OM Infra Share Price Target From 2025 to 2030

OM Infra Share Price Target From 2025 to 2030: Investment in the stock market involves full comprehension of a firm’s finance, its market standing, and growth opportunities in the future. A recent stock making headlines is OM Infra Ltd., a leading infrastructure company boasting about its engineering, manufacturing, and execution capabilities in hydro-mechanical and material handling equipment.

In this article, we delve deeply into the latest stock performance, finances, technical indicators, and institutional holdings of OM Infra, and forecast its potential share price targets for 2025 to 2030.

Company Overview and Market Position

OM Infra Ltd. is a prominent infrastructure company, offering large-sized turnkey hydro-mechanical engineering projects for dams, irrigation, and water resources development. The firm is witnessing an upsurge due to renewed focus by the government of India on water conservation schemes, infrastructure upgradation, and alternate energy.

Growth Drivers:

- Infrastructure Push by Government of India: The government of India remains quite active in infrastructural investment.

- Hydropower Projects: More focus on the generation of renewable power facilitates OM Infra’s business model sustenance.

- Export Potential: Engineering exports to developing countries are growing.

- Diversified Portfolio: Power sector and water and irrigation project endeavors reduce concentration risks to business.

The positioning of OM Infra within this niche elevates it as a strategic investment of India and worldwide next generation infrastructure growth.

Recent Stock Market Performance

- Current Price: ₹121.00

- 52-Week High: ₹227.90

- 52-Week Low: ₹97.05

- Market Capitalization: ₹1,129 Crore

- Volume: 1,47,501 shares traded

- Total Traded Value: ₹1.77 Crore

Price Movement: The stock has fallen by 14.40% in the last one year, either because of profit booking or short-term headwinds. But the correction is a chance to buy for long-term investors.

Fundamental Analysis

- Market Cap: ₹1,129 Cr

- P/E Ratio (TTM): 46.69

- P/B Ratio: 1.54

- EPS (TTM): 2.51

- Book Value: 76.27

- Dividend Yield: 0.43%

- ROE: 3.49%

- Debt to Equity: 0.14

- Face Value: 1

Key Takeaways:

- OM Infra is a low-debt company, indicating good financial management.

- A high P/E indicates that the stock is premium-valued for growth but premium valuation as well.

- Return on equity (ROE) is moderate but consistent.

