Maharashtra Bank Share Price Target Tomorrow 2025 To 2030

Bank of Maharashtra is a leading public sector bank in India that has been serving customers since 1935. Headquartered in Pune, the bank offers a wide range of financial services including savings accounts, loans, fixed deposits, and digital banking. Known for its strong network, it has a large number of branches and ATMs across the country, making banking more accessible for everyone. Maharashtra Bank Share Price on NSE as of 20 May 2025 is 53.20 INR.

Maharashtra Bank Share Market Overview

- Open: 51.09

- High: 54.09

- Low: 51.03

- Previous Close: 51.06

- Volume: 35,472,570

- Value (Lacs): 18,839.48

- 52 Week High: 73.50

- 52 Week Low: 27.35

- Mkt Cap (Rs. Cr.): 40,849

- Face Value: 10

Maharashtra Bank Share Price Chart

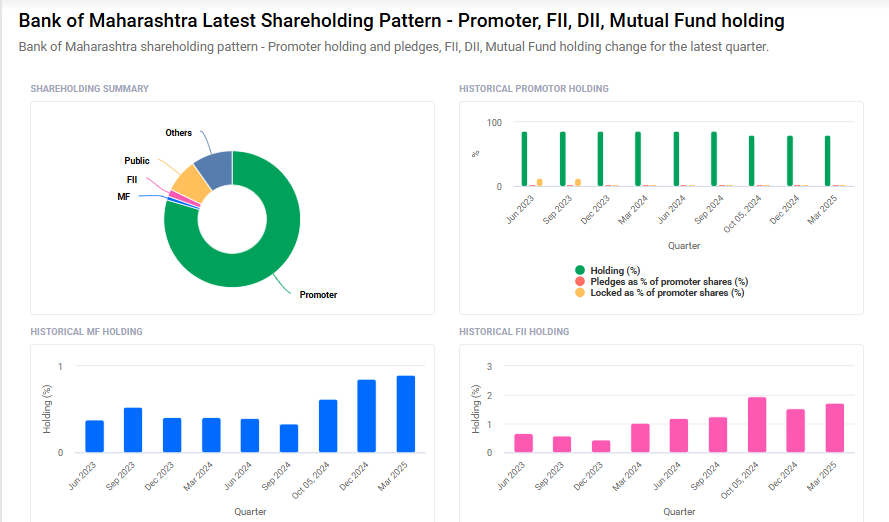

Maharashtra Bank Shareholding Pattern

- Promoters: 79.6%

- FII: 1.7%

- DII: 10.7%

- Public: 8%

Maharashtra Bank Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹75 |

| 2026 | ₹90 |

| 2027 | ₹105 |

| 2028 | ₹120 |

| 2029 | ₹135 |

| 2030 | ₹150 |

Maharashtra Bank Share Price Target 2025

Maharashtra Bank share price target 2025 Expected target could ₹75. Here are five key factors influencing the growth of Bank of Maharashtra’s share price target for 2025:

1. Strong Financial Performance and Profitability

Bank of Maharashtra has demonstrated robust financial growth, with its net profit rising by 23% year-on-year to ₹1,493 crore in Q4 FY25. The bank’s total income increased to ₹7,711 crore during the same quarter, up from ₹6,488 crore in the previous year. Additionally, the net interest income grew by 20.59% year-on-year to ₹3,116 crore, and the net interest margin improved to 4.01% as of March 31, 2025.

2. Robust Credit and Deposit Growth

The bank has achieved significant growth in its credit and deposit portfolios. As of March 31, 2025, credit growth stood at 17.84%, reaching ₹2.40 lakh crore, while total deposits increased by 13.45% to ₹3.07 lakh crore. This led to a 15.3% rise in total business, amounting to ₹5.47 lakh crore, with an improved Current Account Savings Account (CASA) ratio of 53.29%.

3. Expansion and Diversification Strategy

Bank of Maharashtra is actively expanding its branch network to enhance its core business and reduce concentration risk. The bank aims to increase its branches outside of Maharashtra, targeting 2,500 branches by the end of FY24.

4. Improved Asset Quality

The bank has maintained a strong asset quality, with one of the lowest non-performing asset (NPA) ratios among public sector banks. In the 2024-25 financial year, the gross NPA ratio marginally decreased from 5.57% to 5.32%, despite an increase in absolute NPA value. Bank of Maharashtra’s NPA ratios ranged between 0.75% and 3.5%, indicating effective credit risk management.

5. Capital Infusion and Regulatory Compliance

In October 2024, the bank raised ₹3,500 crore through a Qualified Institutional Placement (QIP), issuing shares at ₹57.36 per share. This capital infusion reduced the government’s holding from 86.46% to 79.60%, aiding in meeting the minimum public shareholding requirement of 25% by August 2026.

Maharashtra Bank Share Price Target 2030

Maharashtra Bank share price target 2030 Expected target could ₹150. Here are five key risks and challenges that could influence Bank of Maharashtra’s share price trajectory by 2030:

1. Valuation Concerns

As of May 2025, Bank of Maharashtra is trading at a significant premium compared to its estimated intrinsic value. The bank’s intrinsic value is assessed at approximately ₹7.20, while the current trading price is around ₹53.11, indicating a premium of over 637%. This overvaluation suggests that the stock may be overpriced relative to its fundamentals, potentially limiting future upside and increasing the risk of a price correction.

2. Divergent Long-Term Forecasts

Long-term projections for the bank’s share price vary significantly. Some forecasts predict a substantial increase to ₹118.55 by May 2030, implying a 129% return over five years. Conversely, other analyses anticipate a decline to ₹38.86 by 2030, suggesting a potential 26% decrease from current levels. These conflicting forecasts highlight uncertainties in the bank’s future performance and market conditions.

3. Market Volatility and Share Price Declines

The bank has experienced periods of share price volatility. For instance, in October 2024, the stock price fell by 8.5% within a month, reflecting investor concerns and market fluctuations. Such volatility can affect investor confidence and the bank’s ability to raise capital.

4. Asset Quality and Non-Performing Assets (NPAs)

Maintaining asset quality remains a challenge. While the bank has managed to keep its gross NPA ratio relatively low, any deterioration in asset quality could impact profitability and capital adequacy. Economic downturns or sector-specific issues could lead to an increase in NPAs, affecting the bank’s financial health.

5. Regulatory and Compliance Risks

As a public sector bank, Bank of Maharashtra is subject to stringent regulatory requirements. Changes in banking regulations, capital adequacy norms, or government policies can impact operational flexibility and profitability. Compliance with evolving regulations requires continuous investment in systems and processes, which can strain resources.

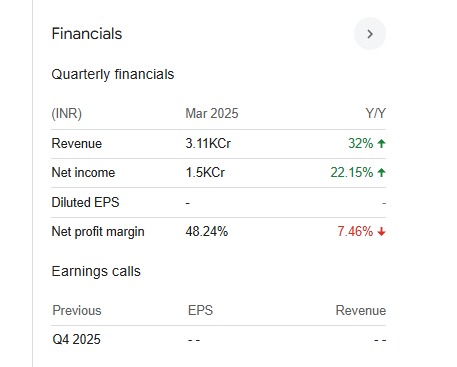

Maharashtra Bank Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 115.25B | 29.92% |

| Operating expense | 58.01B | 20.48% |

| Net income | 55.42B | 36.10% |

| Net profit margin | 48.08 | 4.75% |

| Earnings per share | — | — |

| EBITDA | — | — |

| Effective tax rate | 3.53% | — |

Read Also:- SRF Share Price Target Tomorrow 2025 To 2030