SNL Bearings Share Price Target Tomorrow 2025 To 2030

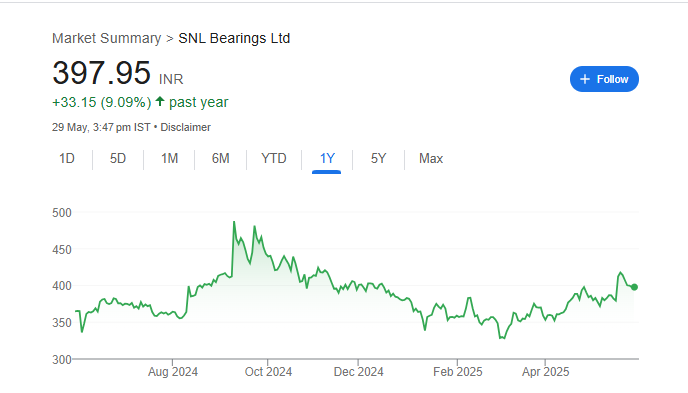

SNL Bearings is a small but reliable company in India that makes high-quality ball and roller bearings. These parts are important for machines, especially in the automotive and industrial sectors. The company is a part of NRB Bearings, a well-known name in the bearing industry. SNL focuses on producing long-lasting and efficient bearings that help machines run smoothly. SNL Bearings Share Price on NSE as of 30 May 2025 is 397.95 INR.

SNL Bearings Share Market Overview

- Open: 396.50

- High: 404.70

- Low: 396.50

- Previous Close: 399.85

- Volume: 2,008

- Value (Lacs): 7.99

- VWAP: 399.20

- UC Limit: 477.50

- LC Limit: 318.40

- 52 Week High: 514.40

- 52 Week Low: 319.70

- Mkt Cap (Rs. Cr.): 143

- Face Value: 10

SNL Bearings Share Price Chart

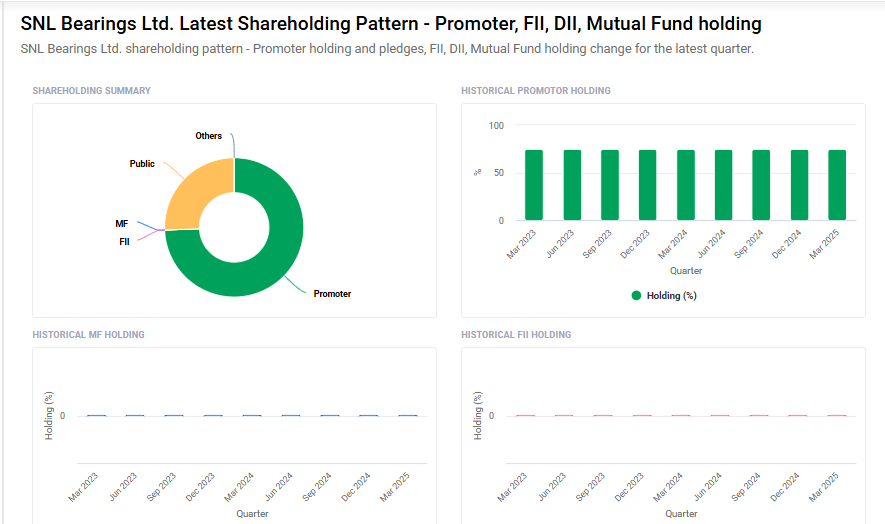

SNL Bearings Shareholding Pattern

- Promoters: 74.4%

- FII: 0%

- DII: 0%

- Public: 25.6%

SNL Bearings Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹520 |

| 2026 | ₹570 |

| 2027 | ₹620 |

| 2028 | ₹670 |

| 2029 | ₹720 |

| 2030 | ₹770 |

SNL Bearings Share Price Target 2025

SNL Bearings share price target 2025 Expected target could ₹520. Here are 5 key factors affecting the growth of SNL Bearings share price target for 2025:

-

Automotive Industry Demand:

SNL Bearings largely serves the automotive and industrial sectors. Growth or slowdown in auto manufacturing, particularly in two-wheelers and passenger vehicles, will directly influence the company’s order book and revenue. -

Raw Material Costs:

The price of steel and other key input materials impacts margins. Volatility in raw material prices without a proportional increase in product prices can compress profitability, affecting investor sentiment and share price. -

Parent Company Support (NRB Bearings):

As a subsidiary of NRB Bearings, strategic direction, technology transfer, and operational synergies with the parent can contribute to performance improvements and investor confidence. -

Export Opportunities and Diversification:

Expansion into global markets or new sectors can fuel growth. A diversified client base beyond automotive OEMs (original equipment manufacturers) will reduce dependency and add resilience to revenue streams. -

Capex and Modernization Initiatives:

Investment in automation, capacity expansion, or product innovation can position SNL Bearings for future growth. Positive developments on this front may support higher valuation expectations and share price targets for 2025.

SNL Bearings Share Price Target 2030

SNL Bearings share price target 2030 Expected target could ₹770. Here are 5 key risks and challenges that could affect the SNL Bearings share price target by 2030:

-

Dependence on Automotive Sector:

A large portion of SNL Bearings’ revenue comes from the auto industry. A prolonged slowdown, EV transition, or regulatory disruptions in this sector could significantly impact growth and margins. -

Technology Obsolescence:

Failure to innovate or adapt to new bearing technologies—especially with the rise of electric vehicles and advanced machinery—could render some of SNL’s products less relevant by 2030. -

Limited Scale and Market Reach:

Compared to larger global bearing manufacturers, SNL Bearings has a relatively small scale. This can limit bargaining power, R&D investment, and access to international markets. -

Volatility in Raw Material Prices:

Continuous fluctuations in steel and other input costs can pressure margins. If the company cannot pass on higher costs to customers, profitability could be at risk. -

Regulatory and Environmental Compliance:

Increasing ESG (Environmental, Social, and Governance) norms and sustainability requirements may lead to higher compliance costs. Non-compliance or delays in adopting eco-friendly practices could hurt its reputation and investor interest.

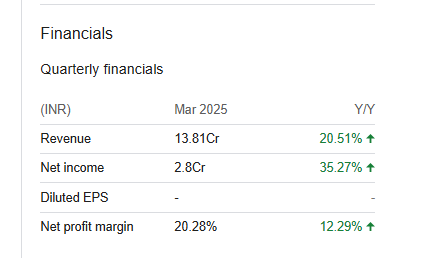

SNL Bearings Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 511.90M | 7.34% |

| Operating expense | 216.40M | 1.64% |

| Net income | 108.60M | 38.87% |

| Net profit margin | 21.21 | 29.33% |

| Earnings per share | — | — |

| EBITDA | 130.90M | 26.72% |

| Effective tax rate | 23.20% | — |

Read Also:- GCM Commodity Share Price Target Tomorrow 2025 To 2030