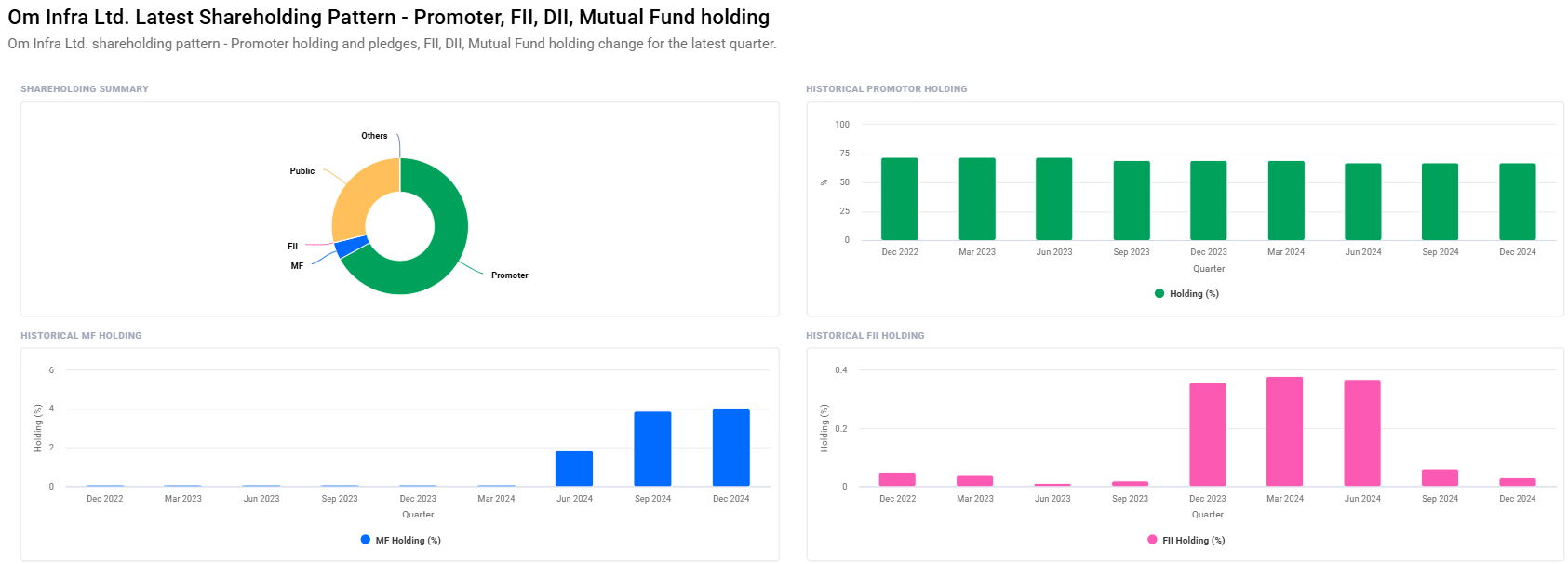

Ownership Structure and Institutional Confidence

- Promoters: 67.05% (from 67.02%)

- Retail and Others: 28.86%

- Mutual Funds: 4.06% (from 3.92%)

- Foreign Institutions (FII): 0.02% (from 0.06%)

Observations:

- Promoter confidence remains strong with marginal increase in holding.

- Mutual funds have marginally increased holdings, which reflects increasing institutional confidence.

- FIIs have recorded a marginal withdrawal, exhibiting prudence by foreign investors.

Technical Analysis

- Momentum Score: 35.3, Neutral to weak

- MACD (12,26,9): -0.9, Bearish

- MACD Signal: -1.5, Bearish

- ADX: 11.1, Weak trend

- RSI (14): 50.8, Neutral

- ROC (21): 15.3, Mild positive momentum

- MFI: 60.4, Approaching overbought, yet healthy

- ATR: 7.8, Moderate volatility

- ROC (125): -28.8, Negative long-term trend

The stock is technically neutral with conflicting signals. While short-term indicators like ROC (21) and MFI are positive, long-term indicators like ROC (125) are negative. Investors must watch for MACD and RSI crossovers to make entry calls.

OM Infra Share Price Target (2025 to 2030)

Based on the company’s fundamentals, industry scenario, and expected infrastructure boom, following is a likely price projection:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹230 |

| 2026 | ₹360 |

| 2027 | ₹500 |

| 2028 | ₹640 |

| 2029 | ₹780 |

| 2030 | ₹920 |

This estimate presumes consistent growth in earnings, favorable economic conditions, and smooth implementation of major projects.

Investment Strategy

Short-Term Investors (1-2 Years)

- Risk Level: High

- Strategy: Wait to purchase breakout above ₹125.

- Target: ₹210 – ₹230 by 2025

Medium-Term Investors (3-5 Years)

- Risk Level: Moderate

- Strategy: Purchase dips below ₹110 and hold.

- Target: ₹350 – ₹500 by 2027

Long-Term Investors (5+ Years)

- Risk Level: Low

- Strategy: Accumulate position gradually and hold for long-term appreciation.

- Target: ₹900+ by 2030

Risks and Challenges

- Market Volatility: The stocks are cyclical and policy-sensitive.

- Execution Delays: Revenue will be impacted by project delays.

- Global Uncertainty: Disruptions in supply or exports will impact profitability.

- Valuation Risk: Topping P/E now may deter new investors if earnings lag.

Last Word – Is OM Infra a Good Investment?

OM Infra Ltd. is favorably positioned in a niche and expanding area of the infrastructure space. It offers an acceptable combination of technical expertise, order book size, and promoter dedication. Although the stock has corrected from its highs, the fundamentals remain intact and have a long-term potential for patient investors.

If the company manages to maintain and improve its margins, low debt, and timely completion of projects, the stock can do better in the long term.

FAQs For OM Infra Share Price

Q1: Is OM Infra a good long-term buy?

Yes, long-term investors would be able to benefit from OM Infra’s infrastructure theme, government-backed projects, and low debt.

Q2: What is the share price of OM Infra likely to be in 2025?

The share price would be between ₹180 and ₹230 by 2025.

Q3: Why did OM Infra share fall recently?

The recent decline could be profit-booking, technical correction, or overall market mood.

Q4: Is OM Infra giving dividends?

Yes, the dividend yield is very low at 0.43%.

Q5: What is the risk of investing in OM Infra?

The major risks involved are delay in implementation, market volatility, and over-valuation.

Q6: Has the promoter holding recently changed?

Yes, it increased by a small margin from 67.02% to 67.05% reflecting positive emotions.

Q7: Do I wait before buying OM Infra?

If you are a short-term investor, then waiting for technical clearance may be wise. If you are a long-term investor, you may indulge in SIP-type accumulation.

OM Infra Ltd. has a strong tale backed by good fundamentals, technical positives, and government sector tailwinds. Aggressive entry and waiting on this stock can lead to rich returns till the year 2030.