and financial performance.

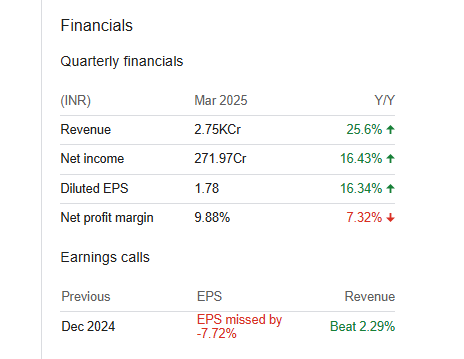

CG Power Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 99.09B | 23.15% |

| Operating expense | 17.90B | 26.40% |

| Net income | 9.75B | -31.70% |

| Net profit margin | 9.84 | -44.53% |

| Earnings per share | 6.37 | 13.40% |

| EBITDA | 13.05B | 18.90% |

| Effective tax rate | 27.82% | — |

Read Also:- NBCC Share Price Target Tomorrow 2025 To 2030