Accent Microcell Share Price Target Tomorrow 2025 To 2030

Accent Microcell Limited is an Indian company that manufactures high-quality cellulose-based excipients, primarily used in the pharmaceutical, nutraceutical, food, and cosmetic industries. Established in 2012 and headquartered in Ahmedabad, the company operates two advanced manufacturing facilities located in Pirana and Dahej SEZ in Gujarat. These facilities enable Accent Microcell to serve customers across India and export to over 45 countries, including the USA, Canada, Germany, and the UK. Accent Microcell Share Price on NSE as of 7 May 2025 is 199.95 INR.

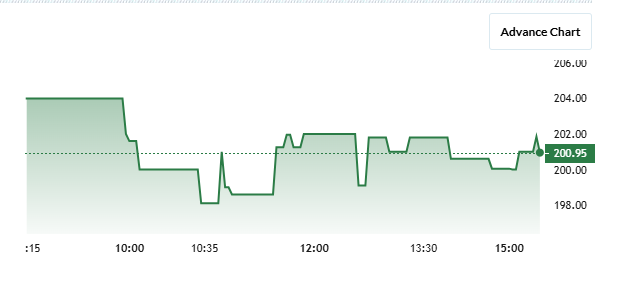

Accent Microcell Share Market Overview

- Open: 199.95

- High: 199.95

- Low: 199.95

- Previous Close: 200.95

- Volume: 500

- Value (Lacs): 1.00

- VWAP: 199.95

- UC Limit: 241.10

- LC Limit: 160.80

- 52 Week High: 339.95

- 52 Week Low: 180.00

- Mkt Cap (Rs. Cr.): 420

- Face Value: 10

Accent Microcell Share Price Chart

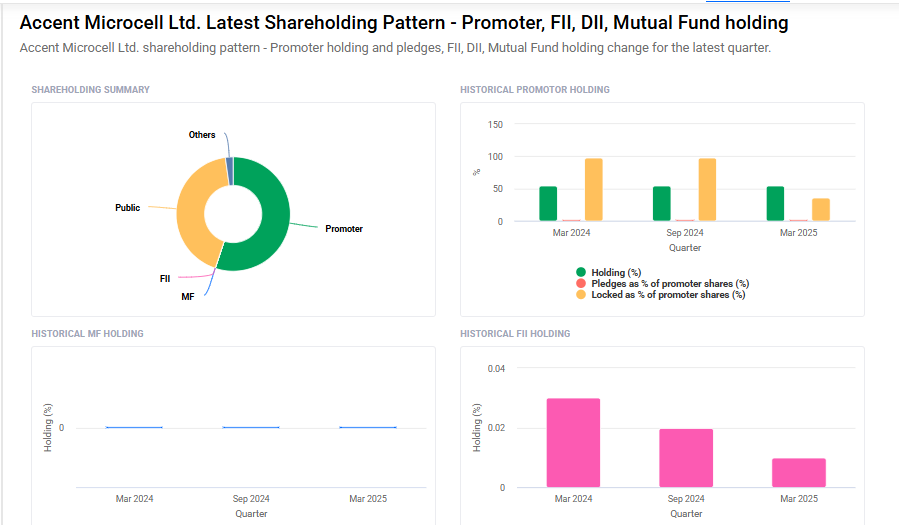

Accent Microcell Shareholding Pattern

- Promoters: 55.1%

- FII: 0%

- DII: 2.2%

- Public: 42.7%

Accent Microcell Share Price Target Tomorrow 2025 To 2030

| Accent Microcell Share Price Target Years | Accent Microcell Share Price |

| 2025 | ₹340 |

| 2026 | ₹380 |

| 2027 | ₹420 |

| 2028 | ₹460 |

| 2029 | ₹500 |

| 2030 | ₹540 |

Accent Microcell Share Price Target 2025

Accent Microcell share price target 2025 Expected target could ₹340. Here are four key factors that could influence Accent Microcell’s share price target by 2025:

1. Capacity Expansion and Product Diversification

Accent Microcell is investing ₹54.39 crore from its IPO proceeds to establish a new manufacturing facility at Navagam Kheda, Gujarat. This plant will produce Croscarmellose Sodium (CCS), Sodium Starch Glycolate (SSG), and Carboxymethylcellulose (CMC), expanding the company’s product portfolio beyond Microcrystalline Cellulose (MCC). The facility is expected to be operational by April 2025, increasing the total annual production capacity from 8,000 to 10,400 tonnes.

2. Robust Financial Performance

In the fiscal year 2023–24, Accent Microcell reported a 24.45% increase in total sales, reaching ₹245.5 crore, compared to ₹197.3 crore in the previous year. The Profit After Tax (PAT) surged by 146.63% to ₹30.17 crore, up from ₹12.23 crore, driven by cost-saving measures, strategic pricing, and stable raw material costs.

3. Strong Global Presence

The company has established a significant international footprint, supplying products to over 75 countries, including the USA, Europe, Latin America, and Southeast Asia. With two advanced manufacturing facilities in Pirana and Dahej SEZ, Accent Microcell is well-positioned to meet global demand and expand into new markets.

4. Positive Market Reception and Investor Confidence

Accent Microcell’s IPO received an overwhelming response, being subscribed 362 times, with the retail investor segment subscribed 410 times. The company’s shares debuted at ₹300 on the NSE SME platform, a 114% premium over the IPO price of ₹140, reflecting strong investor confidence and market enthusiasm.

Accent Microcell Share Price Target 2030

Accent Microcell share price target 2030 Expected target could ₹₹540. Here are four key Risks and Challenges that could impact Accent Microcell’s share price target by 2030:

1. High Dependence on Pharmaceutical Sector

Approximately 73% of Accent Microcell’s revenue is derived from the pharmaceutical industry. This heavy reliance means that any downturns, regulatory changes, or shifts in the pharmaceutical sector could significantly affect the company’s financial performance and, consequently, its share price.

2. Limited Supplier Base for Raw Materials

The company depends on a small number of suppliers for its raw materials, often without long-term contracts. This concentration risk exposes Accent Microcell to potential supply disruptions or price volatility, which could impact production schedules and profit margins.

3. Ongoing Legal Proceedings

Accent Microcell is involved in legal proceedings related to wastewater management at its Dahej facility. The outcome of these proceedings could lead to financial liabilities or operational constraints, affecting the company’s profitability and investor confidence.

4. Exposure to International Market Fluctuations

With over 60% of its sales coming from exports, Accent Microcell is vulnerable to global market dynamics, including currency exchange rate fluctuations, changes in international trade policies, and geopolitical tensions. Such factors could adversely affect the company’s revenue and profitability.

Read Also:- BEML Share Price Target Tomorrow 2025 To 2030