NIIT Share Price Target From 2025 to 2030

NIIT Share Price Target From 2025 to 2030: Investment in the stock market requires an entry into the business fundamentals, technical setup, investor psychology, and long-term prospects of a company. Such firms that have drawn significant investor attention include NIIT Learning Systems Ltd., the leader in the education and learning solutions space.

With the digital revolution turning the old ways of learning on their head, NIIT alone stands ready to supply top-of-the-line learning solutions to corporates as well as individuals. This article presents a thorough overview of past NIIT stock performance, its finances, technicals, shareholder base, and share price target projections from 2025 to 2030.

Overview: NIIT Learning Systems Ltd.

NIIT Learning Systems Ltd. is the global leader in talent development, providing managed training services to Fortune 500 companies and institutions worldwide. With a strong focus on digital learning, analytics, and future workforce readiness, NIIT aims at one of the fastest-growing education segments.

The global learning solutions of the company are structured to cater to the contemporary enterprise needs through platforms and partnerships that serve the digital workforce. With increasing investments in employee development globally, NIIT has become a key knowledge transformation driver.

Current Share Price Performance & Key Statistics

As of the last trading session, the following are the significant NIIT Learning Systems Ltd. facts:

- Open Price: ₹124.20

- High: ₹124.75

- Low: ₹113.61

- Current Price: ₹115.75

- Market Capitalization: ₹1,572 Cr

- P/E Ratio (TTM): 36.00

- Industry P/E: 35.57

- EPS (TTM): ₹3.28

- Dividend Yield: 1.08%

- Book Value: ₹77.30

- 52-Week High: ₹233.80

- 52-Week Low: ₹90.55

- Upper Circuit: ₹138.90

- Lower Circuit: ₹92.80

- Volume Traded: 11,41,187

- Total Traded Value: ₹13.21 Cr

Despite the bearish trend of stock price recently experienced by NIIT, it possesses good valuation bases and strong fundamentals to promise long-term appreciation.

Technical Analysis – Current Weakness or Opportunity?

Let us look at NIIT’s short-term technical indicators:

- Momentum Score: 30.0 (Technically weak)

- MACD (12,26,9): -10.9 (Bearish)

- MACD Signal: -7.1 (Bearish)

- RSI (14): 31.4 (Near oversold zone)

- ADX: 25.9 (Weak trend)

- ROC (21): -9.5 (Negative momentum)

- ROC (125): -25.0 (Long-term weakness)

- MFI: 25.3 (Oversold – Rebound Possible)

- ATR: 18.6 (High volatility)

Technical Summary

NIIT technical tips suggest the stock is bearish in sentiment, on the verge of being oversold levels. It can be a sign of reversal or bounce-back, especially for long- and medium-term investors. RSI and MFI suggest the stock may be undervalued in the short term.

