Unitech Share Price Target Tomorrow 2025 To 2030

Unitech Limited is a prominent Indian real estate and infrastructure company established in 1971 by a group of technocrats. Initially founded as United Technical Consultants Pvt. Ltd., the company transitioned into a public limited entity in 1985 and was renamed Unitech Ltd.

Headquartered in Gurugram, Haryana, Unitech has significantly contributed to India’s urban development through its diverse portfolio, which includes residential communities, commercial spaces, retail centers, and hospitality projects. Notable developments encompass integrated townships like Nirvana Country in Gurgaon and Uniworld City in Kolkata, as well as commercial hubs such as Signature Towers and Global Business Park. Unitech Share Price on NSE as of 22 May 2025 is 6.53 INR.

Unitech Share Market Overview

- Open: 6.07

- High: 6.53

- Low: 6.07

- Previous Close: 6.22

- Volume: 2,564,209

- Value (Lacs): 167.44

- 52 Week High: 13.20

- 52 Week Low: 5.50

- Mkt Cap (Rs. Cr.): 1,708

- Face Value: 2

Unitech Share Price Chart

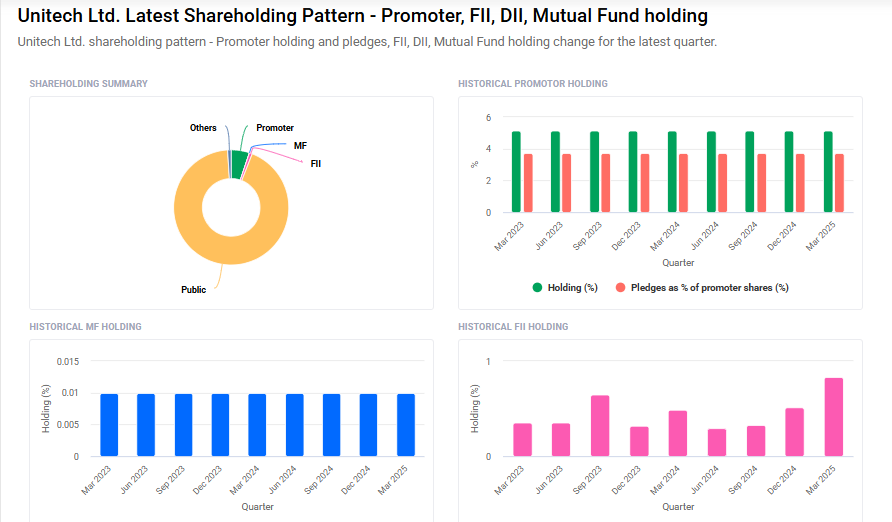

Unitech Shareholding Pattern

- Promoters: 5.1%

- FII: 0.8%

- DII: 1.1%

- Public: 93%

Unitech Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹14 |

| 2026 | ₹18 |

| 2027 | ₹22 |

| 2028 | ₹26 |

| 2029 | ₹30 |

| 2030 | ₹35 |

Unitech Share Price Target 2025

Unitech share price target 2025 Expected target could ₹14. Here are five key factors influencing Unitech Ltd’s share price target for 2025:

-

Projected Revenue Growth: Analysts anticipate a significant turnaround for Unitech, with a projected compound annual growth rate (CAGR) of 24% over the next eight years. This optimistic outlook suggests potential revenue expansion, which could positively impact the company’s share price by 2025.

-

Improved Market Sentiment: Despite recent financial challenges, Unitech’s stock has shown resilience. Over the past five years, the share price has experienced a compound annual growth of 24%, indicating renewed investor confidence and potential for continued upward momentum.

-

Undervaluation Signals: According to AlphaSpread, Unitech’s intrinsic value is estimated at ₹9.91, suggesting the stock is currently undervalued by approximately 37% compared to its market price. This discrepancy may attract value investors, potentially driving demand and share price growth.

