Aarti Drugs Share Price Target Tomorrow 2025 To 2030

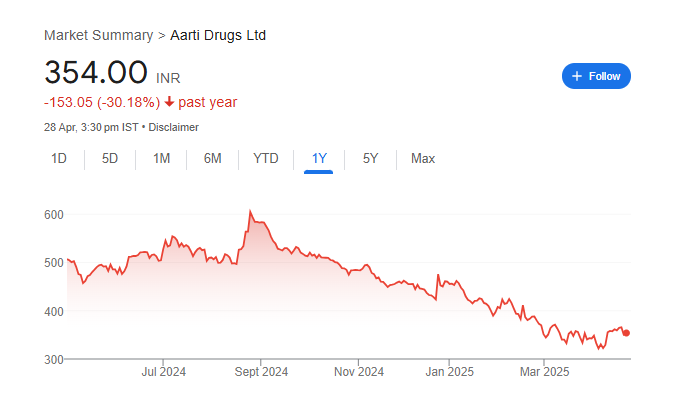

Aarti Drugs Limited, established in 1984, is a leading Indian pharmaceutical company headquartered in Mumbai. As part of the $900 million Aarti Group of Industries, the company specializes in manufacturing Active Pharmaceutical Ingredients (APIs), pharmaceutical intermediates, specialty chemicals, and formulations. With a robust R&D division located in Tarapur, Maharashtra, Aarti Drugs has developed over 50 API molecules, including antibiotics, anti-inflammatory, antidiabetic, and antifungal agents. Aarti Drugs Share Price on NSE as of 29 April 2025 is 354.00 INR.

Aarti Drugs Share Market Overview

- Open: 350.00

- High: 360.80

- Low: 346.60

- Previous Close: 350.80

- Volume: 240,583

- Value (Lacs): 846.01

- 52 Week High: 645.75

- 52 Week Low: 312.00

- Mkt Cap (Rs. Cr.): 3,209

- Face Value: 10

Aarti Drugs Share Price Chart

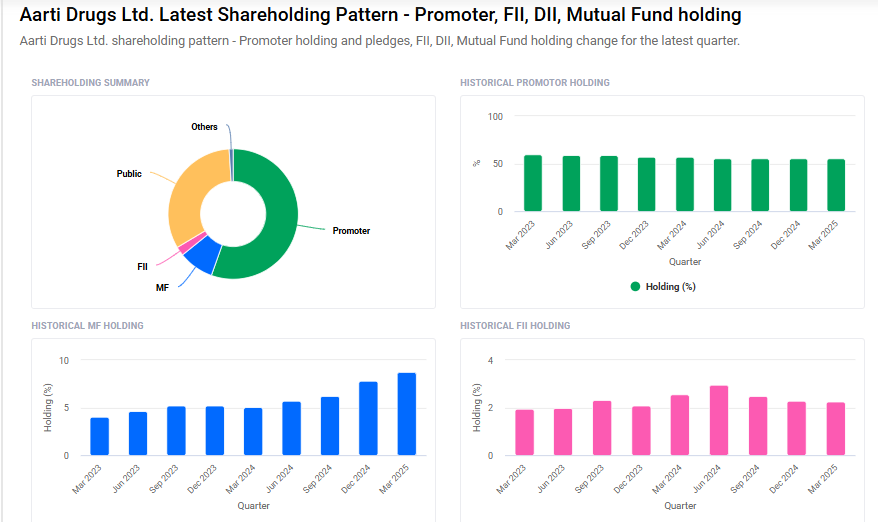

Aarti Drugs Shareholding Pattern

- Promoters: 55.5%

- FII: 2.3%

- DII: 9.7%

- Public: 32.6%

Aarti Drugs Share Price Target Tomorrow 2025 To 2030

| Aarti Drugs Share Price Target Years | Aarti Drugs Share Price |

| 2025 | ₹640 |

| 2026 | ₹680 |

| 2027 | ₹720 |

| 2028 | ₹760 |

| 2029 | ₹800 |

| 2030 | ₹840 |

Aarti Drugs Share Price Target 2025

Here are four key factors that could influence the growth of Aarti Drugs’ share price by 2025:

1. Regulatory Approvals and Export Opportunities

Aarti Drugs has received approval from the US FDA for its API manufacturing facility, allowing the company to resume exports to the US market. This clearance enables Aarti to export key pharmaceutical products without restrictions, marking a significant boost for the company.

2. Product Portfolio Expansion and Capacity Enhancement

The company is focusing on expanding its product portfolio, particularly in the antidiabetic and oncology segments. Additionally, Aarti Drugs is investing in capacity expansion projects, which are expected to drive future growth with a projected volume increase of 15% to 20%.

3. Strong Financial Forecasts

Analysts forecast that Aarti Drugs’ earnings and revenue will grow by 27.6% and 13% per annum, respectively. This growth is expected to result in a return on equity of 15.7% over the next three years, indicating strong financial performance.

4. Increased Institutional and Promoter Holdings

Mutual funds have increased their holdings in Aarti Drugs from 7.78% to 8.75% in the March 2025 quarter. Similarly, promoter holdings have risen from 55.38% to 55.48% in the same period. These increases reflect growing confidence in the company’s prospects.

Aarti Drugs Share Price Target 2030

Here are four risks and challenges for Aarti Drugs Share Price Target 2030:

1. Regulatory Risks

Aarti Drugs operates in a highly regulated industry, and any changes in government policies, drug approval processes, or international regulations could impact its ability to sell products in key markets like the US and Europe. Strict regulatory requirements could delay new product launches and affect revenues.

2. Rising Competition

The pharmaceutical industry is becoming more competitive, both from domestic and international companies. Increased competition may put pressure on Aarti Drugs’ profit margins and could limit its market share if new players offer better pricing or more innovative products.

3. Raw Material Price Volatility

Aarti Drugs depends on various chemicals and raw materials to manufacture its products. If the prices of these materials rise sharply or supply becomes inconsistent, the company’s production costs could increase, which might hurt profitability and affect share price performance.

4. Dependence on Specific Markets

A significant portion of Aarti Drugs’ revenue comes from specific markets. Any economic slowdown, currency fluctuation, or trade barriers in these regions could negatively impact sales and growth. Heavy reliance on a few markets increases the risk if there are sudden unfavorable changes.

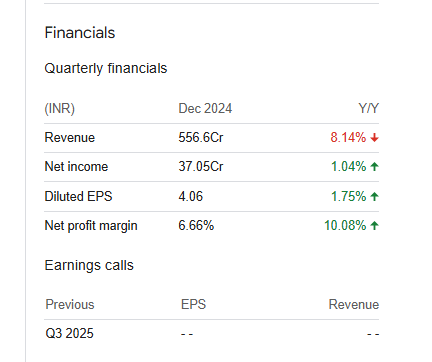

Aarti Drugs Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 25.29B | -6.90% |

| Operating expense | 5.67B | 2.92% |

| Net income | 1.71B | 3.07% |

| Net profit margin | 6.78 | 10.78% |

| Earnings per share | 18.56 | 3.28% |

| EBITDA | 3.14B | 3.69% |

| Effective tax rate | 27.15% | — |

Read Also:- Union Bank Share Price Target Tomorrow 2025 To 2030