Aakash Exploration Share Price Target Tomorrow 2025 To 2030

Aakash Exploration Services Limited (AESL), headquartered in Ahmedabad, Gujarat, is a prominent Indian company specializing in oil and gas field services. Established in 2007, AESL has grown to become a trusted partner for major clients like Oil & Natural Gas Corporation (ONGC), Reliance Industries, Vedanta, and Indian Oil Corporation. The company offers a comprehensive range of services, including mobile workover rigs, hot oil circulation units, air compressors, mobile steaming units, and manpower solutions, catering to both public and private sector oil field operators across India. Aakash Exploration Share Price on NSE as of 3 May 2025 is 8.29 INR.

Aakash Exploration Share Market Overview

- Open: 8.25

- High: 8.55

- Low: 8.25

- Previous Close: 8.25

- Volume: 50,847

- Value (Lacs): 4.23

- VWAP: 8.33

- UC Limit: 9.90

- LC Limit: 6.60

- 52 Week High: 17.15

- 52 Week Low: 7.30

- Mkt Cap (Rs. Cr.): 84

- Face Value: 1

Aakash Exploration Share Price Chart

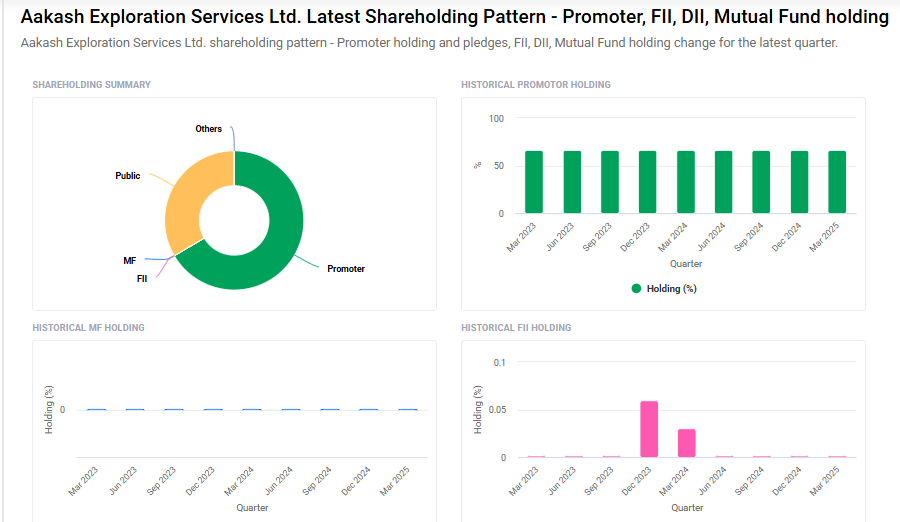

Aakash Exploration Shareholding Pattern

- Promoters: 66.5%

- FII: 0%

- DII: 0%

- Public: 33.5%

Aakash Exploration Share Price Target Tomorrow 2025 To 2030

| Aakash Exploration Share Price Target Years | Aakash Exploration Share Price |

| 2025 | ₹20 |

| 2026 | ₹25 |

| 2027 | ₹30 |

| 2028 | ₹35 |

| 2029 | ₹40 |

| 2030 | ₹45 |

Aakash Exploration Share Price Target 2025

Aakash Exploration share price target 2025 Expected target could ₹20. Here are four key factors that could influence the growth of Aakash Exploration Services Ltd:

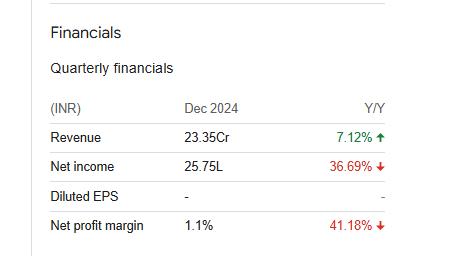

1. Consistent Revenue Growth

Aakash Exploration Services has demonstrated steady revenue growth, with net sales reaching ₹23.35 crore in December 2024, marking a 7.12% year-over-year increase. This consistent performance indicates robust demand for the company’s services and effective operational strategies, which could positively impact its share price.

2. Strong Profitability Metrics

The company maintains healthy profitability, with a net profit of ₹62.04 million and an earnings per share (EPS) of ₹6.13 over the last 12 months. Such strong financial metrics suggest efficient cost management and a solid business model, contributing to potential share price appreciation.

3. Favorable Industry Outlook

The exploration services market is projected to experience significant growth between 2025 and 2033, driven by increased demand in the oil & gas and mining sectors. This positive industry trend provides a conducive environment for Aakash Exploration Services to capitalize on emerging opportunities.

4. Efficient Capital Utilization

Aakash Exploration Services exhibits strong capital efficiency, with a Return on Capital Employed (ROCE) averaging 13.6% over the past three years. This indicates effective utilization of capital to generate profits, which can enhance investor confidence and support share price growth.

Aakash Exploration Share Price Target 2030

Aakash Exploration share price target 2030 Expected target could ₹45. Here are four key Risks and Challenges that could impact Aakash Exploration Services Ltd:

1. High Dependency on Oil & Gas Sector

Aakash Exploration’s business is closely tied to the oil and gas industry. Any downturn in global crude oil prices or a shift toward renewable energy could reduce exploration activity and negatively affect the company’s revenue and long-term growth.

2. Limited Diversification and Market Presence

As a relatively small-cap company, Aakash Exploration has limited geographic reach and service diversification. Heavy reliance on a few clients or regions may expose the company to market-specific risks and limit growth opportunities compared to larger competitors.

3. Regulatory and Environmental Risks

Exploration and drilling services are subject to strict environmental and safety regulations. Any tightening of rules or environmental concerns could increase compliance costs or delay projects, affecting operational efficiency.

4. Volatility in Earnings and Operational Costs

The company operates in a highly cyclical industry where project delays, rising input costs (like diesel and labor), and equipment maintenance can significantly affect profit margins. Such volatility may reduce investor confidence and impact long-term share performance.

Aakash Exploration Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 922.33M | -0.37% |

| Operating expense | 720.44M | -2.59% |

| Net income | 62.04M | 36.77% |

| Net profit margin | 6.73 | 37.35% |

| Earnings per share | — | — |

| EBITDA | 171.10M | 27.53% |

| Effective tax rate | 25.94% | — |

Read Also:- Lambodhara Textiles Share Price Target Tomorrow 2025 To 2030