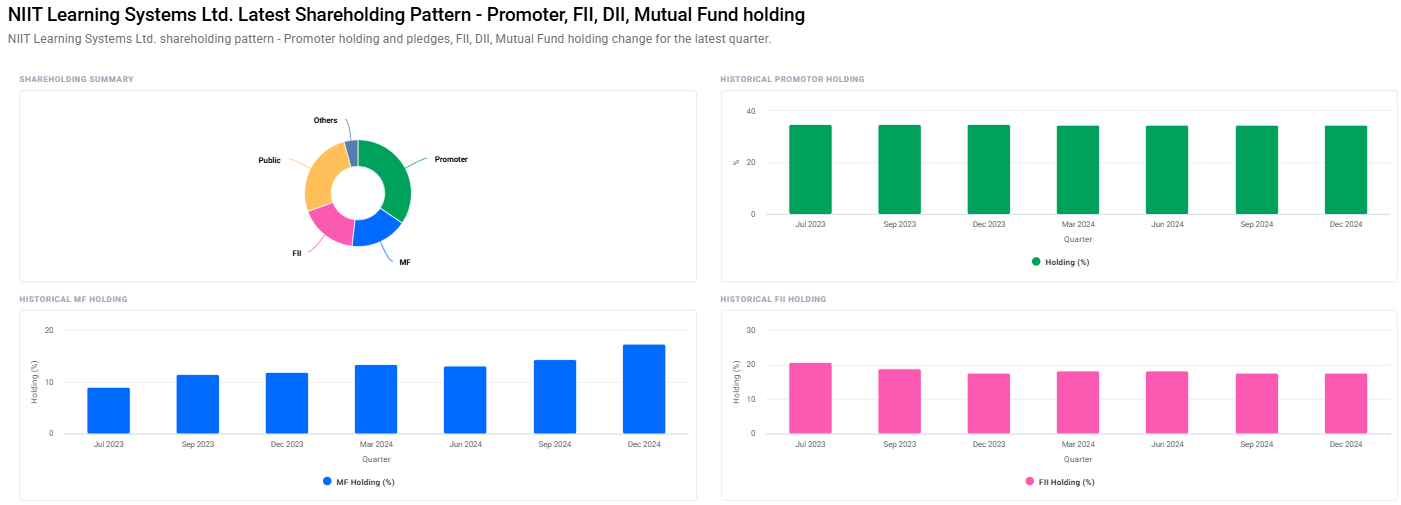

Shareholding Pattern – Institutional Sentiment

It is essential to identify the owner of any stock while assessing it. Following is the existing pattern of ownership:

- Retail & Others: 37.82%

- Promoters: 37.22%

- Foreign Institutional Investors (FIIs): 13.46%

- Mutual Funds: 8.25%

- Other Domestic Institutions: 3.26%

December Quarter Insights:

- Promoters: Down slightly from 34.52% to 34.48%

- FII/FPI: From 17.66% to 17.63%, though the number of investors went up from 147 to 153

- Mutual Funds: From 14.35% to 17.34%

- MF Schemes: Went up from 9 to 10

- Institutional Investors Overall: Went up from 36.39% to 39.17%

This indicates growing institutional confidence, and more significantly, domestic mutual fund confidence—a good sign for long-term investors.

NIIT Share Price Target (2025 to 2030)

Given NIIT’s growing digital learning presence, institutional attraction, and growing global emphasis on reskilling, the ensuing long-term share price targets are envisioned:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹250 |

| 2026 | ₹400 |

| 2027 | ₹550 |

| 2028 | ₹700 |

| 2029 | ₹850 |

| 2030 | ₹1000 |

These are extrapolative estimates and dependent on macroeconomic conditions, implementation of strategy, and market sentiment.

Time Horizon-Based Investment Strategies

Short-Term (Less than 1 year)

- Risk: High

- Strategy: Wait for confirmation technically. Wait for RSI > 40 and MACD crossover for safe entry.

- Exit Range: ₹180 – ₹200

Medium-Term (1 to 3 years)

- Risk: Moderate

- Strategy: Buy on dips, especially around ₹115-₹125 level.

- Exit Range: For ₹400 – ₹550

Long-Term (3 to 6 years)

- Risk: Low

- Strategy: Ride India’s EdTech growth, global upskilling demand.

- Target: ₹850 to ₹1000+

Risks & Challenges

- High Volatility: NIIT has seen sharp price action in the last few quarters.

- Institutional Shuffling: Small decline in promoter and FII holdings may suggest caution.

- Sector Sensitivity: Frankly dependent on corporate learning expenses and macro stability.

- Technical Weakness: Short-term investors can’t ignore the dominant bearish indications.

Why Invest in NIIT

- Positioned in a growth segment (corporate learning & digital skilling)

- Institutional interest and mutual fund activity are high

- Global client base with revenue visibility

- Resist economic slowdowns due to enterprise dependence

- Encouraging entry point near its 52-week low

FAQs For NIIT Share Price

1. Is NIIT a long-term investment to consider for

Yes, NIIT’s strong fundamentals in the learning tech industry, consistent profit, and increasing global demand for digital skilling make it an excellent long-term investment.

2. What is the 2025 share price target of NIIT?

On technical resurgence and institutional support, NIIT can reach about ₹250 by December 2025.

3. What are the biggest risks of investing in NIIT?

Market volatility, institutional holding variation, and enterprise learning contract dependency could be risks.

4. Is NIIT undervalued currently?

With its RSI and MFI on the edge of oversold positions and poor price momentum, it may be trading at below its intrinsic value in the near future.

5. Is NIIT likely to reach ₹1000 by 2030?

Yes, with the assumption of sustained strategic implementation, expansion to new geographies, and profitability, ₹1000 is an achievable long-term goal.

6. What is the best entry point for NIIT?

Technical charts suggest accumulation between ₹110 and ₹125, especially if RSI falls below 30 or bounces hard from there.

Last Verdict: Whether or not to invest in NIIT

NIIT Learning Systems Ltd. is a solid company in a high-potential sector. As global firms focus on training and digitalization, NIIT’s role is only going to rise. Even though short-term technicals are bad, long-term fundamentals are very positive.

Investors with a horizon of 5 to 6 years and medium risk tolerance can consider building this stock in tranches. The price targets on the cards between 2025 and 2030 hold astounding upside potential, provided the company maintains its strategy pace.

Pro Tip: Monitor technical indicators desirously for short-term entry and note quarterly trends in institutional holding.