Adani Transmission Share Price Target Tomorrow 2025 To 2030

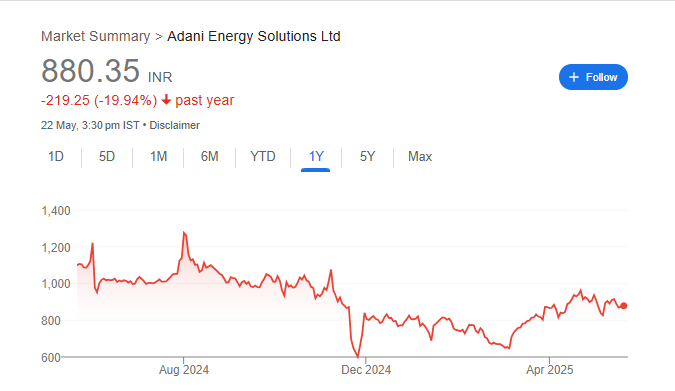

Adani Transmission Limited is one of India’s largest private power transmission companies. It plays a key role in delivering electricity across long distances by building and maintaining high-voltage transmission lines. A part of the Adani Group, the company was established to meet the growing demand for power in a fast-developing country like India. Adani Transmission owns and operates transmission lines that help move electricity from power plants to cities, towns, and industries. Adani Transmission Share Price on NSE as of 23 May 2025 is 880.35 INR.

Adani Transmission Share Market Overview

- Open: 869.00

- High: 886.40

- Low: 864.35

- Previous Close: 872.15

- Volume: 1,121,955

- Value (Lacs): 9,861.98

- 52 Week High: 1,348.00

- 52 Week Low: 588.00

- Mkt Cap (Rs. Cr.): 105,592

- Face Value: 10

Adani Transmission Share Price Chart

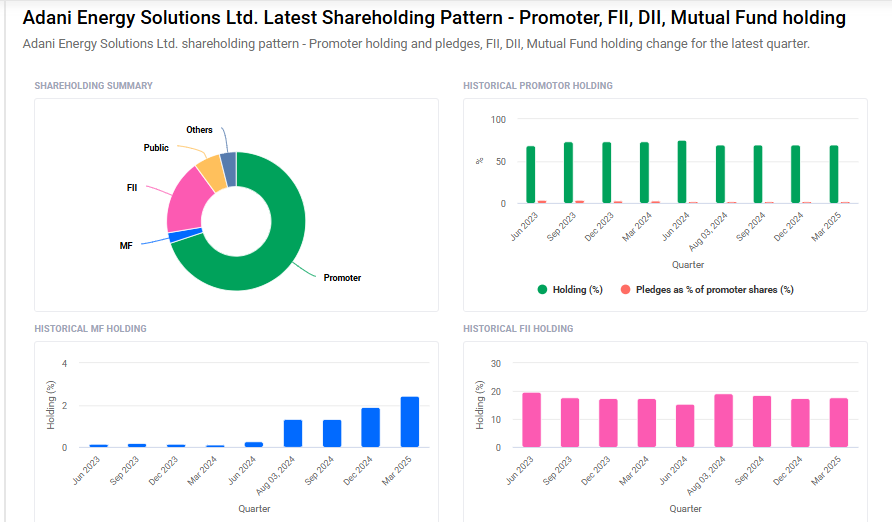

Adani Transmission Shareholding Pattern

- Promoters: 69.9%

- FII: 17.6%

- DII: 6.3%

- Public: 6.2%

Adani Transmission Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹1350 |

| 2026 | ₹1500 |

| 2027 | ₹1640 |

| 2028 | ₹1885 |

| 2029 | ₹2020 |

| 2030 | ₹2260 |

Adani Transmission Share Price Target 2025

Adani Transmission share price target 2025 Expected target could ₹1350. Here are 5 key factors affecting the growth of Adani Transmission Ltd’s share price target for 2025:

-

Expansion of Transmission Network

Adani Transmission is one of India’s largest private power transmission companies. Its ongoing expansion across various states, including the acquisition of transmission assets and development of greenfield projects, is expected to boost its revenue and market share.

-

Rising Demand for Power Infrastructure

India’s growing energy consumption and the government’s push for 24×7 electricity access are driving the need for robust power transmission infrastructure. Adani Transmission is well-positioned to benefit from this demand through increased project opportunities.

-

Focus on Renewable Energy Integration

With India’s aggressive renewable energy targets, there is a rising need for grid upgrades to handle solar and wind power. Adani Transmission’s efforts to build smart and flexible transmission networks that support renewable integration are seen as a major growth driver.

-

Regulatory Support and Tariff-Based Projects

Government-backed policies, such as tariff-based competitive bidding (TBCB), provide a transparent environment for private players. Favorable regulatory frameworks increase Adani Transmission’s chances of securing new projects and ensure stable revenue through long-term contracts.

-

Operational Efficiency and Financial Performance

Strong EBITDA margins, operational efficiency, and steady cash flows from its transmission assets have built investor confidence. Continued financial discipline and timely project execution will be key to maintaining upward momentum in its share price.

Adani Transmission Share Price Target 2030

Adani Transmission share price target 2030 Expected target could ₹2260. Here are 5 key risks and challenges that could affect Adani Transmission Ltd’s share price target by 2030:

-

Regulatory and Policy Uncertainty

Power transmission is a heavily regulated sector. Any unfavorable changes in government policies, tariff regulations, or delays in approvals can directly impact project viability and cash flows, leading to potential pressure on long-term share price performance.

-

High Debt and Financial Leverage

Adani Transmission has undertaken significant expansion funded by debt. While this supports growth, a high debt-to-equity ratio increases vulnerability to interest rate hikes and refinancing risks, which could strain profitability and investor confidence.

-

Environmental and ESG-Related Scrutiny

The broader Adani Group has faced intense scrutiny over environmental, social, and governance (ESG) concerns. Any negative sentiment or global backlash could spill over to Adani Transmission, potentially affecting its brand value and access to global capital.

-

Execution and Operational Risks

Large-scale infrastructure projects often face execution delays due to land acquisition issues, regulatory bottlenecks, or supply chain challenges. Delayed project completion could result in cost overruns and lower-than-expected returns.

-

Reliance on Government Contracts and Payments

A significant portion of revenue comes from long-term contracts with government bodies and power distribution companies (DISCOMs). Delays in payments or changes in contract terms could affect liquidity and long-term financial health.

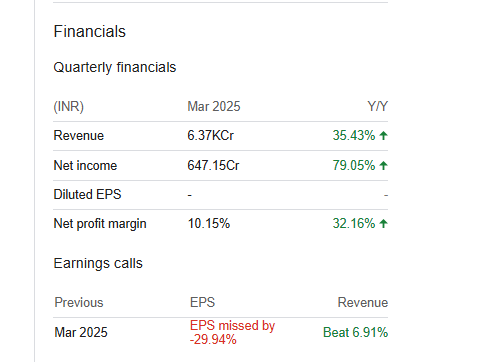

Adani Transmission Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 237.67B | 43.11% |

| Operating expense | 49.53B | -1.88% |

| Net income | 10.60B | -6.80% |

| Net profit margin | 4.46 | -34.89% |

| Earnings per share | 9.05 | -11.27% |

| EBITDA | 84.07B | 37.78% |

| Effective tax rate | 14.25% | — |

Read Also:- JSW Infra Share Price Target Tomorrow 2025 To 2030