ACC Share Price Target Tomorrow 2025 To 2030

ACC Ltd is one of India’s leading cement and building materials companies, known for its strong presence in the construction and infrastructure sectors. Founded in 1936, the company has built a solid reputation for producing high-quality cement that is widely used in homes, roads, and large-scale projects. As a part of the Adani Group, ACC benefits from a strong business network and operational support. The company’s share price is influenced by factors like demand for construction, raw material and energy costs, and government infrastructure spending. ACC Share Price on NSE as of 22 April 2025 is 2,085.00 INR.

ACC Share Market Overview

- Open: 2,088.40

- High: 2,104.40

- Low: 2,073.80

- Previous Close: 2,088.40

- Volume: 97,202

- Value (Lacs): 2,023.45

- VWAP: 2,089.69

- UC Limit: 2,297.20

- LC Limit: 1,879.60

- 52 Week High: 2,844.00

- 52 Week Low: 1,778.45

- Mkt Cap (Rs. Cr.): 39,091

- Face Value: 10

ACC Share Price Chart

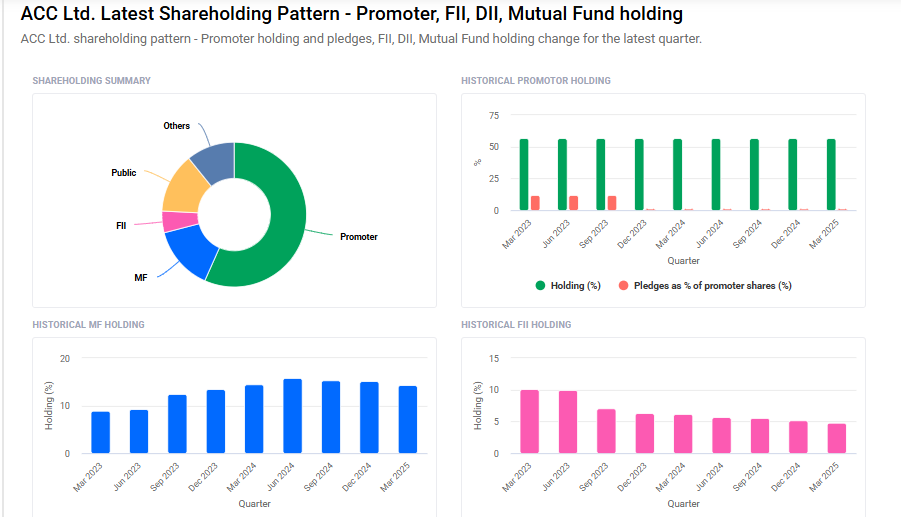

ACC Shareholding Pattern

- Promoters: 56.7%

- FII: 4.8%

- DII: 25.1%

- Public: 13.4%

ACC Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹2850

- 2026 – ₹3200

- 2027 – ₹3400

- 2028 – ₹3600

- 2030 – ₹4000

Major Factors Affecting ACC Share Price

Here are six key factors that influence the share price of ACC Ltd:

1. Financial Performance and Profitability

ACC’s financial results play a significant role in determining its share price. For instance, in the December 2024 quarter, the company reported a consolidated net profit of ₹1,092 crore, marking a 103% year-on-year increase. Such strong financial performance can boost investor confidence and positively impact the stock price.

2. Cement Demand and Pricing Trends

The demand for cement and its pricing directly affect ACC’s revenues. In the September 2024 quarter, despite a 15% increase in sales volume, the company’s profit declined by 39% due to a 17% rise in input costs and a drop in cement prices to a five-year low. These factors can lead to fluctuations in the share price.

3. Operational Efficiency and Cost Management

Efficient operations and cost control are crucial for profitability. ACC’s EBITDA margin, a key indicator of operational efficiency, stood at 18.8% in the third quarter of FY25. Maintaining or improving such margins can positively influence investor sentiment and the stock price.

4. Competitive Landscape

ACC operates in a highly competitive industry, facing rivals like UltraTech Cement, Ambuja Cements, and Shree Cement. Competitive pressures can impact market share and pricing power, influencing the company’s financial performance and, consequently, its share price.

5. Macroeconomic Factors and Infrastructure Development

The company’s performance is closely tied to the broader economy and infrastructure projects. Economic slowdowns or delays in infrastructure development can reduce cement demand, affecting ACC’s revenues and share price. Conversely, economic growth and increased construction activities can boost demand and positively impact the stock.

6. Valuation Metrics

Investors often assess a stock’s valuation to determine its attractiveness. As of April 2025, ACC’s share price was ₹2,088.40, while its intrinsic value was estimated at ₹2,209.05, suggesting the stock was undervalued by approximately 5%. Such valuation insights can influence buying or selling decisions, affecting the share price.

Risks and Challenges for ACC Share Price

Here are six key risks and challenges that could impact the share price of ACC Ltd:

1. Rising Raw Material Costs

The prices of essential raw materials like clinker, fly ash, and limestone have been increasing. For instance, the cost of clinker rose by 12% in the first quarter of 2023 compared to the previous year. Such increases can reduce profit margins and affect the company’s profitability.

2. High Energy Expenses

Cement production is energy-intensive, and fluctuations in energy prices can significantly impact operational costs. Managing these energy expenses is crucial for maintaining profitability.

3. Weak Demand and Price Cuts

During the April-June 2024 quarter, ACC experienced a slowdown in demand due to factors like general elections and extreme heat, which curtailed construction activities. To cope, the company resorted to price cuts, which, combined with the weak demand, led to profits falling short of expectations.

4. Intense Market Competition

ACC operates in a highly competitive industry, facing challenges from major players like UltraTech Cement and Ambuja Cements. This intense competition can impact market share and profitability.

5. Underperformance Compared to Market Indices

Over the past three years, ACC’s stock has delivered a return of -7.73%, underperforming compared to the Nifty 100 index, which returned 37.57% during the same period. Such underperformance can affect investor confidence.

6. Downgrade Due to Poor Long-Term Growth

In October 2024, ACC was downgraded to a ‘Sell’ rating by MarketsMojo due to poor long-term growth, with net sales and operating profit growing at annual rates of 5.28% and 4.54% respectively over the last five years. This downgrade reflects concerns about the company’s growth prospects.

Read Also:- Good Luck Share Price Target Tomorrow 2025 To 2030