LIC Share Price Target Tomorrow 2025 To 2030

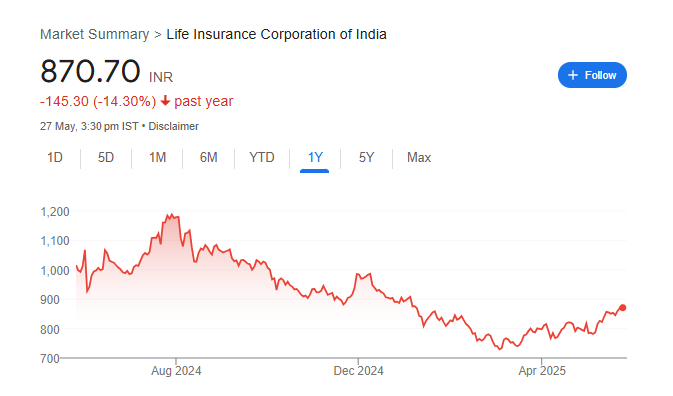

Life Insurance Corporation of India, commonly known as LIC, is the largest life insurance company in India. Founded in 1956, LIC has been a trusted name for millions of families, offering a wide range of insurance and investment products. It is owned by the Government of India and is known for its strong presence across the country, even in small towns and rural areas. LIC not only provides life insurance but also helps people save money for the future through various plans. Over the years, it has played a big role in promoting financial security and savings among Indians. LIC Share Price on NSE as of 28 May 2025 is 870.70 INR.

LIC Share Market Overview

- Open: 873.00

- High: 873.00

- Low: 861.50

- Previous Close: 870.05

- Volume: 1,430,284

- Value (Lacs): 12,461.35

- 52 Week High: 1,222.00

- 52 Week Low: 715.30

- Mkt Cap (Rs. Cr.): 551,065

- Face Value: 10

LIC Share Price Chart

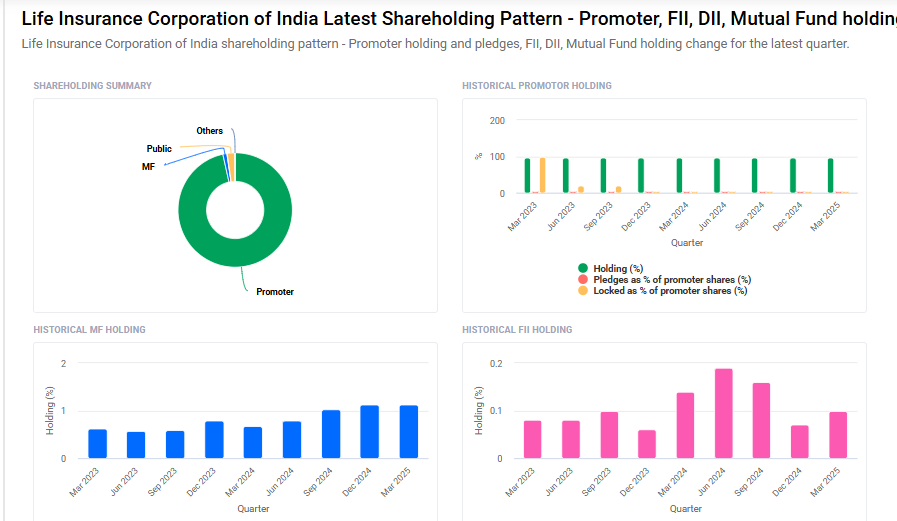

LIC Shareholding Pattern

- Promoters: 96.5%

- FII: 0.1%

- DII: 1.3%

- Public: 2.1%

LIC Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹1230 |

| 2026 | ₹1410 |

| 2027 | ₹1520 |

| 2028 | ₹1615 |

| 2029 | ₹1730 |

| 2030 | ₹1822 |

LIC Share Price Target 2025

LIC share price target 2025 Expected target could ₹1230. Here are five key factors that could influence Life Insurance Corporation of India (LIC)’s share price target by 2025:

-

Strong Financial Performance

In Q4 FY25, LIC reported a 38% year-on-year increase in consolidated net profit, reaching ₹19,039 crore. This growth was driven by improved profit margins and a strategic focus on non-participating insurance products, which typically offer higher margins. -

Diversified Product Portfolio

LIC’s expansion into high-margin non-participating products has enhanced its profitability. This diversification reduces reliance on traditional offerings and positions the company to better meet evolving customer needs. -

Market Leadership and Extensive Distribution Network

As India’s largest life insurer, LIC benefits from a vast distribution network, including over 2,000 retail outlets and more than 1,500 offices across nearly 90% of Indian districts. This extensive reach supports sustained premium income and market dominance. -

Positive Industry Outlook

India’s life insurance sector is poised for growth, driven by a large protection gap and increasing per capita income. These factors contribute to higher insurance penetration, benefiting major players like LIC. -

Analyst Confidence and Share Price Momentum

Brokerage firms have expressed optimism about LIC’s stock performance. For instance, Ashika Institutional Equities anticipates a further 45% upside potential, citing improved growth prospects and attractive valuations.

LIC Share Price Target 2030

LIC share price target 2030 Expected target could ₹1822. Here are 5 key risks and challenges that could affect LIC’s share price target by 2030:

-

Market Competition from Private Insurers

LIC faces increasing competition from private insurance companies that are more agile, tech-savvy, and focused on customer-centric products. If LIC fails to innovate or match their pace, it could lose market share over time. -

Low Profit Margins on Traditional Products

A large portion of LIC’s business comes from traditional life insurance and participating policies, which usually offer lower margins compared to non-participating or unit-linked insurance plans (ULIPs). Continued reliance on low-margin products could weigh on overall profitability. -

Regulatory and Policy Risks

Being a government-owned entity, LIC is subject to strict regulatory oversight. Any changes in insurance laws, tax policies, or government mandates could directly impact its operations and future earnings potential. -

Investment Portfolio Exposure

LIC holds significant investments in Indian equity markets and government securities. Market volatility or poor performance of key portfolio companies could adversely impact its investment income, which is a major component of its profits. -

Digital Transformation Challenges

As the industry rapidly shifts towards digital platforms and data-driven services, LIC may struggle to modernize its legacy systems and processes at the required pace. Delays in tech adoption can affect customer experience and operational efficiency.

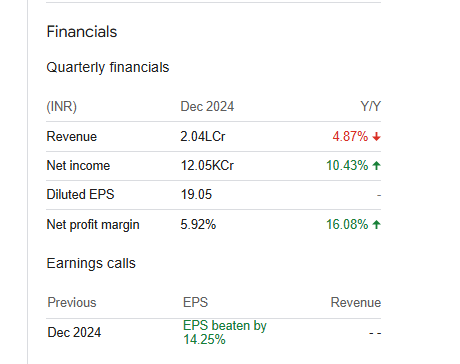

LIC Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 8.48T | 7.99% |

| Operating expense | 397.58B | -14.11% |

| Net income | 424.29B | -0.57% |

| Net profit margin | 5.00 | -7.92% |

| Earnings per share | 64.31 | 13.00% |

| EBITDA | 470.77B | 73.84% |

| Effective tax rate | 12.56% | — |

Read Also:- Suzlon Share Price Target Tomorrow 2025 To 2030