MRPL Share Price Target Tomorrow 2025 To 2030

Mangalore Refinery and Petrochemicals Limited (MRPL) is a major oil refining company in India, located in Mangalore, Karnataka. It is a subsidiary of ONGC (Oil and Natural Gas Corporation) and plays an important role in refining crude oil into useful products like petrol, diesel, LPG, and other fuels. MRPL operates a large and modern refinery with the capacity to process over 15 million metric tonnes of crude oil each year. MRPL Share Price on NSE as of 23 May 2025 is 137.21 INR.

MRPL Share Market Overview

- Open: 139.50

- High: 140.80

- Low: 136.14

- Previous Close: 139.72

- Volume: 1,540,432

- Value (Lacs): 2,113.32

- 52 Week High: 253.56

- 52 Week Low: 98.92

- Mkt Cap (Rs. Cr.): 24,043

- Face Value: 10

MRPL Share Price Chart

MRPL Shareholding Pattern

- Promoters: 88.6%

- FII: 1.3%

- DII: 1.3%

- Public: 8.8%

MRPL Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹260 |

| 2026 | ₹300 |

| 2027 | ₹350 |

| 2028 | ₹400 |

| 2029 | ₹450 |

| 2030 | ₹500 |

MRPL Share Price Target 2025

MRPL share price target 2025 Expected target could ₹260. Here are five key factors that could influence the growth of Mangalore Refinery and Petrochemicals Ltd (MRPL) and its share price by 2025:

1. Improved Gross Refining Margins (GRMs)

In Q4 FY2025, MRPL reported a GRM of $6.23 per barrel, higher than the annual average of $4.45 per barrel. Sustaining or enhancing GRMs through operational efficiencies and favorable crude spreads can significantly boost profitability and investor confidence.

2. Earnings Growth Despite Revenue Decline

While MRPL’s revenue is projected to decline at 6.6% annually, its earnings per share (EPS) are expected to grow at an impressive 71.2% per year. This indicates improved operational efficiency and cost management, which can positively impact the share price.

3. Strategic Crude Procurement Amid Global Disruptions

Following U.S. sanctions affecting Russian oil supplies, MRPL has proactively sought alternative crude sources, such as issuing tenders for 1 to 2 million barrels for delivery in February 2025. This adaptability ensures continuity in operations and can mitigate supply chain risks.

4. Undervalued Stock with Growth Potential

Analysts have projected a fair value of ₹164 for MRPL, suggesting the stock is potentially 27% undervalued compared to its current price of ₹119. This presents an opportunity for price appreciation as the market corrects the undervaluation.

5. Positive Technical Indicators and Market Sentiment

Recent analyses indicate a bullish trend for MRPL’s stock, with positive candlestick patterns and RSI indicators suggesting upward momentum. Such technical signals can attract short-term investors and contribute to share price growth.

MRPL Share Price Target 2030

MRPL share price target 2030 Expected target could ₹500. Here are 5 key risks and challenges that could impact MRPL (Mangalore Refinery and Petrochemicals Ltd.) and its share price target by 2030:

1. Volatility in Crude Oil Prices

MRPL’s profitability is highly dependent on global crude oil prices. Sharp fluctuations in oil prices due to geopolitical tensions, supply disruptions, or changes in OPEC policies can squeeze refining margins and hurt overall financial performance.

2. Environmental Regulations and Carbon Emissions Norms

As environmental concerns rise, stricter emissions regulations may require costly upgrades to MRPL’s refineries. Compliance with evolving global and domestic environmental norms could increase operational costs and affect profit margins.

3. Global Shift Toward Renewable Energy

With the global energy transition gaining momentum, long-term demand for fossil fuels and refined petroleum products may decline. MRPL could face challenges in sustaining growth unless it diversifies into green energy or adapts to the changing energy mix.

4. Foreign Exchange Risk

As MRPL imports a significant portion of its crude oil, it is exposed to foreign currency risk, especially fluctuations in the USD-INR exchange rate. Depreciation of the rupee can increase input costs and reduce profit margins.

5. Infrastructure and Operational Challenges

Delays in refinery upgrades, maintenance shutdowns, or supply chain disruptions can lead to production losses. Additionally, any major technical failure or accident could harm the company’s reputation and stock performance.

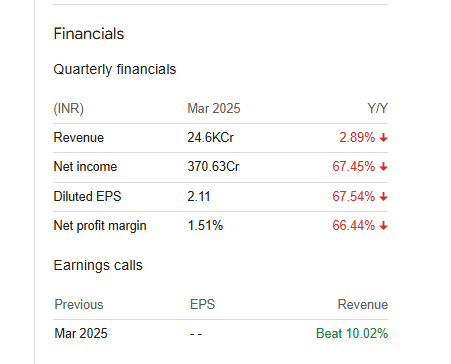

MRPL Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 946.82B | 4.73% |

| Operating expense | 45.13B | 35.02% |

| Net income | 562.10M | -98.44% |

| Net profit margin | 0.06 | -98.49% |

| Earnings per share | 0.29 | -98.59% |

| EBITDA | 22.93B | -71.13% |

| Effective tax rate | 52.72% | — |

Read Also:- Adani Transmission Share Price Target Tomorrow 2025 To 2030