Indegene Share Price Target From 2025 to 2030

Indegene Share Price Target From 2025 to 2030: Share investment is not just being trend following but interpreting the financial health, strategic logic, and possibility in the businesses’ markets. Another such share that has also come under the lens of retail as well as institutional investors is that of Indegene Ltd., a life science commercialization firm with a digital-first business model offering solutions to facilitate improved patient outcomes for biopharma and med device firms.

As life and health science businesses shift more towards digital products and tech-based services, Indegene is a beneficiary of this massive secular trend. As the firm expands its customer base with its new philosophy, it has turned into a long-term investment opportunity.

This detailed report provides technical and fundamental performance, technical analysis indicators, shareholding pattern, and share price target estimation of Indegene Ltd. for 2025-2030 years. Once you read that, you will understand well about this stock whether you can include in your investment scheme or not.

Company Overview and Market Position

Indegene Ltd. stands where healthcare and technology meet, delivering solutions to the world’s top pharma companies in drug development, marketing, and sales. It uses AI, machine learning, analytics, and automation to facilitate greater patient engagement, faster product commercialization, and enhanced regulatory compliance.

Some of the biggest strengths of Indegene are:

- Increased global customer base of top pharma companies.

- Positioning itself in a technology-led, high-margin space of the healthcare industry.

- Strong pharma and biotech industry digitalization demand.

- Indegene’s expansion in AI-based healthcare solutions.

With increased reliance on life sciences and healthcare services on the internet, Indegene’s competitive opportunity appears strong over the next two years.

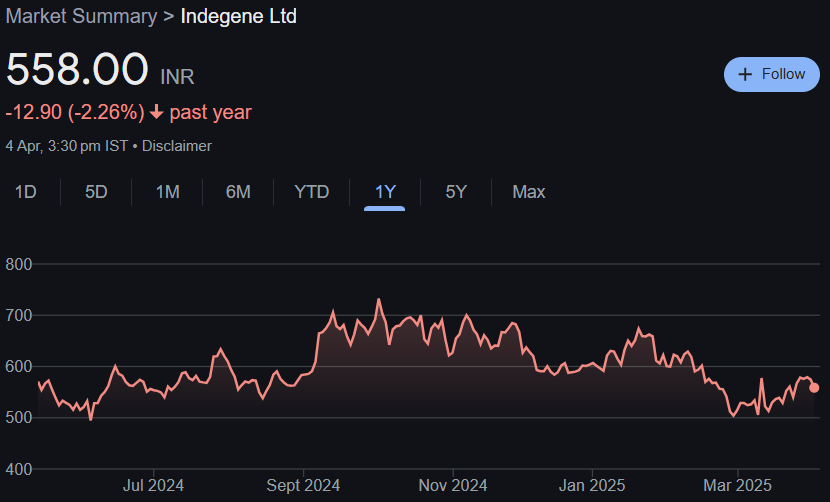

Recent Stock Performance

Following are the recent performance statistics of Indegene Ltd.:

- Open Price: ₹573.70

- High: ₹575.45

- Low: ₹552.00

- Current Market Price: ₹558.00

- 52-Week High: ₹736.30

- 52-Week Low: ₹470.10

- Market Capitalization: ₹13,350 Cr

- Volume (Day): 3,18,780 shares

- Total Traded Value: ₹17.80 Cr

- P/E Ratio (TTM): 31.58

- Book Value: ₹98.38

- EPS (TTM): ₹16.00

- Dividend Yield: 0.00%

- Return on Capital Employed (ROCE): 15.81%

- Industry P/E: 68.88

The stock has declined by about 2.26% in the last one year due to largely general market corrections and profit-booking by investors following its own good rally in the recent past. Overall fundamentals, however, are healthy, and it is well-placed for long-term growth.

