Ashok Leyland Share Price Target Tomorrow 2025 To 2030

Ashok Leyland is a leading Indian multinational automotive company headquartered in Chennai, Tamil Nadu. Established in 1948 as Ashok Motors, the company was renamed Ashok Leyland in 1955 following a collaboration with British Leyland. Today, it stands as the second-largest manufacturer of commercial vehicles in India and the fourth-largest manufacturer of buses globally. Ashok Leyland Share Price on NSE as of 27 May 2025 is 239.60 INR.

Ashok Leyland Share Market Overview

- Open: 241.80

- High: 241.90

- Low: 237.05

- Previous Close: 239.61

- Volume: 15,551,999

- Value (Lacs): 37,307.69

- 52 Week High: 264.65

- 52 Week Low: 191.86

- Mkt Cap (Rs. Cr.): 70,444

- Face Value: 1

Ashok Leyland Share Price Chart

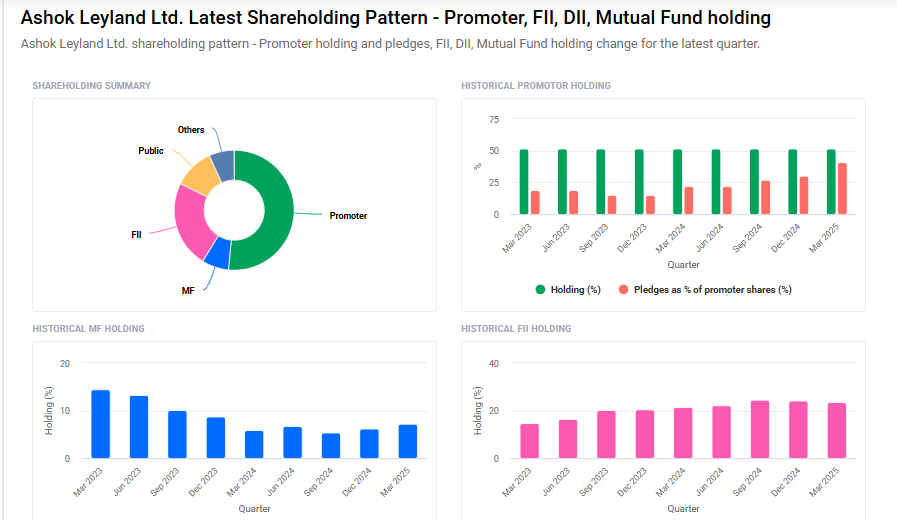

Ashok Leyland Shareholding Pattern

- Promoters: 51.5%

- FII: 23.5%

- DII: 14.1%

- Public: 10.8%

Ashok Leyland Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹270 |

| 2026 | ₹290 |

| 2027 | ₹310 |

| 2028 | ₹330 |

| 2029 | ₹350 |

| 2030 | ₹370 |

Ashok Leyland Share Price Target 2025

Ashok Leyland share price target 2025 Expected target could ₹270. Here are five key factors that could influence Ashok Leyland’s share price target by 2025:

-

Robust Financial Performance

In Q4 FY25, Ashok Leyland reported a 38% year-on-year increase in standalone net profit, reaching ₹1,246 crore. The company’s EBITDA margin improved to 15%, up from 14.1% in the previous year, indicating enhanced operational efficiency and cost management. -

Diversification into Non-Vehicle Segments

The company is expanding its revenue streams beyond traditional vehicle sales by focusing on sectors like defense, power solutions, and aftermarket services. This diversification aims to reduce dependency on the cyclical commercial vehicle market and stabilize earnings. -

Strategic Investments and Expansion Plans

Ashok Leyland has committed to significant investments, including setting up an electric vehicle manufacturing plant in Uttar Pradesh. Such initiatives are expected to position the company favorably in the growing EV market and contribute to long-term growth. -

Positive Industry Outlook

Analysts anticipate single-digit growth in the Medium and Heavy Commercial Vehicle (MHCV) segment, driven by increased government capital expenditure and infrastructure development. This sectoral growth is likely to benefit Ashok Leyland’s core business. -

Strong Cash Position Enabling Strategic Flexibility

With a net cash reserve of ₹4,242 crore at the end of FY25, Ashok Leyland has the financial flexibility to invest in new technologies, pursue acquisitions, and navigate market uncertainties, thereby supporting its growth trajectory.

Ashok Leyland Share Price Target 2030

Ashok Leyland share price target 2030 Expected target could ₹370. Here are 5 key risks and challenges that could impact Ashok Leyland’s share price target by 2030:

-

Economic Cyclicality and Demand Fluctuations

The commercial vehicle industry is highly cyclical and sensitive to economic conditions. Economic slowdowns, inflation, or reduced infrastructure spending can lower demand for trucks and buses, affecting Ashok Leyland’s sales and profitability. -

Transition to Electric Vehicles (EVs)

While Ashok Leyland is investing in EV technology, the shift from traditional internal combustion engines to electric powertrains poses challenges. High development costs, uncertain consumer adoption rates, and evolving government regulations could impact the company’s EV business growth. -

Raw Material Price Volatility

Fluctuations in prices of steel, aluminum, and other key raw materials can increase production costs. This may pressure profit margins, especially if the company cannot pass on cost increases to customers due to competitive pricing. -

Intense Competition

The commercial vehicle sector faces stiff competition from established players like Tata Motors, Volvo, and international entrants. Increased competition can lead to pricing pressure, reduced market share, and margin erosion. -

Regulatory and Environmental Compliance

Stricter emission norms and safety regulations require continuous investment in technology upgrades. Compliance failures or delays can lead to fines, product recalls, or loss of market access, impacting brand reputation and financial performance.

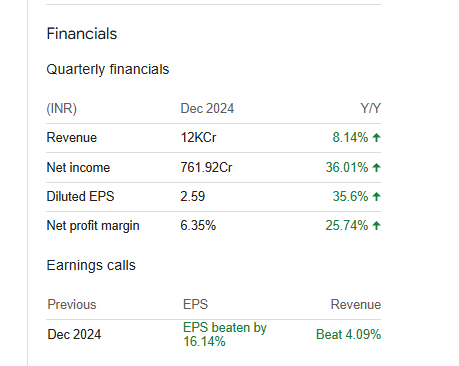

Ashok Leyland Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 457.91B | 9.88% |

| Operating expense | 95.46B | 10.21% |

| Net income | 24.84B | 100.49% |

| Net profit margin | 5.42 | 82.49% |

| Earnings per share | 9.14 | 86.87% |

| EBITDA | 78.64B | 56.99% |

| Effective tax rate | 34.33% | — |

Read Also:- Birla Soft Share Price Target Tomorrow 2025 To 2030