Dixon Share Price Target Tomorrow 2025 To 2030

Dixon Technologies is a leading Indian electronics manufacturing services (EMS) company headquartered in Noida, Uttar Pradesh. Founded in 1993 by Sunil Vachani, the company began by manufacturing color televisions and has since diversified its product portfolio to include LED TVs, washing machines, mobile phones, lighting products, and security devices. Dixon serves both domestic and international clients, including major brands like Samsung, Xiaomi, Panasonic, and Philips. Dixon Share Price on NSE as of 26 May 2025 is 15,025.00 INR.

Dixon Share Market Overview

- Open: 15,270.00

- High: 15,277.00

- Low: 14,862.00

- Previous Close: 15,170.00

- Volume: 619,564

- Value (Lacs): 93,052.32

- 52 Week High: 19,148.90

- 52 Week Low: 8,453.00

- Mkt Cap (Rs. Cr.): 90,783

- Face Value: 2

Dixon Share Price Chart

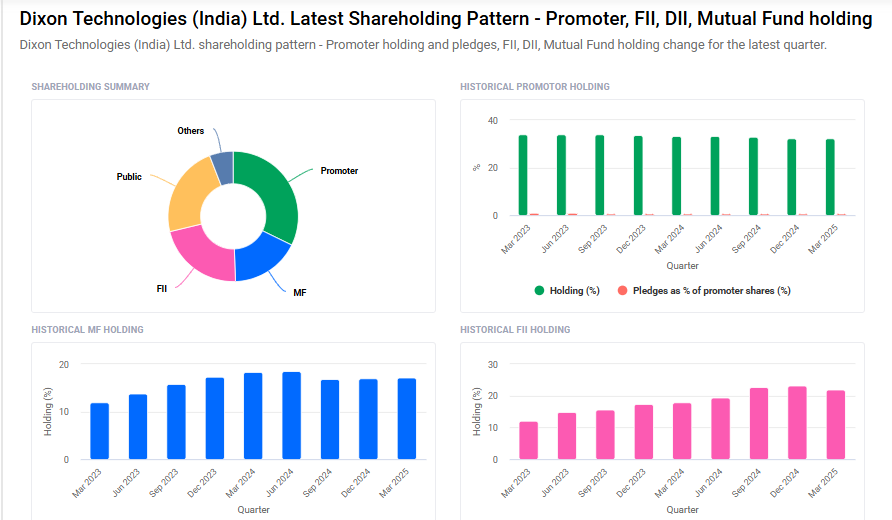

Dixon Shareholding Pattern

- Promoters: 32.3%

- FII: 21.8%

- DII: 23.1%

- Public: 22.9%

Dixon Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹19,150 |

| 2026 | ₹24,280 |

| 2027 | ₹29,110 |

| 2028 | ₹34,140 |

| 2029 | ₹39,270 |

| 2030 | ₹44,200 |

Dixon Share Price Target 2025

Dixon share price target 2025 Expected target could ₹19,150. Here are 5 key factors that could influence Dixon Technologies’ share price target for 2025:

-

Expansion in Mobile and EMS Segments

Dixon Technologies is experiencing significant growth in its Mobile and Electronics Manufacturing Services (EMS) divisions. In FY25, the company reported a 124% year-over-year revenue increase, with the Mobile and EMS segment contributing to 62% of total revenue. This expansion is expected to continue, with projections indicating the segment could account for 89% of revenue by 2029. -

Strategic Joint Ventures

Dixon has formed a joint venture with Taiwan-based Inventec to manufacture IT hardware products, including notebooks and servers, in India. This partnership aims to leverage Inventec’s design capabilities and Dixon’s manufacturing expertise, potentially boosting revenue and enhancing Dixon’s position in the IT hardware market. -

Backward Integration Initiatives

The company is focusing on backward integration to enhance profit margins. This includes in-house production of display modules and plans to expand into manufacturing camera modules, lithium-ion batteries, and enclosures. Such initiatives are expected to improve operational efficiency and reduce dependency on external suppliers. -

Government Incentives and Policy Support

Dixon benefits from India’s Production-Linked Incentive (PLI) schemes aimed at boosting domestic manufacturing. The government has approved substantial incentives for electronics component manufacturing, which are expected to support Dixon’s growth and competitiveness in the industry. -

Financial Performance and Analyst Projections

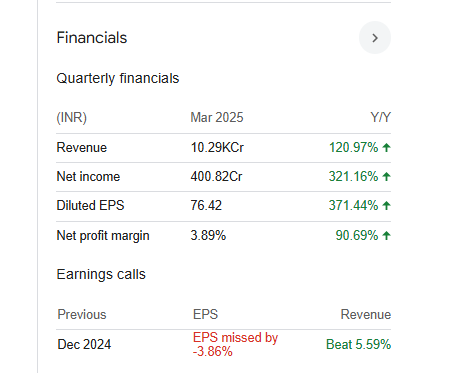

The company’s strong financial performance, with a 322% increase in net profit in Q4 FY25, reflects its growth trajectory. Analysts have projected a compound annual growth rate (CAGR) of 22% in revenue over the next three years, indicating continued positive momentum.

Dixon Share Price Target 2030

Dixon share price target 2030 Expected target could ₹44,200. Here are 5 key risks and challenges that could impact Dixon Technologies’ share price target by 2030:

-

Intense Competition in the Electronics Manufacturing Sector

The electronics manufacturing services (EMS) market is highly fragmented and competitive. Dixon faces challenges in maintaining a significant market share amidst numerous players vying for contracts. Despite India’s growing EMS capacity, Dixon’s share may not proportionally increase, limiting its growth potential. -

Overdependence on Government Incentives

Dixon’s growth has been significantly supported by India’s Production-Linked Incentive (PLI) schemes. While these incentives have provided short-term benefits, long-term sustainability will require Dixon to develop structural advantages independent of government support. -

Challenges in Component Manufacturing

India still imports a substantial portion of its electronic components, exposing Dixon to supply chain vulnerabilities. Efforts to enhance domestic component manufacturing are underway, but achieving self-sufficiency will require significant investments and time. -

Geopolitical Risks Affecting Exports

Global trade tensions and potential tariffs, such as those threatened by the U.S., could impact India’s export sectors, including Dixon’s. Analysts estimate potential losses of about $7 billion annually for India’s export sectors if such tariffs are imposed, posing a risk to Dixon’s revenue from international markets. -

Capital Intensity and Execution Risks

Dixon’s plans for backward integration, including investments in display manufacturing and other components, require substantial capital expenditure. These initiatives carry execution risks and could strain the company’s financial resources, especially if the expected returns do not materialize as planned.

Dixon Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 388.60B | 119.66% |

| Operating expense | 18.01B | 63.38% |

| Net income | 10.96B | 197.90% |

| Net profit margin | 2.82 | 35.58% |

| Earnings per share | 135.80 | 117.41% |

| EBITDA | 15.08B | 126.96% |

| Effective tax rate | 21.48% | — |

Read Also:- ITC Share Price Target Tomorrow 2025 To 2030