SKIL Infrastructure Share Price Target Tomorrow 2025 To 2030

SKIL Infrastructure Limited, established in 1983 and headquartered in Mumbai, is a prominent infrastructure development company in India. The company specializes in creating large-scale projects such as seaports, logistics hubs, railways, defense shipyards, offshore construction yards, special economic zones (SEZs), and smart cities. SKIL Infrastructure often undertakes these projects through Special Purpose Vehicles (SPVs), allowing for focused management and execution. Notable past projects include the development of Pipavav Port, Pipavav Railways, and Pipavav Shipyard. SKIL Infrastructure Share Price on NSE as of 19 April 2025 is 3.94 INR.

SKIL Infrastructure Share Market Overview

- Open: 4.10

- High: 4.10

- Low: 3.75

- Previous Close: 3.87

- 52 Week High: 7.60

- 52 Week Low: 3.35

- Mkt Cap (Rs. Cr.): 83

- Face Value: 10

SKIL Infrastructure Share Price Chart

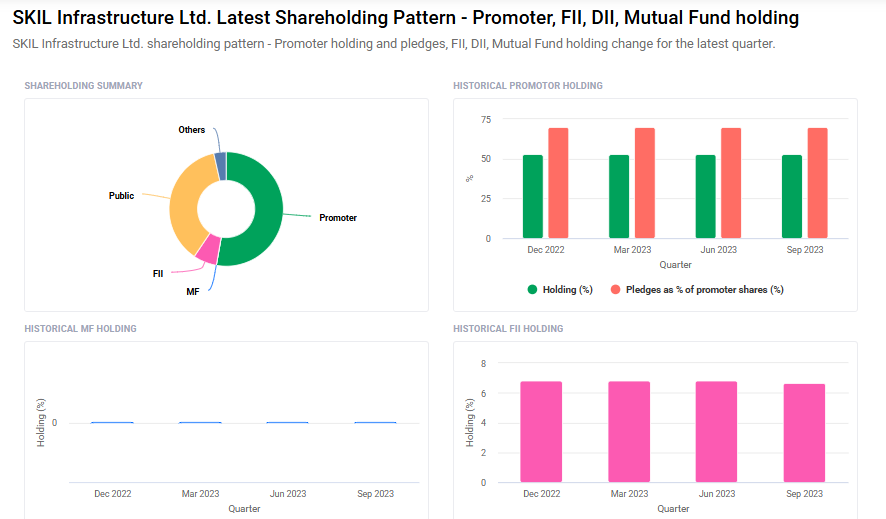

SKIL Infrastructure Shareholding Pattern

- Promoters: 52.8%

- FII: 6.7%

- DII: 0%

- Public: 40.6%

SKIL Infrastructure Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹10

- 2026 – ₹15

- 2027 – ₹20

- 2028 – ₹25

- 2030 – ₹30

Major Factors Affecting SKIL Infrastructure Share Price

-

High Debt Levels

SKIL Infrastructure has a significant amount of debt compared to its equity. As of March 2024, the company’s debt-to-equity ratio stood at 10.09, indicating that it has more debt than equity. High debt levels can lead to increased interest payments and financial risk, which may negatively impact investor confidence and the share price. -

Low Liquidity Position

The company’s current ratio, which measures its ability to cover short-term liabilities with short-term assets, is 0.00. This suggests potential challenges in meeting short-term obligations, raising concerns about liquidity and financial stability among investors. -

Volatile Earnings Performance

SKIL Infrastructure’s earnings have shown significant fluctuations over the years. For instance, the company reported a net profit of ₹8.90 crore in FY24, a turnaround from a net loss of ₹50.41 crore in FY23. Such volatility can lead to uncertainty about future performance, affecting investor sentiment and share price stability. -

Weak Operational Efficiency

The company’s operating margin and return on assets (ROA) are relatively low. For example, the ROA is around 9%, which may indicate less efficient use of assets to generate profits. Lower operational efficiency can impact profitability and, consequently, the attractiveness of the stock to investors. -

Limited Revenue Growth

Over the past five years, SKIL Infrastructure has experienced stagnant revenue growth, with net sales growing at an annual rate of 0%. This lack of growth can be a concern for investors looking for companies with expanding operations and increasing revenues. -

Promoter Share Pledging

A significant portion of the promoters’ shares, approximately 69.8%, are pledged. High levels of pledged shares can be risky, as any default on loans by the promoters could lead to the sale of these shares in the market, potentially causing a decline in the share price.

Risks and Challenges for SKIL Infrastructure Share Price

-

High Debt Burden

One of the biggest challenges for SKIL Infrastructure is its high debt. The company has borrowed a large amount of money, and repaying this debt with interest is a heavy responsibility. If the company struggles to manage its debt, it may affect profits and lower investor confidence, putting pressure on the share price. -

Weak Financial Performance

The company has experienced inconsistent financial results, including losses in some years. Such unstable performance creates uncertainty about the future of the business. If the company continues to post poor financial results, investors may lose interest, which can negatively impact the stock price. -

Limited Liquidity

SKIL Infrastructure’s low liquidity means it may face difficulties in meeting its short-term financial needs. A lack of available funds to handle day-to-day operations or urgent expenses is a red flag for investors, which can reduce trust and hurt the stock’s performance. -

Project Execution Delays

Being in the infrastructure sector, the company often handles large projects that require time and coordination. Delays in completing projects, whether due to funding issues, regulations, or planning problems, can affect revenue and lead to cost overruns. This can eventually harm the share price. -

High Promoter Share Pledging

A large portion of the promoter’s shares are pledged as collateral for loans. If these loans are not paid back, lenders may sell the shares in the market, causing a sudden fall in the share price. This also creates uncertainty and risk for retail investors. -

Low Market Confidence

Due to its financial struggles and operational challenges, the overall market sentiment around SKIL Infrastructure remains cautious. When investors are not confident in the company’s long-term vision or management practices, the stock tends to remain under pressure or may see low trading activity.

Read Also:- Baazar Style Retail Share Price Target Tomorrow 2025 To 2030