Abhishek Infra Share Price Target Tomorrow 2025 To 2030

Abhishek Infraventures Limited, established in 1984 and based in Hyderabad, India, is a publicly listed company specializing in construction and infrastructure development. The company undertakes a variety of projects, including residential and commercial buildings, parks, gardens, and other infrastructural facilities. Over the years, it has evolved from its original name, Executive Leasing Limited, to its current identity, reflecting its focus on infrastructure ventures. Abhishek Infra Share Price on BOM as of 14 May 2025 is 6.99 INR.

Abhishek Infra Share Market Overview

- Open: 7.35

- High: 7.35

- Low: 6.99

- Previous Close: 7.35

- Volume: 251

- Value (Lacs): 0.02

- VWAP: 7.31

- 52 Week High: 11.36

- 52 Week Low: 4.40

- Mkt Cap (Rs. Cr.): 3

- Face Value: 10

Abhishek Infra Share Price Chart

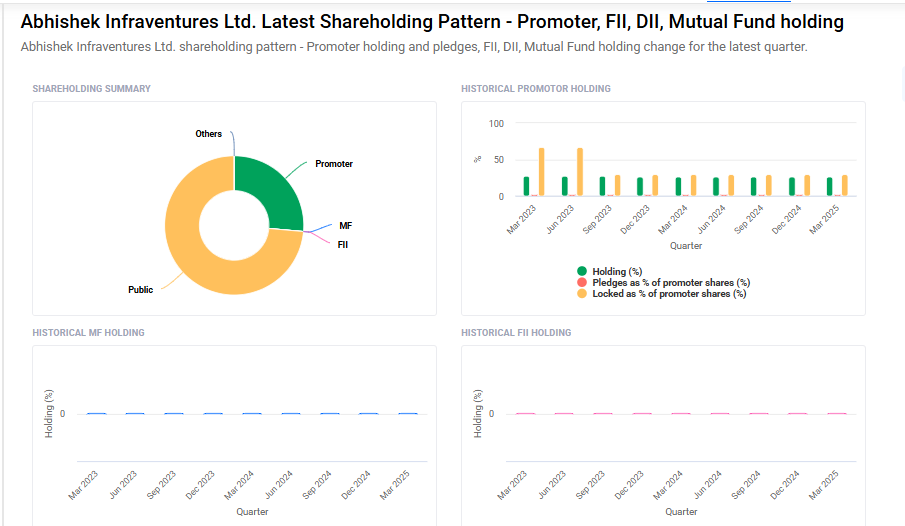

Abhishek Infra Shareholding Pattern

- Promoters: 26.4%

- FII: 0%

- DII: 0%

- Public: 73.6%

Abhishek Infra Share Price Target Tomorrow 2025 To 2030

| Abhishek Infra Share Price Target Years | Abhishek Infra Share Price |

| 2025 | ₹12 |

| 2026 | ₹16 |

| 2027 | ₹20 |

| 2028 | ₹24 |

| 2029 | ₹28 |

| 2030 | ₹32 |

Abhishek Infra Share Price Target 2025

Abhishek Infra share price target 2025 Expected target could ₹12. Here are 4 key factors influencing the growth of Abhishek Infraventures Ltd.’s share price target for 2025:

-

Infrastructure Development Projects: Abhishek Infraventures Ltd. is engaged in infrastructure development and realty activities, including construction of residential and commercial buildings, parks, and other structures. The company’s involvement in such projects positions it to benefit from the growing demand in the infrastructure sector.

-

Stock Performance Trends: As of May 2025, the company’s share price is ₹7.39, with a 52-week high of ₹11.36 and a low of ₹4.40. Over the past year, the stock has shown a positive trend, increasing by approximately 28%, indicating investor confidence and potential for future growth.

-

Market Capitalization and Shareholding: With a market capitalization of ₹3.76 crore and promoter holding at 26.41% as of March 2025, the company’s financial structure and ownership dynamics can influence investor perception and stock performance.

-

Financial Performance Indicators: The company’s financial metrics, such as a PE ratio of -16.52 and a PB ratio of 0.92, reflect its current valuation and profitability status. While the negative PE ratio indicates losses, the PB ratio suggests the stock is trading below its book value, which might attract value investors looking for turnaround opportunities.

Abhishek Infra Share Price Target 2030

Abhishek Infra share price target 2030 Expected target could ₹32. Here are 4 key risks and challenges that could impact Abhishek Infraventures Ltd.’s share price target for 2030:

-

Weak Financial Performance: Over the past three years, the company has reported negative returns on equity (ROE) and capital employed (ROCE), indicating inefficiencies in utilizing shareholders’ funds and capital investments. For instance, the ROE stood at -5.88% in FY 2024. Such financial metrics may deter potential investors and affect the company’s valuation.

-

Low Promoter Holding: As of March 2025, the promoter holding in the company is relatively low at 26.41%. A declining promoter stake can be perceived as a lack of confidence in the company’s future prospects, potentially impacting investor sentiment and share price stability.

-

Liquidity Risks: The company faces liquidity challenges, which refer to the risk of not meeting short-term financial obligations. While promoters have been infusing funds based on requirements, reliance on such measures may not be sustainable in the long term, especially if external funding becomes necessary.

-

Market and Credit Risks: Abhishek Infraventures is exposed to market risks, including fluctuations in currency and other price risks, as well as credit risks stemming from potential defaults by counterparties. These risks can lead to financial losses and affect the company’s operational performance.

Read Also:- Oscar Global Share Price Target Tomorrow 2025 To 2030