Sun TV Share Price Target Tomorrow 2025 To 2030

Sun TV Network is one of the biggest and most popular media companies in India. It is best known for running a large number of television channels in different South Indian languages like Tamil, Telugu, Kannada, and Malayalam. The company offers a mix of entertainment, including serials, movies, news, and reality shows, which are loved by millions of viewers. Sun TV also has a strong presence in the radio and movie production business. Sun TV Share Price on NSE as of 23 May 2025 is 635.95 INR.

Sun TV Share Market Overview

- Open: 639.00

- High: 646.00

- Low: 631.00

- Previous Close: 641.60

- Volume: 113,747

- Value (Lacs): 722.75

- 52 Week High: 921.00

- 52 Week Low: 549.30

- Mkt Cap (Rs. Cr.): 25,040

- Face Value: 5

Sun TV Share Price Chart

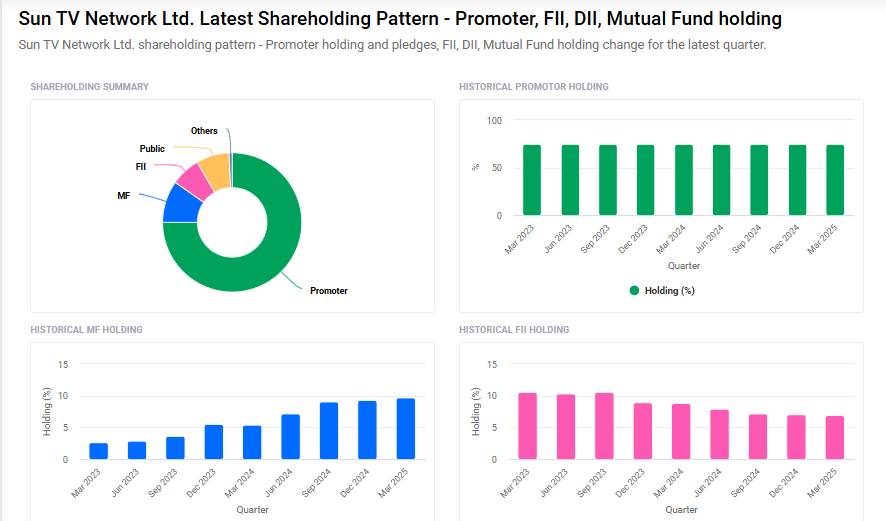

Sun TV Shareholding Pattern

- Promoters: 75%

- FII: 6.9%

- DII: 10.5%

- Public: 7.7%

Sun TV Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹925 |

| 2026 | ₹970 |

| 2027 | ₹920 |

| 2028 | ₹960 |

| 2029 | ₹1000 |

| 2030 | ₹1150 |

Sun TV Share Price Target 2025

Sun TV share price target 2025 Expected target could ₹925. Here are five key factors that could influence the growth of Sun TV Network’s share price by 2025:

1. Steady Revenue and Earnings Growth

Sun TV Network is projected to achieve an annual revenue and earnings growth rate of approximately 6.3%, with earnings per share (EPS) expected to grow by around 7% per annum. This consistent financial performance can bolster investor confidence and support share price appreciation.

2. Expansion in Subscription Revenue

The company has experienced significant growth in domestic subscription revenues, driven by increased digitization and higher cable and DTH penetration. For instance, there was a 21% year-over-year increase in domestic subscription revenue, with cable and DTH revenues growing by 28% and 20% respectively.

3. Strategic Content Investments

Sun TV Network continues to invest in high-quality content across various genres and languages, enhancing its appeal to a broader audience. Such strategic content development can attract more viewers and advertisers, contributing to revenue growth.

4. Strong Return on Equity (ROE)

The company’s return on equity is forecasted to be around 15.5% over the next three years, indicating efficient utilization of shareholders’ funds to generate profits.

5. Positive Technical Indicators

Recent technical analyses have issued buy signals for Sun TV Network’s stock, suggesting potential upward momentum. For example, a buy signal was noted from a pivot bottom point on May 8, 2025, with the stock rising over 6% since then.

Sun TV Share Price Target 2030

Sun TV share price target 2030 Expected target could ₹1150. Here are 5 key risks and challenges that could impact Sun TV Network’s share price target by 2030:

1. Intense Competition in the Media Industry

The Indian entertainment sector is highly competitive, with players like Zee, Star, Sony, and digital platforms such as Netflix and Amazon Prime. Increased competition could impact Sun TV’s market share, advertising revenue, and viewer retention over the long term.

2. Shift Toward Digital and OTT Platforms

The rapid rise of OTT (Over-The-Top) platforms is changing consumer viewing habits. If Sun TV does not adapt quickly enough to digital trends or fails to scale its OTT presence, it may struggle to retain younger audiences and advertising income.

3. Regulatory and Content Restrictions

Government regulations related to content, broadcasting licenses, or pricing frameworks (such as TRAI’s tariff orders) can limit operational flexibility. Any unfavorable policy changes could affect revenue models and profit margins.

4. Dependence on Regional Markets

Sun TV heavily depends on the South Indian market, particularly Tamil Nadu. Any economic slowdown, political changes, or regional disruptions in these key areas could have a disproportionate impact on its business.

5. Fluctuations in Advertisement Revenue

Ad revenue remains a major income source for Sun TV. A slowdown in the economy or shifts in advertiser preferences toward digital platforms may reduce ad spending on traditional TV, thereby impacting revenue and stock performance.

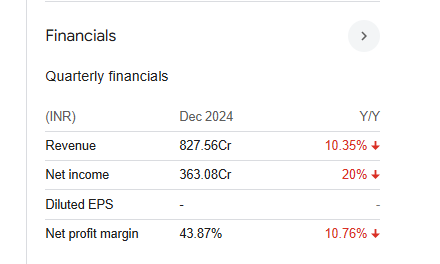

Sun TV Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 8.28B | -10.35% |

| Operating expense | 1.88B | 1.64% |

| Net income | 3.63B | -20.00% |

| Net profit margin | 43.87 | -10.76% |

| Earnings per share | 9.22 | -16.94% |

| EBITDA | 3.60B | -28.91% |

| Effective tax rate | 23.34% | — |

Read Also:- MRPL Share Price Target Tomorrow 2025 To 2030