Hindalco Share Price Target Tomorrow 2025 To 2030

Hindalco Share is one of the popular choices among investors who are looking for long-term growth in the metal and manufacturing sector. Hindalco Industries Limited is a part of the Aditya Birla Group and is one of the leading producers of aluminium and copper in India. The company also owns Novelis, a global player in aluminium rolled products and recycling, which adds great value to its global presence. Hindalco Share Price on NSE as of 14 April 2025 is 601.80 INR.

Hindalco Share Market Overview

- Open: 585.00

- High: 607.95

- Low: 576.10

- Previous Close: 564.00

- Volume: 12,562,852

- Value (Lacs): 75,414.80

- VWAP: 596.56

- UC Limit: 620.40

- LC Limit: 507.60

- 52 Week High: 772.65

- 52 Week Low: 546.45

- Mkt Cap (Rs. Cr.): 134,901

- Face Value: 1

Hindalco Share Price Chart

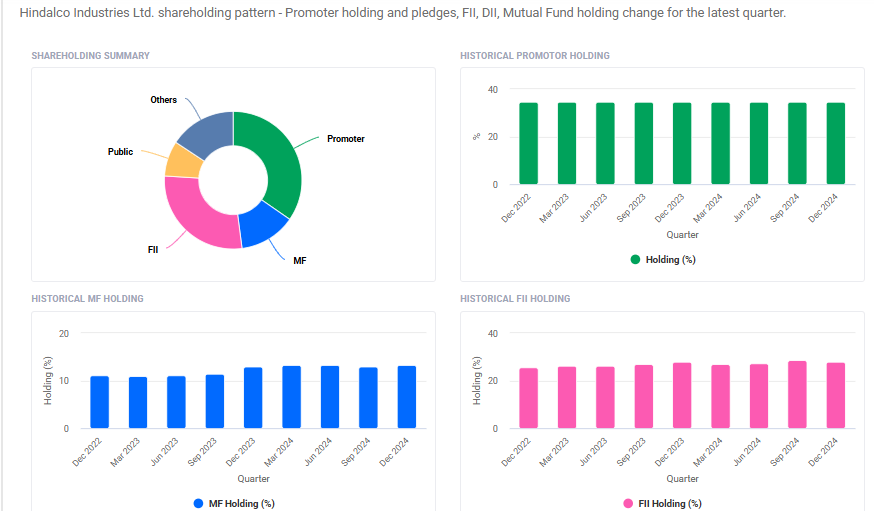

Hindalco Shareholding Pattern

- Promoters: 34.6%

- FII: 28%

- DII: 28.6%

- Public: 8.8%

Hindalco Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹780

- 2026 – ₹900

- 2027 – ₹1000

- 2028 – ₹1100

- 2029 – ₹1200

- 2030 – ₹1300

Major Factors Affecting Hindalco Share Price

Here are five key factors influencing the growth of Hindalco Industries Ltd.’s share price:

1. Global Metal Prices

Hindalco earns most of its revenue from aluminum and copper. When the prices of these metals go up in the global market, the company earns more profit, which increases investor interest and pushes the share price higher. On the other hand, falling prices can reduce profits and lower the stock value.

2. Demand from Key Industries

Hindalco supplies metals to industries like automobiles, construction, and packaging. If these sectors grow and require more raw materials, Hindalco gets more business. A strong demand helps boost its performance and positively affects its share price.

3. Company’s Expansion Plans

Hindalco’s big investment in capacity expansion, such as setting up new plants or upgrading existing ones, shows that it is preparing for future growth. Investors usually take this as a good sign, which increases confidence in the stock and helps the price rise.

4. Performance of Novelis (Subsidiary)

Hindalco owns Novelis, a global leader in aluminum recycling and rolled products. Novelis contributes a significant share to Hindalco’s earnings. If Novelis performs well, it strengthens Hindalco’s overall financial health and lifts the share price.

5. Government Policies and Support

Supportive policies for the manufacturing and metal sectors, like lower import duties or subsidies, help companies like Hindalco grow. On the other hand, strict mining rules or higher taxes can add costs and impact profits.

6. Foreign Exchange Rates

Since Hindalco operates internationally, currency exchange rates also affect its earnings. A stronger U.S. dollar compared to the Indian rupee can benefit the company’s export earnings, which can increase investor interest and affect share value positively.

7. Investor Sentiment and Market Trends

Share prices also depend on how investors feel about the company and the overall stock market. If the market is bullish and people have confidence in Hindalco’s growth, the stock usually does well. Negative news or global uncertainty, however, can bring the share price down even if the company is performing okay.

Risks and Challenges for Hindalco Share Price

Here are 7 key risks and challenges that can affect the growth and performance of Hindalco’s share price:

1. Fluctuating Commodity Prices

Hindalco’s business depends heavily on the prices of aluminum and copper. If global prices of these metals fall due to low demand or oversupply, it directly impacts the company’s profits. This, in turn, can bring down the share price.

2. High Capital Investment Risk

The company is planning big investments (like ₹45,000 crore) in its aluminum and copper businesses. While these investments are made for future growth, if they don’t give the expected returns, it could lead to financial pressure and affect investor confidence.

3. Global Economic Slowdown

Hindalco has a global presence through its subsidiary Novelis. If the global economy slows down, especially in major markets like the US and Europe, it could reduce demand for metals. This would impact both sales and profits, pulling the share price down.

4. Regulatory and Environmental Challenges

Being a metal and mining company, Hindalco has to follow strict environmental and mining rules. If new regulations are introduced or if the company fails to meet existing standards, it could face legal penalties or shutdowns, affecting operations and share value.

5. Debt and Financial Pressure

Large companies often take loans to fund big projects. If Hindalco’s debt increases too much without enough revenue growth, it can lead to repayment difficulties and affect credit ratings. This creates negative sentiment among investors.

6. Operational Risks at Novelis

Novelis is a major part of Hindalco’s global business. Any issues in its performance — like low demand, production cuts, or management challenges — can reduce overall profits. This can hurt the parent company’s valuation and share price.

Read Also:- Indo Farm Equipment Share Price Target From 2025 to 2030