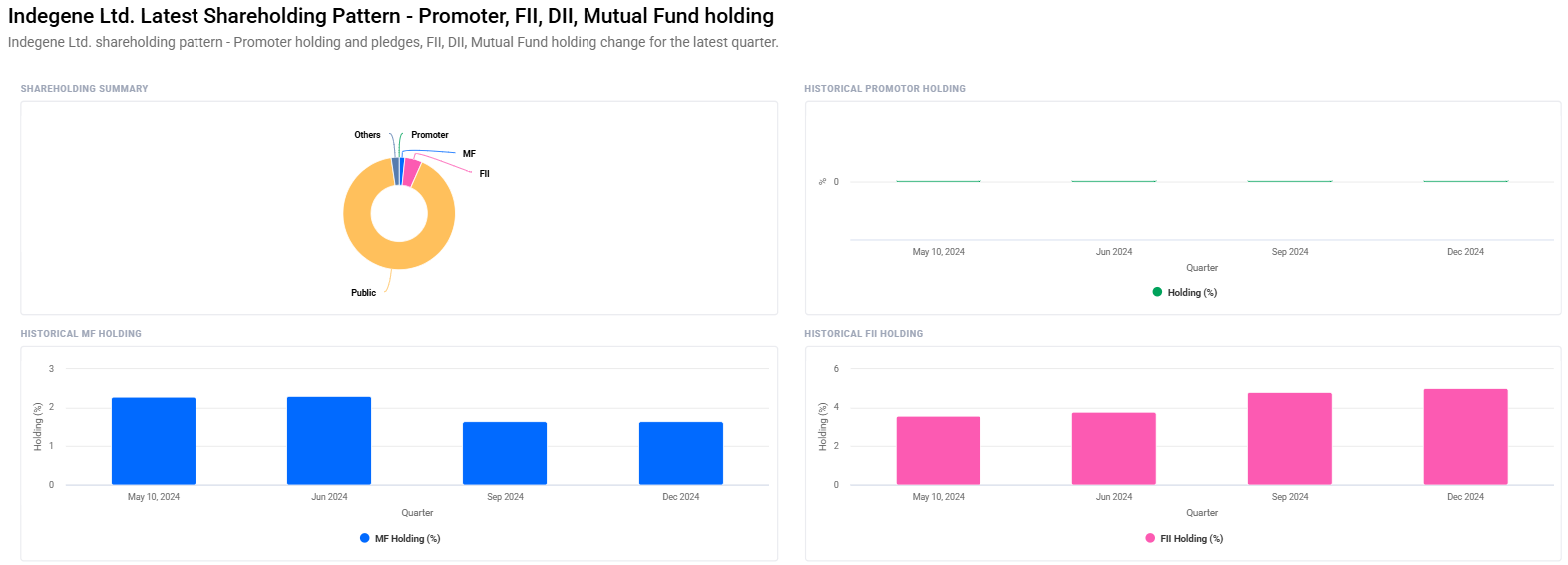

Ownership Structure and Institutional Confidence

Shareholding pattern as of the latest quarter reported shows strong retail interest underpinned by ever-growing institutional confidence:

- Retail and Others: 90.99

- Foreign Institutional Investors (FIIs): 5.03% (from 4.82%)

- Mutual Funds: 1.64% (no change)

- Other Domestic Institutions: 2.34%

Surprisingly, FIIs have risen holding from 4.82% to 5.03%, and FII/FPI investors are up from 70 to 102—a sign of healthy increasing global institutional investment. Mutual funds did not change, a sign of consistent domestic support.

Technical Analysis – Is Indegene a Buy Now?

Indegene Ltd. is showing a neutral technical trend at present but there are signs that it would be likely to increase if the market situation is in its favor.

- RSI (14): 49.8, Neutral (Neither oversold nor overbought)

- MACD: 3.2, Bullish momentum (above signal line)

- MACD Signal: -2.2, Confirms bullish crossover

- ADX: 27.2, Moderate trend strength

- MFI: 74.5, Overbought zone; short-term pullback in sight

- ATR: 26.0, Moderate volatility

- ROC (21 Days): 5.0, Short-term upward movement

- ROC (125 Days): -19.0, Long-term period of correction under way

Though the indicators like MACD and ROC (21) are bullish, the MFI level above 70 indicates that the stock will correct or consolidate in the short run before resuming the upmove.

Indegene Share Price Target 2025-2030

Based on the company fundamentals, market direction, technicals, and the rapid growth of digital healthcare development, the following is a share price projection for Indegene for the next six years:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹770 |

| 2026 | ₹1070 |

| 2027 | ₹1370 |

| 2028 | ₹1670 |

| 2029 | ₹1970 |

| 2030 | ₹2270 |

These stand to be achieved going by the company being capable of maintaining its growth trajectory and making hay while the digital revolution in healthcare anywhere in the world is on.

Investment Strategy – What to do for investors?

Short-Term Investors (1-2 Years)

- Risk Level: Moderate to High

- Strategy: Hold during consolidation between ₹540-₹560 to be complete, then break out.

- Target: ₹770 by December 2025.

Medium-Term Investors (3-5 Years)

- Risk Level: Moderate

- Strategy: Ride on dips, especially if the price drops near ₹500-₹520 zone.

- Target: ₹1370 by 2027.

Long-Term Investors (5+ Years)

- Risk Level: Low to Moderate

- Strategy: Buy in tranches; hold for digital healthcare structural growth.

- Target: ₹2270 by 2030.

Risks and Challenges

Since Indegene Ltd. is also promising, investors must keep one eye open for threats as well

- High Valuation Risk: A P/E multiple of over 31 makes the stock already growth-priced. Any below-forecast performance on the earnings front can result in ugly corrections.

- Industry Competition: The electronics life sciences and healthcare industry is heating up with domestic and foreign players competing for market share.

- Overbought Signals: Short-term correction would be experienced prior to the resumption of the uptrend as seen from some technical indicators.

- No Dividends: There is no dividend yield being provided at present by the company, thus making it less appealing to income seekers.

Ultimate Verdict – Is Indegene a Good Investment?

Yes, to long-term investors.

Indegene Ltd. provides a compelling investment opportunity in the nascent convergence of new life sciences and technology. With its growing institutional support, favorable market fundamentals, and strategic position in the digital healthcare value chain, it has the potential to be a likely multi-bagger in 5-6 years’ time.

But with current price valuations for the stock and what it is doing on the chart, dips can be used to accumulate positions or wait for consolidation to aggressively buy. Long-term patient thinking is the key to bringing out the full potential of this stock.

Frequently Asked Questions (FAQs)

Q1. Should Indegene Ltd. be bought now?

Indegene is basically solid and on the rise in a high-potential industry. It is technically even-keel at present, but short-term traders can await better momentum cues. Long-term buyers can buy in stages.

Q2. Indegene’s share price in 2025 will be:

The likely share price target of Indegene Ltd. as on end-2025 would be about ₹770, with consistent growth and sustained institutional support.

Q3. Indegene to cross ₹2000 in the next 5 years?

Yes, given its earnings growth, market growth, and favorable industry situation, Indegene can reach ₹1970 in 2029 and ₹2270 in 2030, as per estimates.

Q4. What are the significant risks of investing in Indegene Ltd.?

Significant risks are high valuation, industry competition, risk of regulatory problems, and no dividend yield for income investors.

Q5. Does Indegene Ltd. pay dividend?

Currently, Indegene does not distribute any dividend. The company is seen to invest profits in growth and expansion.

Q6. What is the future potential of the digital healthcare industry?

The digital healthcare industry will grow predominantly in the future years as the demand for technology-driven medical services grows, AI gathers pace, and digital health transformation accelerates globally.