Shah Metacorp Share Price Target Tomorrow 2025 To 2030

Shah Metacorp Limited is an Indian company based in Ahmedabad, Gujarat, that manufactures and sells stainless and mild steel long products. Established in 1999, the company operates in two main segments: Stainless Steel Products and Agricultural Products. Its product range includes stainless steel items like equal angle bars, bright bars, flat bars, flats, and ingots, as well as mild steel angle bars. Shah Metacorp Share Price on BOM as of 17 April 2025 is 3.25 INR.

Shah Metacorp Share Market Overview

- Open: 3.26

- High: 3.29

- Low: 3.21

- Previous Close: 3.22

- Volume: 246,695

- Value (Lacs): 8.07

- VWAP: 3.24

- UC Limit: 3.86

- LC Limit: 2.57

- 52 Week High: 7.37

- 52 Week Low: 2.80

- Mkt Cap (Rs. Cr.): 194

- Face Value: 1

Shah Metacorp Share Price Chart

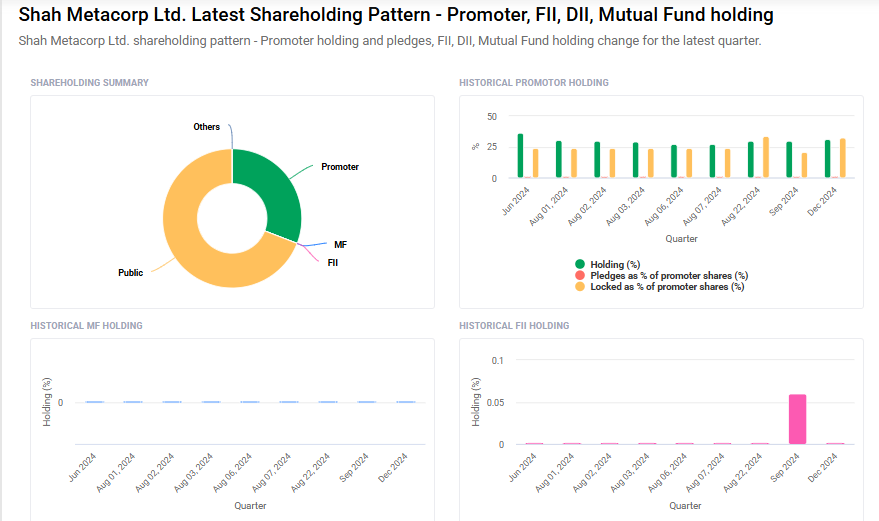

Shah Metacorp Shareholding Pattern

- Promoters: 30.9%

- FII: 0%

- DII: 0%

- Public: 69.1%

Shah Metacorp Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹8

- 2026 – ₹10

- 2027 – ₹12

- 2028 – ₹14

- 2030 – ₹16

Major Factors Affecting Shah Metacorp Share Price

Here are 6 Factors Affecting Shah Metacorp Share Price:

-

Company’s Financial Performance

The overall profit, revenue, and growth of Shah Metacorp play a big role in how its share price moves. If the company reports good earnings and shows steady growth, investors gain confidence, and the share price often rises. But if profits fall or expenses rise, the stock may lose value. -

Raw Material Prices

Shah Metacorp works in the metal and manufacturing sector, so changes in the cost of raw materials like copper, aluminum, or steel can directly affect its business. If raw material prices go up, the company might spend more and earn less, which can negatively affect the share price. -

Demand in the Market

The demand for Shah Metacorp’s products in both domestic and international markets is a key factor. If industries like construction, power, or infrastructure need more of their products, the company may see higher sales and profits. This strong demand can lead to a rise in the share price. -

Government Policies and Import-Export Rules

Since Shah Metacorp may be involved in both local and global trade, changes in government policies, import duties, or export regulations can impact the business. Supportive policies can help growth, while heavy taxes or restrictions can reduce earnings and affect the stock price. -

Global Metal Prices and Market Trends

Global prices of metals and changes in international markets can influence Shah Metacorp’s share value. If global metal prices rise, the company may benefit and attract investors. But if prices drop or global demand slows, it can put pressure on the share price. -

Investor Sentiment and Stock Market Trends

Sometimes, the share price is influenced by how people feel about the market or the company’s future. Positive news, new contracts, or expansion plans can create a good impression, while rumors, delays, or economic fears may cause the price to drop even if the company’s business is stable.

Risks and Challenges for Shah Metacorp Share Price

Here are 6 Risks and Challenges for Shah Metacorp Share Price:

-

Volatility in Metal Prices

Since Shah Metacorp is involved in the metal and manufacturing sector, it is directly affected by ups and downs in global metal prices. If prices of key metals like copper or aluminum fall, the company may earn less, which can lower investor confidence and hurt the share price. -

High Competition in the Industry

The metal industry is highly competitive, with many local and international players. If competitors offer better pricing or newer technology, Shah Metacorp could lose market share. This pressure can impact sales and reduce profits, putting stress on the share price. -

Economic and Industrial Slowdown

If there is a slowdown in the economy or in industries like construction and infrastructure (which use Shah Metacorp’s products), it can lower demand. Less demand usually means lower income for the company, which may cause the share price to decline. -

Dependence on Global Markets

Shah Metacorp may rely on exports or international business, which exposes it to risks like currency fluctuations, changes in global demand, or trade restrictions. Political or economic issues in foreign countries can also affect sales and, in turn, influence the share price. -

Regulatory and Environmental Challenges

The metal and manufacturing industry often faces strict environmental and safety regulations. Any changes in rules or failure to meet compliance can lead to fines, production delays, or extra costs, all of which can negatively affect investor trust and share value. -

Supply Chain Disruptions

Problems in getting raw materials on time or delays in transportation can slow down production. Whether due to strikes, natural disasters, or international shipping issues, such disruptions can impact delivery schedules and business performance, affecting the stock price.

Read Also:- Hira Automobile Share Price Target Tomorrow 2025 To 2030