Sahaj Solar Share Price Target Tomorrow 2025 To 2030

Sahaj Solar Limited is an Indian renewable energy company specializing in solar solutions. The company offers a range of products and services, including solar photovoltaic modules, water pumps, street lights, mobile solar trolleys, and provides system designing, engineering, procurement, and construction services. As of April 11, 2025, Sahaj Solar’s share price on the NSE is ₹240.35, with a market capitalization of ₹503 crore. The company has demonstrated strong financial performance, with a return on equity of 54.08% and a net profit margin of 6.63%. Sahaj Solar Share Price on NSE as of 14 April 2025 is 240.35 INR.

Sahaj Solar Share Market Overview

- Open: 242.00

- High: 250.00

- Low: 235.00

- Previous Close: 228.70

- Volume: 49,200

- Value (Lacs): 118.25

- VWAP: 241.17

- UC Limit: 274.40

- LC Limit: 183.00

- 52 Week High: 395.00

- 52 Week Low: 150.00

- Mkt Cap (Rs. Cr.): 528

- Face Value: 10

Sahaj Solar Share Price Chart

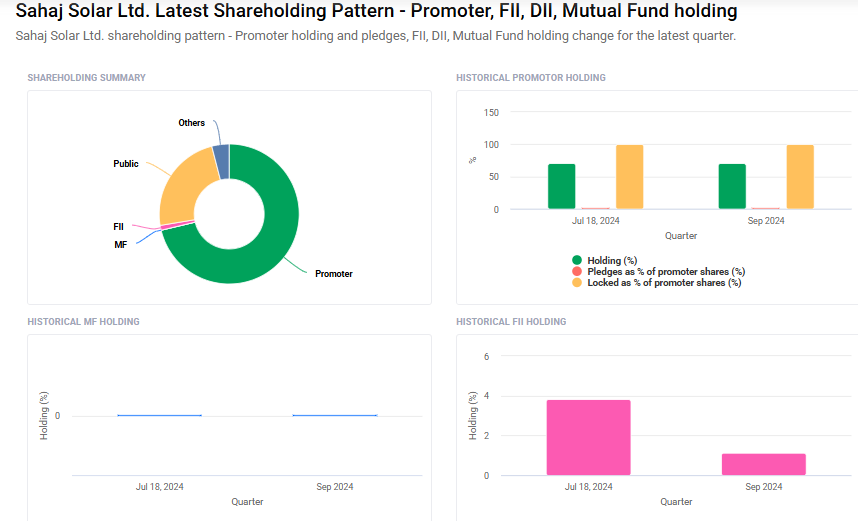

Sahaj Solar Shareholding Pattern

- Promoters: 71.3%

- FII: 1.1%

- DII: 4%

- Public: 23.6%

Sahaj Solar Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹400

- 2026 – ₹650

- 2027 – ₹800

- 2028 – ₹950

- 2029 – ₹1100

- 2030 – ₹12,50

Major Factors Affecting Sahaj Solar Share Price

Here are 6 major factors that influence the share price of Sahaj Solar Ltd:

1. Strong Revenue and Profit Growth

Sahaj Solar has shown impressive growth in both revenue and profit over recent years. For instance, its revenue increased from ₹6,677 lakhs in March 2022 to ₹20,117 lakhs by March 2024, and profit after tax rose from ₹102 lakhs to ₹1,316 lakhs during the same period. Such consistent financial performance boosts investor confidence and positively impacts the share price.

2. Dependence on Solar Pumping Systems

A significant portion of Sahaj Solar’s revenue, over 70%, comes from solar pumping systems. While this specialization has driven growth, it also means the company’s financial health is closely tied to this segment. Any decline in demand or policy changes affecting solar pumping systems could adversely affect the share price.

3. Customer Concentration Risk

The company relies heavily on a few key customers, with the top ten clients contributing a substantial percentage of total sales in recent years. This concentration poses a risk; losing any major customer could significantly impact revenues and, consequently, the share price.

4. Cash Flow Concerns

Despite reporting profits, Sahaj Solar has faced challenges with free cash flow. For example, in the year ending September 2024, the company had a positive accrual ratio and negative free cash flow of ₹244 million, indicating that reported profits were not matched by actual cash generation. Such discrepancies can raise concerns among investors and affect the stock’s valuation.

5. Raw Material Price Volatility

Sahaj Solar depends on third-party suppliers for raw materials and typically does not have long-term supply agreements. This exposes the company to fluctuations in raw material prices and potential supply disruptions, which can increase production costs and impact profitability.

6. High Valuation Metrics

The company’s stock has a high price-to-book (PB) ratio of 14.95, suggesting that investors are paying a premium compared to the company’s book value. While this may reflect growth expectations, it also indicates that the stock might be overvalued, and any underperformance could lead to a sharp decline in the share price.

Risks and Challenges for Sahaj Solar Share Price

Here are six key risks and challenges that may influence the share price of Sahaj Solar Ltd:

1. High Valuation Metrics

Sahaj Solar’s stock is currently trading at a high price-to-book (PB) ratio of 14.95, indicating that investors are paying a premium compared to the company’s book value. While this may reflect growth expectations, it also suggests that the stock might be overvalued, and any underperformance could lead to a sharp decline in the share price.

2. Cash Flow Concerns

Despite reporting profits, Sahaj Solar has faced challenges with free cash flow. For example, in the year ending September 2024, the company had a positive accrual ratio of 0.61 and negative free cash flow of ₹244 million, indicating that reported profits were not matched by actual cash generation. Such discrepancies can raise concerns among investors and affect the stock’s valuation.

3. Customer Concentration Risk

The company relies heavily on a few key customers, with the top ten clients contributing a substantial percentage of total sales in recent years. This concentration poses a risk; losing any major customer could significantly impact revenues and, consequently, the share price.

4. Raw Material Price Volatility

Sahaj Solar depends on third-party suppliers for raw materials and typically does not have long-term supply agreements. This exposes the company to fluctuations in raw material prices and potential supply disruptions, which can increase production costs and impact profitability.

5. Working Capital Challenges

The company has experienced an increase in working capital days, from 86.9 days to 127 days, and high debtor days of 161. This indicates that a significant amount of capital is tied up in receivables, which can strain liquidity and affect the company’s ability to fund operations and growth.

6. Market Volatility

Sahaj Solar’s share price has shown significant volatility, with a 52-week high of ₹395 and a low of ₹150. Such fluctuations can be unsettling for investors and may reflect underlying uncertainties in the company’s performance or market perception.

Read Also:- INDIGO Share Price Target Tomorrow 2025 To 2030