MMTC Share Price Target Tomorrow 2025 To 2030

MMTC Limited, established in 1963, is one of India’s largest public sector trading enterprises, operating under the Ministry of Commerce and Industry. Headquartered in New Delhi, MMTC specializes in the import and export of a diverse range of commodities, including minerals, precious metals, agro products, fertilizers, coal, and hydrocarbons. The company has a significant international presence, with trade networks spanning Asia, Europe, Africa, and the Americas, and a wholly owned subsidiary, MMTC Transnational Pte Ltd., based in Singapore. MMTC has played a pivotal role in India’s foreign trade, being one of the top foreign exchange earners for the country. MMTC Share Price on NSE as of 27 May 2025 is 64.00 INR.

MMTC Share Market Overview

- Open: 64.00

- High: 65.33

- Low: 63.81

- Previous Close: 63.68

- Volume: 3,427,990

- Value (Lacs): 2,196.66

- 52 Week High: 131.80

- 52 Week Low: 44.50

- Mkt Cap (Rs. Cr.): 9,612

- Face Value: 1

MMTC Share Price Chart

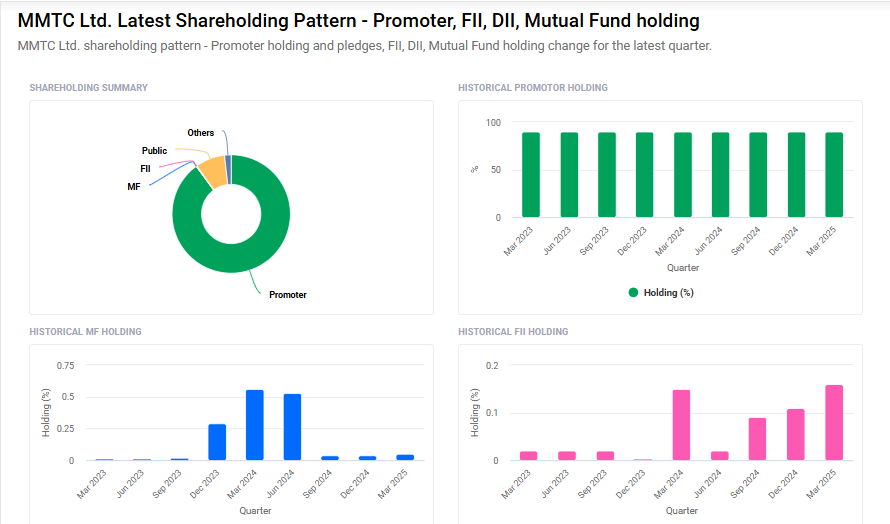

MMTC Shareholding Pattern

- Promoters: 89.9%

- FII: 0.2%

- DII: 1.9%

- Public: 8%

MMTC Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹135 |

| 2026 | ₹150 |

| 2027 | ₹170 |

| 2028 | ₹190 |

| 2029 | ₹210 |

| 2030 | ₹230 |

MMTC Share Price Target 2025

MMTC share price target 2025 Expected target could ₹135. Here are five key factors that could influence MMTC Ltd.’s share price target by 2025:

-

Diversified Trading Portfolio

MMTC Ltd. engages in the import and export of a wide range of commodities, including coal, iron ore, fertilizers, precious metals, and industrial raw materials. This diversified portfolio allows the company to mitigate risks associated with fluctuations in any single commodity market, potentially stabilizing its revenue streams. -

Government Ownership and Support

As a Mini-Ratna Public Sector Undertaking, MMTC Ltd. is owned 89.93% by the Government of India. This strong government backing can provide financial stability and facilitate access to capital, which may positively impact investor confidence and the company’s growth prospects. -

Strategic International Presence

With a wholly owned subsidiary in Singapore, MMTC Ltd. has established a significant international trade network spanning Asia, Europe, Africa, Oceania, and the United States. This global presence enhances the company’s ability to tap into international markets and leverage global trade opportunities. -

Focus on Precious Metals Trading

MMTC Ltd. is a major player in the bullion trade, including retailing, and has historically accounted for a significant share of India’s gold imports. Its leadership in this sector positions the company to benefit from demand in the precious metals market, potentially driving revenue growth. -

Financial Performance and Market Capitalization

As of May 2025, MMTC Ltd. reported a market capitalization of ₹9,552 crore and a share price of ₹64.08. The company’s financial performance, including recent net profit increases, indicates potential for growth, which could positively influence its share price target by 2025.

MMTC Share Price Target 2030

MMTC share price target 2030 Expected target could ₹230. Here are 5 key risks and challenges that could affect MMTC Ltd.’s share price target by 2030:

-

High Dependency on Government Policies

MMTC is a government-owned enterprise, and its operations are heavily influenced by policy decisions. Any shift in trade, export-import, or taxation policies could directly impact its revenue streams and profitability. -

Commodity Price Volatility

As a trading company dealing in metals, minerals, and other commodities, MMTC is highly exposed to global price fluctuations. Sudden changes in the prices of gold, iron ore, or coal can significantly affect its margins and financial stability. -

Limited Operational Diversification

Despite having a broad portfolio, MMTC’s core operations remain centered around commodity trading, which faces increasing competition and regulatory hurdles. Lack of substantial forward integration or value addition can limit long-term growth. -

Geopolitical and Trade Risks

Since MMTC operates in multiple international markets, global tensions, sanctions, or trade barriers can impact its ability to do business smoothly, especially in sectors like precious metals or fertilizers. -

Digital and Technological Lag

The global trading ecosystem is evolving rapidly with digital platforms and automation. If MMTC fails to modernize its operations and adopt new technologies, it may fall behind private sector competitors, reducing its efficiency and competitiveness.

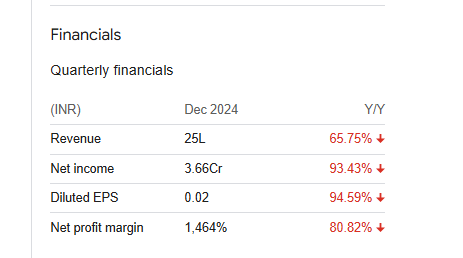

MMTC Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 53.40M | -99.85% |

| Operating expense | 1.65B | -28.85% |

| Net income | 1.92B | -87.70% |

| Net profit margin | 3.60K | 8,027.55% |

| Earnings per share | — | — |

| EBITDA | -1.63B | -49.41% |

| Effective tax rate | 3.91% | — |

Read Also:- Ashok Leyland Share Price Target Tomorrow 2025 To 2030