Aditya Vision Share Price Target Tomorrow 2025 To 2030

Aditya Vision Limited is a leading multi-brand consumer electronics retail chain in India, headquartered in Patna, Bihar. Established in 1999, the company has grown significantly, operating approximately 148 retail showrooms across Bihar, Jharkhand, and Uttar Pradesh . Aditya Vision offers a diverse range of over 10,000 products, including televisions, home theaters, cameras, air conditioners, refrigerators, ovens, and other appliances. Aditya Vision Share Price on NSE as of 19 April 2025 is 441.00 INR.

Aditya Vision Share Market Overview

- Open: 449.50

- High: 449.50

- Low: 435.55

- Previous Close: 445.65

- Volume: 45,063

- Value (Lacs): 197.67

- VWAP: 440.04

- UC Limit: 534.75

- LC Limit: 356.55

- 52 Week High: 546.60

- 52 Week Low: 368.00

- Mkt Cap (Rs. Cr.): 5,643

- Face Value: 1

Aditya Vision Share Price Chart

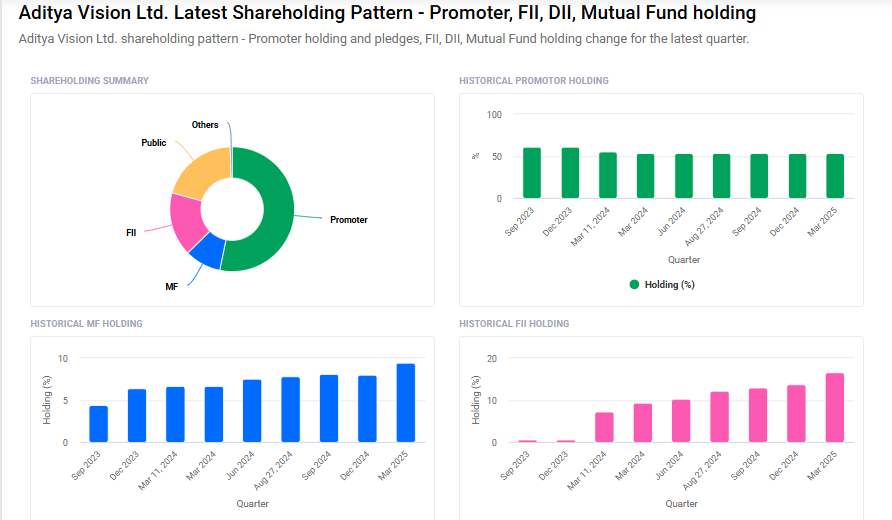

Aditya Vision Shareholding Pattern

- Promoters: 53.2%

- FII: 16.6%

- DII: 9.9%

- Public: 20.3%

Aditya Vision Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹550

- 2026 – ₹590

- 2027 – ₹630

- 2028 – ₹670

- 2030 – ₹710

Major Factors Affecting Aditya Vision Share Price

-

Strong Revenue and Profit Growth

Aditya Vision has demonstrated impressive financial performance, with its revenue growing from ₹8,061 million in FY20 to ₹17,498 million in FY24, marking a compound annual growth rate (CAGR) of 21.4%. Such consistent growth in revenue and profits often boosts investor confidence, positively impacting the company’s share price. -

Efficient Profit Reinvestment Strategy

The company maintains a low dividend payout ratio of 14%, indicating that it reinvests a significant portion of its profits back into the business. This strategy supports expansion and long-term growth, which can enhance the company’s valuation and, in turn, its share price. -

High Return on Equity (ROE)

Aditya Vision boasts a strong ROE of 36.9% over the past three years, reflecting efficient management and effective utilization of shareholders’ funds. A high ROE is often viewed favorably by investors, as it indicates a company’s ability to generate profits from its equity base, potentially leading to a higher share price. -

Expansion of Retail Network

The company’s strategy to densify its store networks in existing clusters and selectively enter new markets is aimed at driving long-term growth. Successful expansion can lead to increased market share and revenues, which may positively influence the share price. -

Market Valuation Metrics

Aditya Vision’s stock is currently trading at a Price-to-Earnings (P/E) ratio of approximately 57.93, which is lower than the industry average of 96.43. This suggests that the stock may be undervalued relative to its peers, potentially making it attractive to investors and influencing its share price. -

Shareholding Pattern and Institutional Interest

The company’s shareholding pattern shows a stable promoter holding of 53.23%, with increasing interest from Foreign Institutional Investors (FIIs), who have raised their stake to 13.75% as of December 2024. Such institutional interest often reflects confidence in the company’s prospects and can positively impact the share price.

Risks and Challenges for Aditya Vision Share Price

-

Share Dilution Impacting Earnings Per Share (EPS)

While Aditya Vision has shown profit growth, the increase in the number of shares has led to a slower rise in EPS compared to net income. This dilution means each share represents a smaller portion of the company’s profit, which can concern investors and potentially affect the share price. -

Volatility in Stock Performance

The company’s stock has experienced significant fluctuations, including notable intraday losses and periods of underperformance compared to its sector. Such volatility can make investors cautious, leading to potential declines in the share price during uncertain times. -

Macroeconomic Factors Affecting Demand

Economic challenges, such as reduced consumer spending or broader market downturns, can lead to sluggish demand for consumer electronics. This decrease in demand can impact Aditya Vision’s sales and profitability, thereby influencing its stock performance. -

Debt Management Concerns

The company has undertaken significant capital expenditures, which might strain its financial resources. If Aditya Vision faces difficulties in servicing its debt, it could raise concerns about financial stability among investors, potentially leading to a drop in share value. -

Overvaluation Relative to Historical Metrics

Currently, Aditya Vision’s stock is trading at a premium compared to its three-year historical valuations. If investors perceive the stock as overvalued, it might lead to reduced buying interest, causing downward pressure on the share price. -

Operational Challenges from External Factors

Events like heavy rainfall and flooding have previously impacted the company’s operations. Such unforeseen challenges can disrupt business activities, affecting revenues and, consequently, the stock’s performance.

Read Also:- Cipla Share Price Target Tomorrow 2025 To 2030