Adani Green Share Price Target Tomorrow 2025 To 2030

Adani Green Energy Limited (AGEL) is one of India’s leading renewable energy companies, dedicated to building a sustainable future through clean energy solutions. Headquartered in Ahmedabad, Gujarat, AGEL develops, owns, and operates large-scale solar, wind, and hybrid power projects across the country. Adani Green Share Price on NSE as of 15 May 2025 is 967.00 INR.

Adani Green Share Market Overview

- Open: 966.00

- High: 975.00

- Low: 957.80

- Previous Close: 958.05

- Volume: 3,634,440

- Value (Lacs): 35,154.12

- 52 Week High: 2,174.10

- 52 Week Low: 758.00

- Mkt Cap (Rs. Cr.): 154,612

- Face Value: 10

Adani Green Share Price Chart

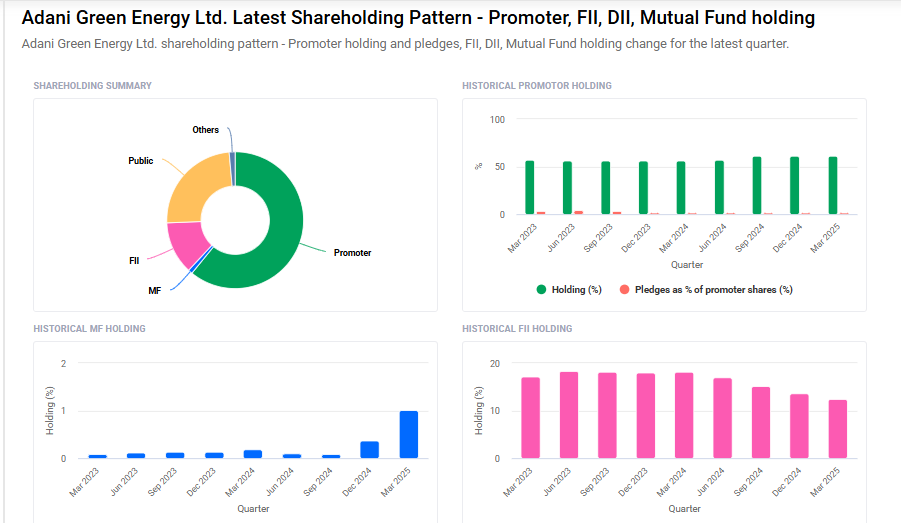

Adani Green Shareholding Pattern

- Promoters: 60.9%

- FII: 12.5%

- DII: 2.4%

- Public: 24.2%

Adani Green Share Price Target Tomorrow 2025 To 2030

| Adani Green Share Price Target Years | Adani Green Share Price |

| 2025 | ₹2180 |

| 2026 | ₹2500 |

| 2027 | ₹2950 |

| 2028 | ₹3360 |

| 2029 | ₹3845 |

| 2030 | ₹4250 |

Adani Green Share Price Target 2025

Adani Green share price target 2025 Expected target could ₹2180. Here are five key factors that could influence the growth of Adani Green Energy Ltd. (AGEL) share price target for 2025:

-

Significant Capacity Expansion: In FY25, AGEL increased its operational capacity by 30% year-over-year, reaching 14,243 MW. This growth was primarily driven by solar energy, with solar capacity expanding to 10,103 MW. The company plans to add an additional 1,000 MW, aiming for a total of over 15,000 MW in the near term.

-

Development of Khavda Renewable Energy Park: AGEL is developing the Khavda Renewable Energy Park in Gujarat, which is set to become the world’s largest renewable energy facility. The park is expected to achieve 30 GW capacity by 2030, significantly contributing to India’s renewable energy goals and AGEL’s growth trajectory.

-

Strong Government Support and Policy Alignment: India’s commitment to achieving 50% of its energy requirements from renewable sources by 2030 aligns with AGEL’s expansion plans. Government policies favoring renewable energy development provide a conducive environment for AGEL’s growth.

-

Strategic Partnerships and International Projects: AGEL’s collaboration with Google’s India cloud operations to supply clean energy from its Khavda project showcases its ability to secure significant international partnerships, enhancing its global presence and revenue streams.

-

Positive Analyst Outlook: Analysts have set a 12-month price target for AGEL ranging from ₹808 to ₹1,598.1, with an average target of ₹1,270.24. This reflects a positive market sentiment and confidence in AGEL’s growth prospects.

Adani Green Share Price Target 2030

Adani Green share price target 2030 Expected target could ₹4250. Here are five key risks and challenges that could impact Adani Green Energy Ltd.’s (AGEL) share price target by 2030:

-

Funding Shortfalls for Expansion Goals: AGEL aims to achieve 50 GW of renewable energy capacity by 2030. However, reports suggest that without raising additional equity, the company may only secure about 50% of the necessary funding, potentially hindering its expansion plans.

-

Legal and Reputational Risks: Allegations of bribery involving AGEL have surfaced, drawing attention to potential governance issues. Such controversies can affect investor confidence and may pose challenges in securing future projects or partnerships.

-

Challenges in Power Purchase Agreements (PPAs): Delays and difficulties in finalizing PPAs with state-owned power distribution companies have been reported. These challenges can lead to project delays and impact the company’s revenue streams.

-

Infrastructure and Grid Integration Issues: India’s renewable energy sector faces challenges related to grid infrastructure and integration. Inadequate transmission facilities can lead to bottlenecks, affecting the timely commissioning and operation of renewable projects.

-

Regulatory and Policy Uncertainties: While India has ambitious renewable energy targets, changes in policies, tariffs, or regulatory frameworks can introduce uncertainties. Such shifts may affect project viability and the overall investment climate for renewable energy companies like AGEL.

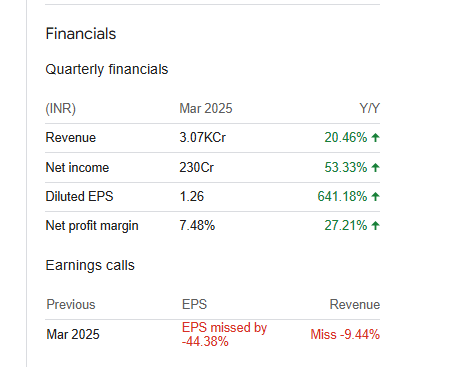

Adani Green Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 112.12B | 21.29% |

| Operating expense | 33.93B | 47.14% |

| Net income | 14.44B | 31.27% |

| Net profit margin | 12.88 | 8.24% |

| Earnings per share | 10.03 | — |

| EBITDA | 88.77B | 22.02% |

| Effective tax rate | 9.66% | — |

Read Also:- Astra Microwave Share Price Target Tomorrow 2025 To 2030