-

Technical Indicators: Recent technical analyses indicate positive momentum for Unitech’s stock. The presence of buy signals from both short-term and long-term moving averages suggests a favorable trend, which could support share price appreciation in the near term.

-

Real Estate Sector Dynamics: The Indian real estate sector is experiencing a recovery, with increased demand for residential and commercial properties. As a player in this sector, Unitech stands to benefit from these favorable market conditions, which could contribute to its growth prospects and positively influence its share price.

Unitech Share Price Target 2030

Unitech share price target 2030 Expected target could ₹35. Here are five key risks and challenges that could impact Unitech Ltd’s share price target by 2030:

1. Legal and Regulatory Liabilities

Unitech has faced significant legal challenges, including allegations of financial misconduct and fraud. In 2023, the Enforcement Directorate filed a criminal fraud case against the company and its directors. While the Supreme Court has granted exemptions for certain projects under RERA, ongoing legal issues could continue to affect investor confidence and the company’s operations.

2. Financial Instability and Losses

The company has reported substantial financial losses in recent years. For the year ending March 2023, Unitech reported a consolidated loss after tax of ₹3,103.29 crore. Such financial instability raises concerns about the company’s ability to fund future projects and meet debt obligations, potentially impacting its long-term growth prospects.

3. Operational Challenges and Project Delays

Unitech has faced difficulties in completing ongoing projects, leading to delays and cost overruns. While the company is focusing on finishing these projects, any further setbacks could strain resources and affect revenue generation, hindering growth by 2030.

4. Market Competition and Demand Fluctuations

The real estate sector is highly competitive, with numerous established players vying for market share. Additionally, demand for residential and commercial properties can be volatile, influenced by economic conditions and consumer preferences. Unitech’s ability to adapt to market changes and maintain a competitive edge will be crucial for its growth.

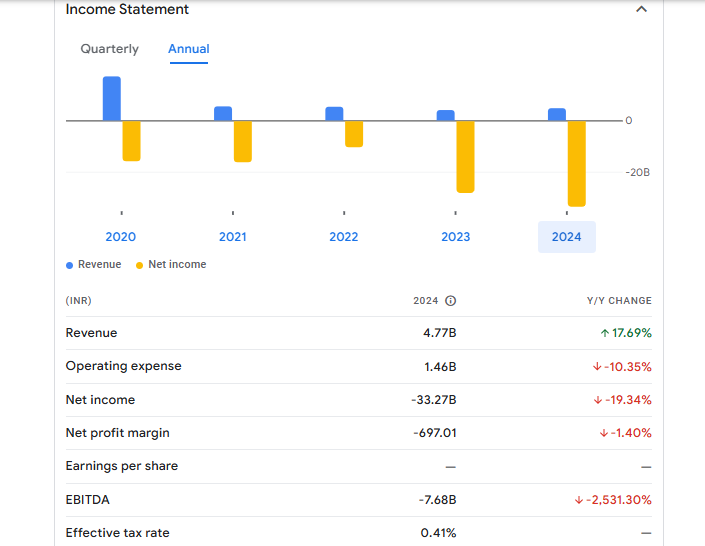

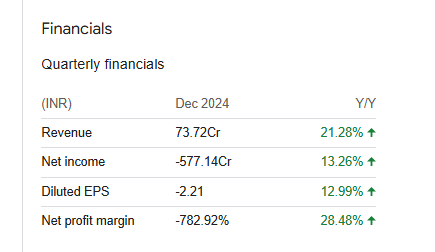

Unitech Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 4.77B | 17.69% |

| Operating expense | 1.46B | -10.35% |

| Net income | -33.27B | -19.34% |

| Net profit margin | -697.01 | -1.40% |

| Earnings per share | — | — |

| EBITDA | -7.68B | -2,531.30% |

| Effective tax rate | 0.41% | — |

Read Also:- Olectra Greentech Share Price Target Tomorrow 2025 To 2030